How scammers are cashing in on the coronavirus pandemic

Texts pretending to be from the government, emails asking you to renew your Netflix subscription and criminals selling fake masks door to door – there are few levels scammers won’t stoop to for personal gain, reports Ben Chapman

Fraudsters are increasingly using the coronavirus pandemic to cash in, and unfortunately there are few safeguards to protect people from being scammed other than their own vigilance.

Most scams remain relatively simple, but have been adapted slightly to link them to coronavirus in the hope of playing upon people’s vulnerability during the crisis.

The Chartered Trading Standards Institute (CTSI) has found people selling fake protective masks both door to door and online.

It’s also warned about sales of coronavirus tests that don’t work, something that even the UK government managed to fall victim to, spending £16m on ineffective antibody testing kits from China.

Other scammers have sent emails pretending to be from streaming services like Netflix or texts claiming to be from the government, demanding fines for breaking coronavirus lockdown conditions.

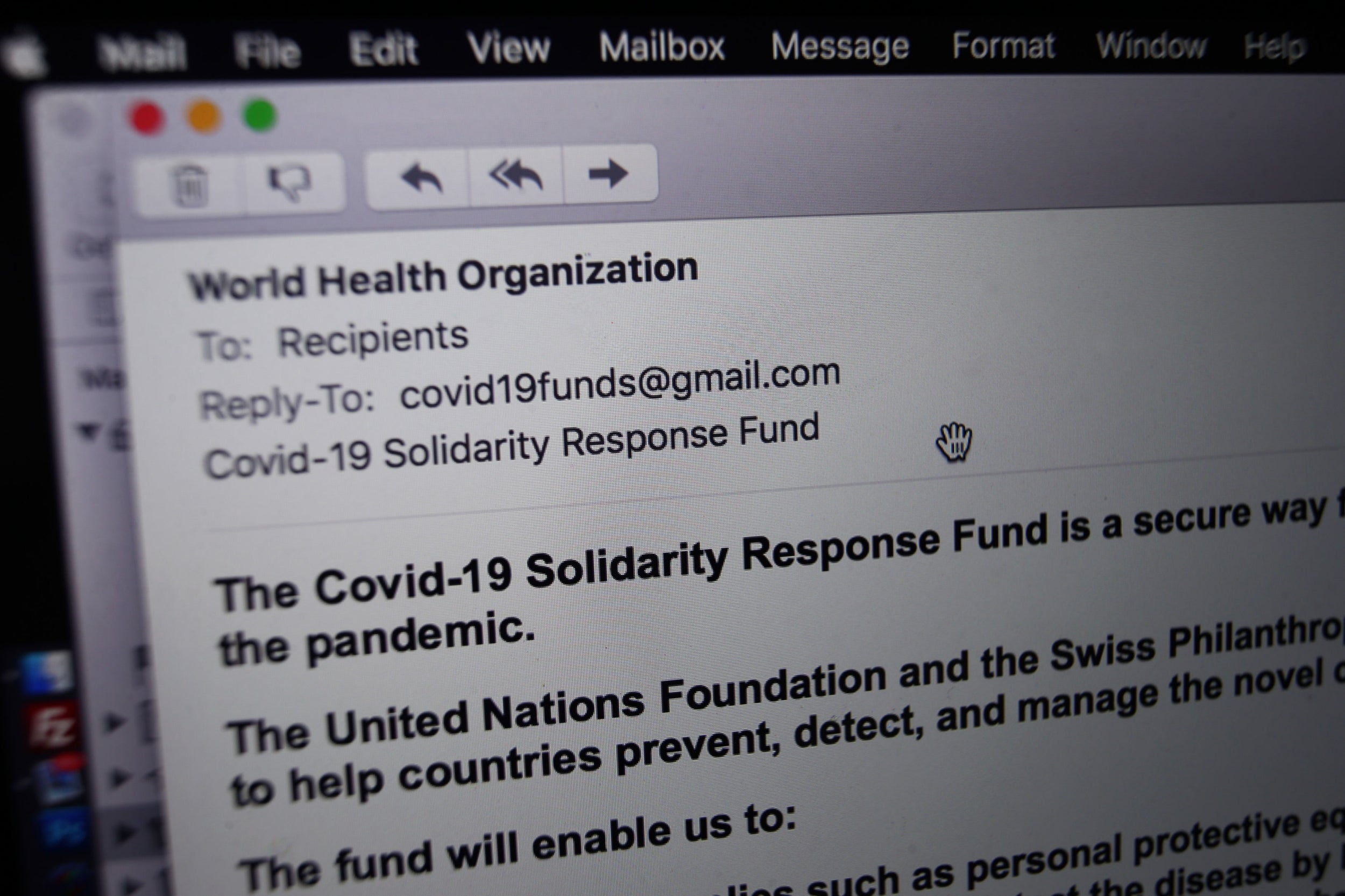

The most common scams, according to Action Fraud, are online phishing scams which direct people to click a link, often pretending to be from an official source such as the police or a bank.

When a user clicks, the scammers either harvest personal data or download malware which compromises the security of a phone, computer or tablet.

People are advised to carefully look at the URL of the link to see that it is in fact from the official source claimed and not to click on anything they are unsure of.

Action Fraud says it knows about more than £2m that has been lost to coronavirus scams. The true figure is likely to be far higher because not all incidents are reported and investigated.

That fraudsters are willing to use a period of international emergency for personal gain should not come as a surprise.

The financial crisis of 2008 saw a rise in scams and the years since then have been fertile ground for fraudsters to hone their craft.

Record low interest rates have made investment fraud particularly attractive as investors chase high returns. At the same time, terrible regulations in the UK riddled with holes, along with weak enforcement, allow fraudsters to frequently operate with impunity.

Trading standards budgets have been cut by more than half. The police are underfunded and do not have the resources to pursue fraud except the very largest cases or those so brazen that they are easy to prosecute.

Banks too have been shamefully slow to act, but are finally taking some action to refund victims duped into making transfers to criminals.

All of which means the onus is really on individuals to remain vigilant, check the identity of any caller, and the source of any email or text message and look out for friends, relatives and neighbours who might be vulnerable.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks