The path to growth under Truss is far from certain

Trussonomics: Can it work? People work harder if they are allowed to keep more of their own money, writes Hamish McRae

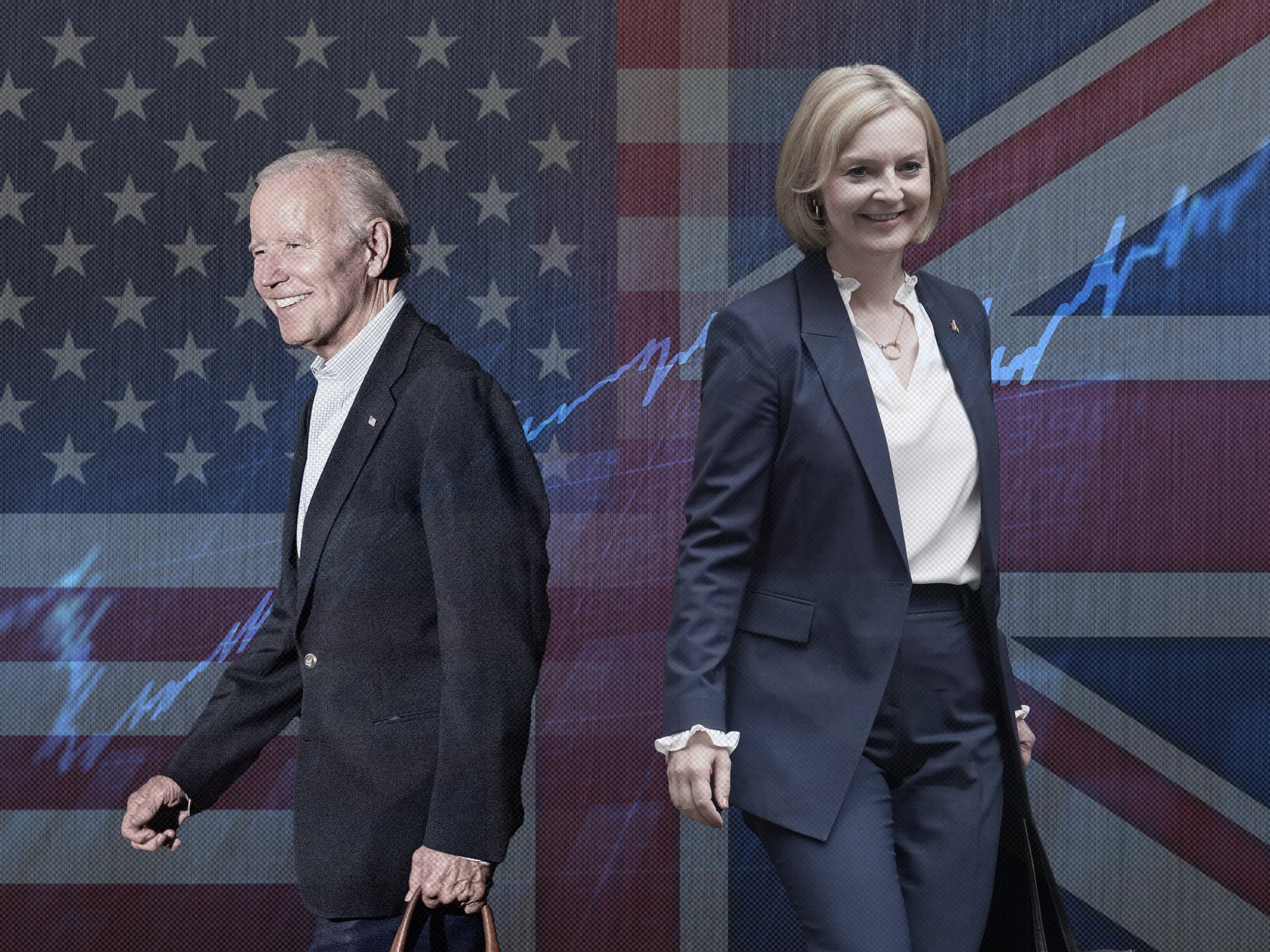

Will Trussonomics work? Or more precisely, is the core economic idea of Liz Truss that tax cuts will lead to faster economic growth a credible one?

It is a contentious view, for it goes to the heart of the great debate about the role of government in a developed economy. Most people accept that in the short-term there will be some boost to growth from lower taxation, but that may not be sustainable if the tax cuts simply boost the fiscal deficit. The longer-term issue is whether countries which have a relatively small public sector are likely to grow faster than those that have a large one.

If that were so, then there would be case for cutting taxes, including taxes on the better-off, in order to grow the overall size of the cake more swiftly. Put crudely, people work harder if they are allowed to keep more of their own money.

That has been the argument of the new prime minister in her bid for the post, and it is behind the tax-cutting rhetoric in politics everywhere, especially the United States. But if small government leads to poorer public services then not only do lower earners suffer, the overall competitiveness of the whole economy is undermined. Countries need decent infrastructure and a well-educated workforce, two areas where government inevitably has a central role.

So what’s the evidence? The honest response to that it is mixed. The OECD does a useful tally of general government spending as a percentage of GDP. The best year to take is 2019, just before the pandemic upended everything. At the top end come France, Finland, Belgium and Norway, all with spending accounting for more than 50 per cent of GDP. At the bottom are Mexico and Ireland, both with government less than 30 per cent of GDP.

Most continental European countries were around 45 per cent, while the English-speaking countries were around 40 per cent, with Canada a bit above that level, Australia, the UK and New Zealand in the middle, and the US a bit below at around 38 per cent of GDP.

So the US does have a somewhat smaller government sector than most other developed countries, but not radically so – and actually is bigger than that of Switzerland and Korea. Indeed if you allow for healthcare costs, which are largely funded by government in Europe and largely by employers in the US, the difference narrows a bit further.

So what about competitiveness? It is true that Europe as a whole has been growing more slowly than the US, but this is partly the result of different demographics. The US (and the rest of the Anglosphere) has a rising population, whereas in much of Europe the population is stable or falling. The population of the EU started to decline in 2020 and fell further last year.

If the US economy is more vibrant than the European one, which it is, it is surely more sensible to attribute that to the age and structure of its population rather than to slightly different tax levels. Besides, there are quite a lot of European countries, notably in Scandinavia, that have sustained decent economic growth despite a relatively high tax burden.

So if you look at the overall size of the government, there is no clear support for the argument that a smaller state will boost growth. It is however pretty obvious that an inefficient government sector will damage the economy. For example, there are legitimate concerns about the quality of government in Italy.

The OECD argued last year that “excessive regulations and their onerous enforcement add to businesses’ operating costs”, and that “trust in public institutions and public service delivery is one of the lowest across OECD countries”. There is a case to be made that the new PM should focus on making government more effective rather than simply wanting to cut its size.

What about cutting tax rates, another element of the Truss project? Here there is some evidence that cuts work. Ireland is the prime example of using a corporate tax rate of 12.5 per cent to lure foreign companies to set up a base there, so successful that there is now joint action to have a global minimum tax rate of 15 per cent. The US is expected to pass its bit of the legislation this week.

Read more from our series on ‘Trussonomics: Can it work?’ by clicking here

Within the US there is strong tax competition between states, both for companies and individuals. Indeed the notion in Europe that the US is a universal low-tax haven does not really wash. Add California’s top income tax rate of 12.3 per cent to the Federal top rate of 37 per cent and you come mighty close to the 50 per cent rate. The top UK rate is 45 per cent.

Where the US system differs is that it has even more exemptions than the UK, so very few high-earners actually pay that top rate – or they move to one of the nine states that have no tax on earned income, especially the two largest, Texas and Florida.

That leads to the crucial questions that Trussonomics raise: will reversing the tax increases announced by her rival, Rishi Sunak, encourage people to change their behaviour? Will companies invest more because there will not be an increase in corporation tax? Or take on more people because national insurance contributions are not going to rise? Will people who had thought of retiring stay on in work?

My conclusion would be: this may change things a bit, but not much. There simply is not the evidence to support that. Vastly more important will be to improve the effectiveness of the public sector. That is the really tough task ahead.

Hamish McRae’s new book, ‘The world in 2050’, is published by Bloomsbury

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks