Bitcoin 2022 news – live: Billionaires offer price predictions at world’s largest BTC conference

Follow latest cryptocurrency updates, analysis and expert price predictions

After a meteoric rise throughout the month of March, BTC saw a slight correction ahead of the Bitcoin 2022 conference geting underway in Miami.

The world’s most valuable cryptocurrency is enjoying a rare moment of stability but could be boosted by any major positive news coming out of the world’s largest bitcoin conference.

Other leading cryptocurrencies, including Ethereum (ETH), Binance Coin (BNB) and Ripple (XRP), have all mirrored bitcoin’s movements, however dogecoin has seen big gains in recent days.

The crypto market calm could be about to come to an end, according to some analysts, who anticipate big moves from announcements coming out of Bitcoin 2022.

The Miami event is the same one that El Salvador President Nayib Bukele announced last year that his country would be adopting BTC as a legal form of tender.

You can follow all the latest news and updates in our live blog below.

After some brief issues with the live stream, the first official day of Bitcoin 2022 can be watched online.

There’ll be no Nayib Bukele after he withdrew last night but we will be hearing from Michael Saylor at 11am (4pm BST) and PayPal founder Peter Thiel at 1.30pm (6.30pm BST).

You can watch the main stage here:

Bitcoin, ethereum prices slightly increase

Bitcoin has grown by about 1 per cent in the last day and is valued at over $43,000 on Friday.

The leading cryptocurrency is showing marginal signs of recovery after its price began sliding down on Monday.

Ethereum has grown by about 2 per cent in the last 24 hours, but its current value remains the same as its price a week earlier.

Other top cryptocurrencies solana and avalanche have grown by about 7 per cent in the last day while polkadot and cardano have surged by about 3 per cent in the last 24 hours.

Meme coins dogecoin and its spinoff shiba inu have grown by about 3 to 6 per cent during this period.

The overall crypto market has grown in value by 2 per cent in the last day and is valued at $2.02 trillion.

Bitcoin, ethereum prices slightly increase

Bitcoin has grown by about 1 per cent in the last day and is valued at over $43,000 on Friday.

The leading cryptocurrency is showing marginal signs of recovery after its price began sliding down on Monday.

Ethereum has grown by about 2 per cent in the last 24 hours, but its current value remains the same as its price a week earlier.

Other top cryptocurrencies solana and avalanche have grown by about 7 per cent in the last day while polkadot and cardano have surged by about 3 per cent in the last 24 hours.

Meme coins dogecoin and its spinoff shiba inu have grown by about 3 to 6 per cent during this period.

The overall crypto market has grown in value by 2 per cent in the last day and is valued at $2.02 trillion.

Peter Thiel says bitcoin price will rise 100X

After throwing cash into the crowd, it turns out Peter Thiel had a lot to say.

It was too long for one blog post so I wrote it all up here.

TLDR: Bitcoin will replace gold and eventually rival the value of the entire stock market with a 100X price rise. Oh, and Warren Buffett is apparently “enemy number “ and a “sociopathic grandpa”.

Peter Thiel throwing out dollars

Peter Thiel starts by throwing a few hundred dollar bills into the crowd, which someone eagerly snaps up.

“I thought you guys were supposed to be bitcoin maximalists,” Thiel quips.

PayPal co-founder Peter Thiel delivers keynote

PayPal co-founder Peter Thiel is now coming to the main stage.

It opens with a video of him in 2009 talking about replacing physical dollars with digital dollars.

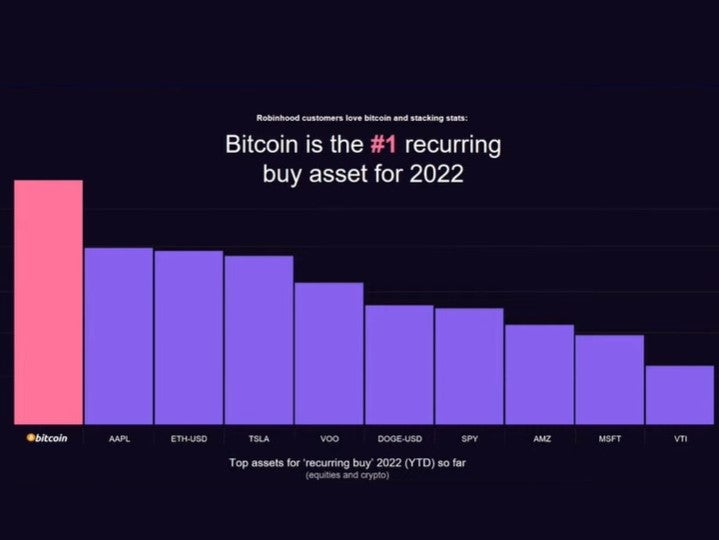

Bitcoin is #1 recurring buy asset on Robinhood app

Robinhood has just revealed that bitcoin is the number one asset that users have as a recurring buy on its app, ahead of Tesla and Apple shares.

Here’s a breakdown:

The trading app also announced that more than 2 million people who were on the waitlist can now send and receive bitcoin through the app.

The biggest news was saved until last, however, revealing that Lightning Network is coming to Robinhood. This will allow users to send and receive BTC instantly with virtually no fees and a much lower carbon footprint.

Bitcoin has ‘greenlight from US president'

More on Michael Saylor’s appearance on the main stage earlier: the MicroStrategy CEO commented on the White House’s recent Executive Order on cryptocurrency, saying it amounted to the US President “giving the green light to bitcoin”.

You can read all about his appearance here.

Bitcoin: World’s biggest corporate investor ‘more bullish than ever’ on crypto

Michael Saylor explains why he’ll never sell bitcoin

Michael Saylor and Cathie Wood’s have left the stage, we’ll have much more on that very soon but his main message was “don’t sell your bitcoin”.

We’ve now got some interesting panellists to discuss bitcoin, including former US presidential candidate Andrew Yang and Pulitzer Prize winning journalist Glenn Greenwald.

Nation-state bitcoin adoption 'spreading’

Islands, autonomous regions and potentially entire nation states are all turning to bitcoin, with President of Madeira in Portugal, a Mexican senator and the president of the island of Prospera in Honduras making announcements.

“I believe in the future and I believe in bitcoin,” said the president of Madeira, saying that people using bitcoin are not subject to personal income taxes.

Joel Bomgar, president of Prospera said bitcoin will be accepted as legal tender on the island, and Mexican senator Indira Kempis has a message for her president: “Bitcoin as legal tender in Mexico, now.”

She said:“67 million people aren’t involved in the traditional financial system. Bitcoin is the solution to this.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks