Budget 2018: What it means for your wallet

"Strivers, grafters and carers", this one is for you. Apparently

It could so easily have been another damp Budgetary squib for us mere mortals.

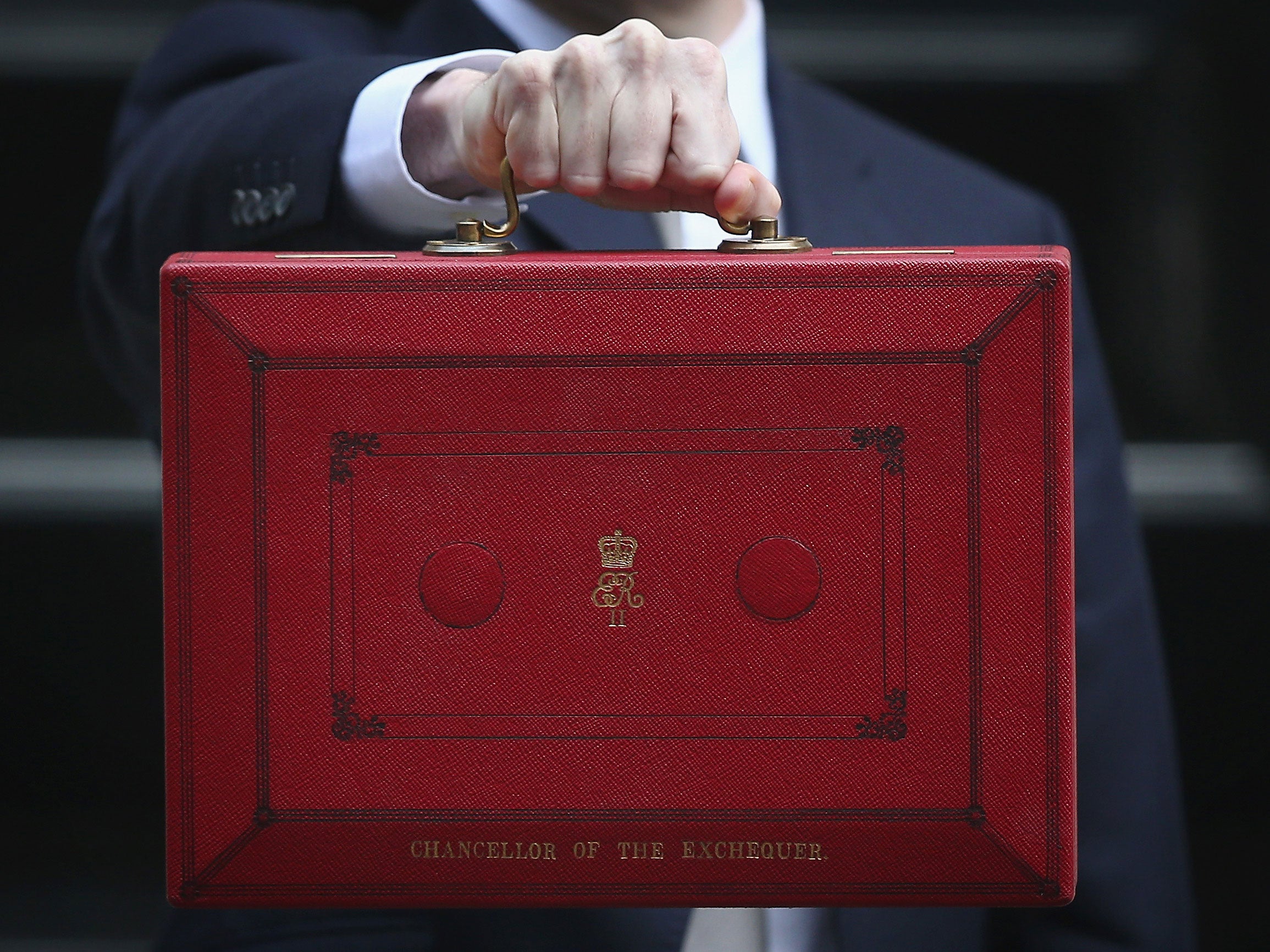

As Chancellor Philip Hammond promised an extra £20bn for the NHS with one hand and had to batten down the economic hatches as we ride into a still unknown Brexit with the other, there was a chance today’s announcement would have few big headlines that would make any difference at all for most of us.

And for the majority of his big speech in the House of Commons, or rather the Office of Ways and Means, this afternoon, it was just that – plenty of broad economic predictions, complex business chat and jokes that fell absolutely flat. Just like any other Budget speech in recent history.

And then he started pulling out the Budget Bunnies – the rabbits from hats that he claimed had largely escaped early. While we had certainly heard about a few in advance he still managed to keep plenty under wraps.

Far from the usual dull Budget speech, this one may have been the longest in a decade, but it was full of surprises.

So what were they? And how will they affect you? Here’s our Budget Briefing for your wallet.

Income tax

By far the biggest headline will be reserved for the new Income Tax threshold of £12,500 a year for basic rate tax payers and £50,000 a year for higher rate payers from next April.

There had been rumours of bringing this giveaway forward, but with such a big financial gap to fill for the health service, few took it seriously. In fact with ministers indicating that the NHS hole would have to be filled in part by a tax increase, there were real fears for the nation’s workers.

Instead, if their salaries remain the same in April, basic rate tax payers – approximately 32 million people - will see their take home pay rise by around £132 a year.

Crucially, the allowance will then rise in line with the rate of inflation.

Minimum wage

Income tax isn’t necessarily the biggest win though, especially for those earning the least.

A minimum wage increase to £8.21 for adults over the age of 25 equates to around £690 extra pounds a year on average, though that is of course subject to income tax – see above.

Benefits

The PR car crash that has been the Universal Credit roll out got a desperate cash injection of £1bn from Philip Hammond today, which may or may not assist the millions of people struggling to navigate the complex application system and facing dire financial straits while doing so.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

But with horrifying numbers of families with at least one working parent struggling on the breadline, the increase of £1000 in the amount you can earn before your benefits begin to be removed could be a lifeline. The Chancellor claims 24 million working families with children will gain £630 a year from this measure alone.

Property

Then there are the policies whose effects may not be so obvious.

The £5.5bn cash injection into the Housing Infrastructure Fund will, Hammond claims, equate to 650,000 extra houses to help ease the housing crisis.

Whether it will depends on where those properties will be built, if planning policy will allow them to be erected in the right areas and, crucially, what time period we’re talking about here.

Given that the UK requires 250,000 extra houses every year to start to ease the supply and demand bubble, it will need to be fast.

Elsewhere, news that 500 neighbourhood planning systems will help local people buy property at a discounted rate to prevent them being priced out of the area they grew up in could work. Or it could make things worse if restrictions on selling those properties on aren’t in place.

“There was also some welcome news for first-time buyers in today’s Budget,” says Daniel Hegarty of digital mortgage broker Habito.

“The Chancellor announced that stamp duty relief will be extended to those who purchase properties up to a value of £500,000 through the shared ownership scheme – which will no doubt be received positively.

“This policy will be backdated to the last budget so that anyone who has purchased a property through the scheme since 22 November 2017 will be entitled a refund.”

With few first time buyers falling into the £300,000 - £500,000, even in the nation’s biggest cities, the Office for Budget Responsibility believes the cost to HMRC will only be £5m in total – hardly transformative.

Debt

It wasn’t included in the typically raucous speech today, but we already know that the government is investigating the possibility of a no-interest loan to try to assist those with problem debt.

Against a backdrop of runaway personal debt levels around the country, StepChange Director of External Affairs Richard Lane said:

“Having campaigned for years for a no-interest loan scheme, we’re looking forward to working with the government and the banks to bring it to life. Over a million people turned to high cost credit last year to meet basic living expenses, which is counterproductive both for households and the economy. If finances are tight and your fridge breaks down, the last thing you need is expensive credit - what you need is simply a replacement fridge.

“By taking away the additional high cost of borrowing, the new scheme will demonstrate how no interest loans can act as a realistic and better alternative to short term high cost credit. It can only be a good thing to reduce the risk of households building up problem debt as a result of trying to meet their basic needs.”

Also in the extensive Budget document itself is reference to a new ‘breathing space scheme’.

Akin to a Scottish policy already in place, debt charities in other parts of the UK have been calling on the Government to give all individual debtors a period of time during which interest, charges and enforcement action is stopped while they seek regulated debt advice.

The Government is now considering increasing the gap from the six weeks originally proposed to a total of 60 days. Joanna Elson OBE, chief executive of the Money Advice Trust, said:

“The government’s planned Breathing Space scheme has the potential to be a game-changer for the fight against problem debt – but only if the scheme provides a genuine ‘breathing space’ covering all kinds of debts, including those owed to government. Anything less would be a missed opportunity.

“If Breathing Space protections apply for 60 days instead of six weeks that should be a positive step, and will give people in financial difficulty more time to start to resolve their debt problems. There will still be some people who will need longer to do this – and we will continue to argue for this period of protection to be extended at the discretion of an expert debt adviser.”

Conspicuously absent

There’s plenty to talk about but several fiscal targets have gone unplundered by the Chancellor yet again, despite real fears that Pensions tax relief in particular would be overhauled in a so-called cash ‘raid’.

It hasn’t happened. Yet.

Mr Hammond opened with the claim that this was a Budget for the strivers, grafters and carers, though his evidence for this remains limited, especially carers.

Nor was this Budget one for savers – long or short term. And while many in the pensions industry will be heaving a sigh of relief that seemingly endless upheaval and massive regulatory changes are being allowed an extended period of bedding in, the risk remains that confused consumers still trying to grapple with changes including early access to pension funds without punitive tax charges are sitting ducks for fraudsters.

Meanwhile, the Lifetime Allowance for pensions – the amount of money a saver can set aside over their entire working life before incurring extra tax charges - will rise by only £25,000 to £1.055m in 2019-20.

Tim Holmes, managing director of financial adviser Salisbury House Wealth, says:

“The increase in the Lifetime pension Allowance is only in line with inflation – it does not go far enough by a long stretch.”

“Many ‘ordinary’ public sector professionals such as GPs and teachers will be facing substantial tax charges as regular contributions from their salaries may exceed the limit, which is just far too low.”

“In previous years the Lifetime Allowance has been chopped back too aggressively, dropping from £1.8m in 2011-12 to a low of £1m in 2017-18, and has just started to recover. The damage done by this is only just beginning to show – with thousands being hit by the punitive tax charges.”

And while we shouldn't ignore the fact that we've been spared the introduction of yet another Individual Savings Account (ISA), the limits for 2019-20 will remain unchanged at £20,000. The annual subscription limit for Junior ISAs for 2019-20 will be uprated in line with the Consumer Prices Index (CPI) inflation measure to £4,368.

“The ISA limit has remained the same, which further inhibits savers,” Holmes adds.

“The Government want to encourage people to save so that they don’t become a burden on the state – but they disincentivise the people who are able to afford to do this. This could make them a burden on the state in the future.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks