Martin Lewis warns Rachel Reeves’ cash ISA cut plan will upset millions

MoneySavingExpert founder says Treasury would receive more tax and mortgage lenders would be hit

Plans by chancellor Rachel Reeves to reduce the amount that savers may put into cash ISAs will upset millions of people but not achieve what she wants, money expert Martin Lewis is warning.

In her Budget next month, Ms Reeves is expected to shake up the rules on tax-free ISAS, cutting everyone’s annual allowance from £20,000 to £10,000.

She wants to encourage people to put their money into shares in British companies instead of cash Isas, fostering an American-style investment culture in the UK.

One option being considered is halving the limit allowable in cash ISAs, the FT reports.

But Mr Lewis, founder of the MoneySavingExpert brand, said a cash ISA limit cut would frustrate people without encouraging them to invest in shares, which Ms Reeves hopes will divert billions of savings into domestic stocks.

“A cash ISA cut would simply p*** millions of often older people off and I doubt will change the dial on investing,” he wrote on social media.

“It'd just mean more tax paid on saving, and a problem for building societies raising cash for mortgages.”

The Treasury would receive more tax from savers if they put money into standard savings accounts that were not shielded from tax.

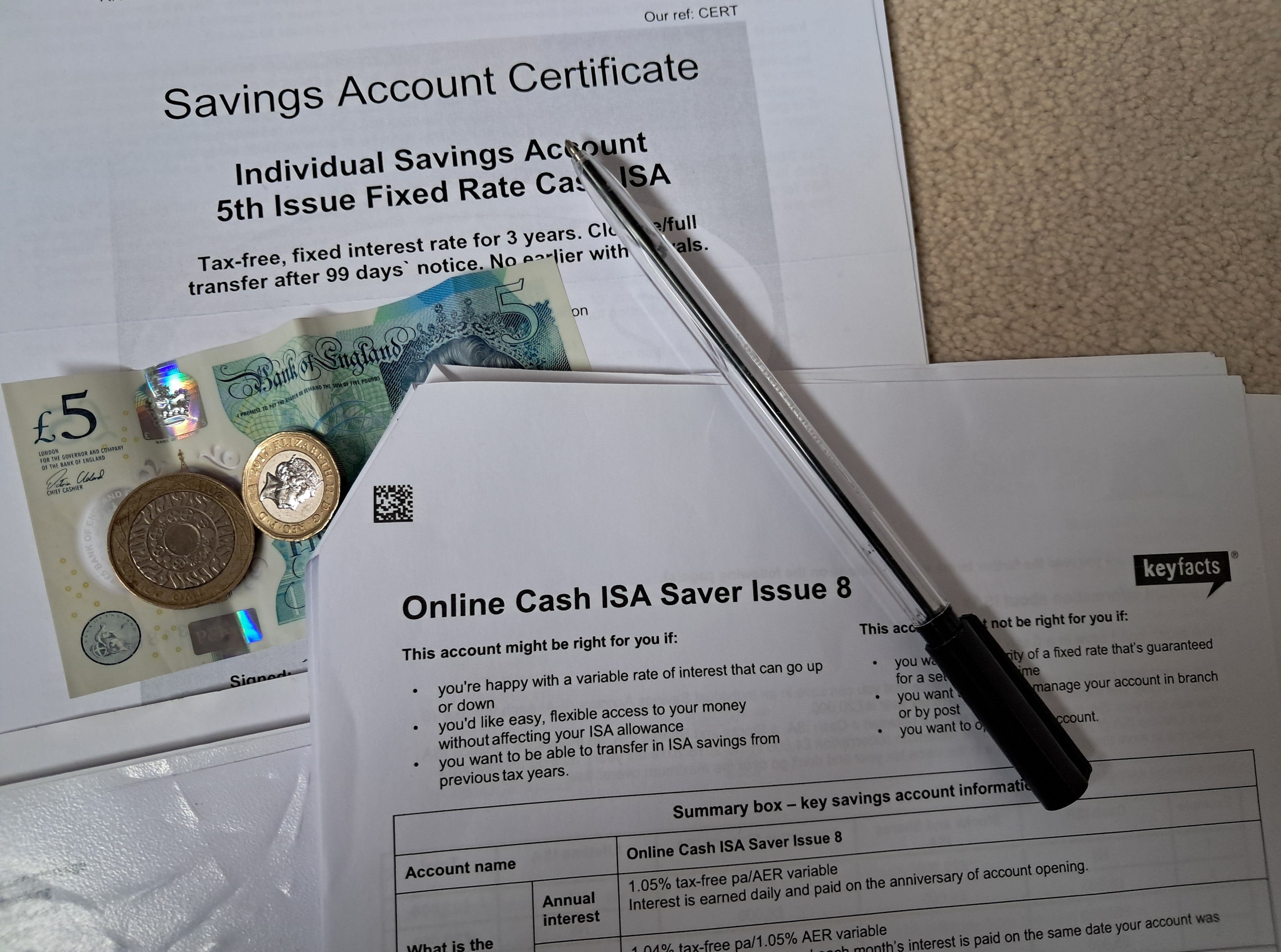

In the 2023-24 financial year, savers put almost £70 billion into cash ISAs – a 67 per cent rise year-on-year, and more than 15 million people used some or all of their allowance, government figures show.

It’s expected that this year’s ISA figures will be higher still, driven by expectations that Ms Reeves would cut the allowance.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Back in February, it was reported that she was considering reducing the annual limit to £4,000. She later dropped the plan, but now appears to have revived the idea of reforming ISAs.

She has argued that investing more in shares would boosts British businesses and create higher returns for investors.

Mr Lewis acknowledged that a “lack of investing is a problem” but insisted cutting the cash Isa limit was not the solution.

“If they [the Treasury] were saying they were doing it to raise revenue, at least that would be logical,” he wrote.

“What is needed is for them to encourage investment, better education, and better incentives.”

He proposed a younger people’s “starter investment Isa bonus” on the first £2,000 invested, funded by investment firms.

Savers may split their £20,000-a-year Isa allowance between different types of ISAs, including cash ISAs, stocks-and-shares ISAs and lifetime ISAs.

A Treasury spokesperson said: “Cash savings are important for people looking to put cash away for a rainy day, and we will protect that. But the chancellor has been clear that she wants to get Britain investing again – so British companies can grow and British savers who choose to can get more in return.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks