Life on the front line of Britain's debt

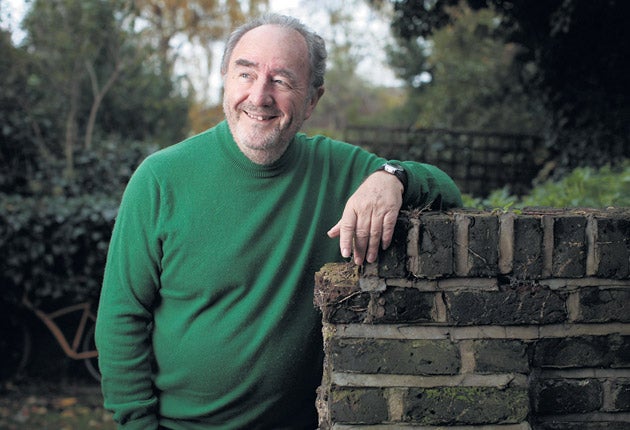

Business has been booming for the Consumer Credit Counselling Service. Julian Knight meets the charity's founder

"We consumers are simply not borrowing enough." Not the words you expect to hear from the head of one of the UK's biggest debt charities.

Then again, Malcolm Hurlston who is stepping down as chief executive of the Consumer Credit Counselling Service next month, is not your usual consumer champion. He's always been a free thinker, willing to engage with the devil and tell it as he sees it rather than parroting the hoary old bash-the-banks line.

"Low interest rates have meant that relatively few people have been truly affected by the credit crunch. Do you know that we have record numbers of homeowners that are keeping up with their repayments? The average mortgage holder is £140 better off than three years ago. However, the noise in the media and the gloom of recession have genuinely spooked consumers, perhaps into retrenching too far.

"Prior to the credit crunch, we had too much lending; now we have too little going on. It's not just the banks' reluctance which is an issue."

In 1992, Mr Hurlston founded the CCCS, which offers free impartial debt advice to the public funded mostly by the banks, rather than calling on public money. Just at the right time: the Tory boom of the late 1980s was unwinding in spectacular fashion with repossession soaring above 100,000 a year and the term negative equity entering the language. Initially a small enterprise, the CCCS grew over the next 15 years bit by bit.

But the main explosion in its services has been since the onset of the credit crunch. In the past year alone, the charity has helped a third of a million people with their debts. The not-for-profit charity has seen it as its mission to take on the fee-charging debt advice providers, who were threatening to add to the misery of hundreds of thousands of debtors by tying them into individual voluntary arrangements, a type of insolvency, with punishing fees and penalties.

"My position is simple: there shouldn't be room for fee-charging debt advice. These firms can spend up to £1,000 to bring in a customer so to make that work they must sell them something," he said. "Some have been masquerading as 'free' advice before when they plainly aren't, and there is evidence of cold calling consumers, persuading them to take out an IVA, which is a massive step not to be taken lightly. Cold-calling is thoroughly reprehensible."

Recently the fee-charging debt firms were rocked when the Office of Fair Trading said it was looking at putting 129 companies out of business unless they improved the way that they treated customers.

"I hope the OFT, which has done a good job with this, stays strong. One thing to do is to further restrict these firms advertising – online, for instance – and make them publish the failure rates [how many of the fee-charging debt advice firms fail to keep up IVA repayments and thereby face penalties]."

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Vulnerable consumers with mental health issues who are being targeted for loans are another serious concern, said Mr Hurlston. "Many of the people we help are bipolar. What happens is when they are in an up mood they take on debts which they can't afford, and then when their mood shifts down this closes in on them and this can further depress them, helping to fuel a negative cycle.

"What I'd like to see is a lending preference service, where consumers can register that they suffer mental health issues and would like not to have loans marketed to them. It would work like the telephone preference service. Alternatively, a note could be made on their credit file which lenders could see and then it's up to them to act responsibly and question if the potential borrower actually needs the money or perhaps is suffering a brief mental health episode."

More generally, Mr Hurlston reckons that the banks should stop cherry-picking the best risk customers and move into the short-term loans to people on lower incomes that are currently paying interest of up to several thousand per cent to payday loan firms or doorstep lending companies.

"There must be a way for this type of loan to be available cheaply and easily, helping those on lower incomes to get over a short-term hole in their finances. This would be a social good. Perhaps three or four banks combined could spread the risk."

As for money laundering rules, designed by the Financial Services Authority, these act as a barrier to the low paid. "Many people don't have passports or even a utility bill. If they are, for example, on a pre-payment meter. This denies them proper access to banking services. Sad to say, there is a bit of gold plating of these rules which go on in branch, putting new customers off. It's all part of the mistrust of the banks which goes back longer than the credit crunch. It started with the change of the bank manager from a respected figure in the community, making decisions, to nothing more than a salesman. I think finally some banks understand the damage done. They get it."

But with personal debt in the UK the highest in the Western world, do British consumers now get that they can't live beyond their means as they have done?

"The culture of homeownership has to be reviewed on both sides of the Atlantic," he said. "A mortgage is a 'gateway' debt: once you have one it's easier to borrow more and more." As for the announcement in the coalition government's "bonfire of the quangos" that Consumer Focus is to be axed, Mr Hurlston asks who will now stand up for consumers.

"It's difficult to see where the advocacy for consumers is going to come from in future. Perhaps the gonzo-style consumerism of moneysavingexpert.com and activism through Twitter will be the way we are going."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks