Budget 2023: Who are the winners and losers of changes to income tax, bills, pensions and childcare costs?

Packages of support are part of the plan to encourage more people back into employment, but will it work? Sean O’Grady asks

Jeremy Hunt has promised a major expansion in state-funded childcare and tax breaks for businesses in budget measures aimed at boosting economic growth.

In an effort to remove barriers to work, he promised up to 30 hours a week of free childcare for eligible households in England with children as young as nine months, instead of three and four-year-olds under the current policy.

He also pledged an expansion in wrap-around care at the start and finish of the school day for parents with older children and changes to staff-to-child ratios in England to expand the supply of childcare.

The chancellor said a recession would be avoided and inflation would fall dramatically as the economy was “proving the doubters wrong”.

In reaction, Sir Keir Starmer said Britain is the “sick man of Europe once again” and the budget shows the “expiry date looms ever closer” for the Conservatives.

He added: “After 13 years of his government, our economy needed major surgery, but like millions across our country, this Budget leaves us stuck in the waiting room with only a sticking plaster to hand.”

But who are the real winners and losers of the budget?

Winners

1. People with kids who pay for child care. Mr Hunt’s changes will undoubtedly help those parents who need it with paying for childcare, and for all ages of child upwards of nine months. At best it looks like it might be worth some £6,500 a year for full-time working parents with two children. The help for schools and nurseries to provide “wrap-around” 8am to 6pm cover will also be extremely welcome. However, for some lower-paid and/or part-time working parents on shifts, the changes will be less beneficial.

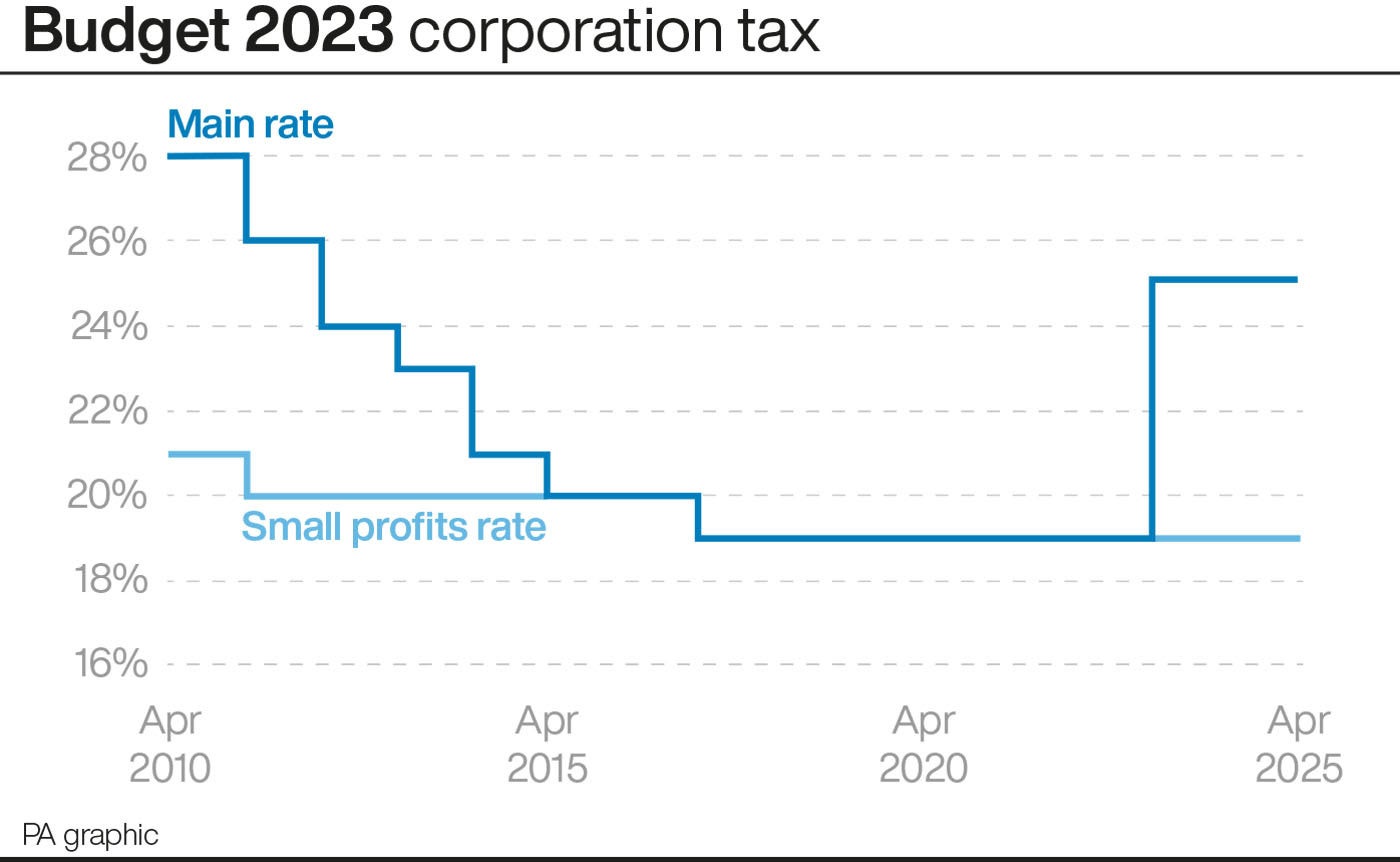

2. Go-ahead high-tech companies who want to invest. Although headline corporation tax rates are not being slashed, the very generous allowances for investment in IT, plant and machinery will be welcome and ought to boost economic growth. The snag is for how long these investment allowances will be sustained - the intention is to make them permanent, but there are no guarantees.

3. Older, wealthier NHS consultants - and NHS patients. The removal of the lifetime allowance on the value of a pension pot is aimed at keeping older, more experienced and efficient workers in their places, driving growth. One particular group that has been quitting early or reducing hours in recent years has been senior NHS clinicians, and they will now no longer face a hefty tax charge, in effect, for booting their nest eggs. Good news for those who need top-quality professional health care from a brilliant surgeon or GP - shorter waiting times and some reassuring grey to complement the wise bedside manner.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

4. Boozers. That is to say, boozers in “boozers”. Pandering to the tabloid caricature of the working man, Mr Hunt was extremely proud to make a pint of “warm British ale” relatively cheaper in the “Great British Pub” than the heavily-discounted alcohol available in the supermarkets. The more serious, and valuable one, is that the move, if sustained, would help the pub trade, an essential and distinctive part of national life, and in many villages about the only place of community focus left. It might just reduce harmful drinking at home and in the street.

5. Robots. Joking aside, the significant subsidies (£2.5bn plus) that will be available for research and development of artificial intelligence, quantum computing should give the country at least a chance of fulfilling the government’s ambition to make Britain a leader in this rapidly expanding field, with its revolutionary industrial potential. A £1m prize for AI innovation, named the Manchester prize after the first British computer (built in that city in 1946), is a nice populist touch. So someone clever will be a millionaire by around this time next year.

Losers

1. Everyone who earns more than about £12,000 a year. The pre-announced freeze in personal tax allowances is a stealth tax that in effect means that most basic rate taxpayers will lose about £500 a year in net income, rising to £1,000 per year for higher rate taxpayers, because wage inflation pushes more of their earnings into higher rates of taxation. It’s the biggest fiscal single factor in the squeeze on living standards (ie aside from general inflation and mortgage rates).

2. Small businesses that don’t have big investment schemes to fund. A typical example might be a small cleaning business, say, whose finance is run through a company and who is now faced with much higher taxation on their profits and dividends, and who has relatively little scope to make the most of the generous investment allowances.

3. Buy-to-let landlords, investors and people selling their businesses. Again, a pre-announced and quite radical change in capital gains tax (and tax on dividend incomes) will leave them worse off sooner or later.

4. Savers. The ISA savings limit of £20,000 per year, though generous, will be frozen for another year, representing a material reduction given current inflation. The measly increases in savings interest rates won’t make up for this.

5. Virtually the whole of the public sector. Departmental spending overall will increase by about 1 per cent overall per annum for the next few years. Given that the NHS and defence will probably be getting a larger share of what’s available, some departments, particularly those without strong lobby groups to protect them, will face real terms cuts once again - another age of austerity, possibly in areas such as criminal justice and the courts, local government, housing and, above all, the non-child care and non-state pension (“triple locked”) elements of social security.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks