Exit the Dragon: European star Anthony Bolton's shaky time in China

Anthony Bolton drew unprecedented investment to his China fund. Now, as he steps aside, Julian Knight asks if, and why, he failed

As far as fund managers are concerned they don't come much bigger than Anthony Bolton. His mere presence heading up the Fidelity China Special Situations fund managed to tempt private investors to plough in an unprecedented £460m of hard-earned cash at launch, followed by £166m a year later.

At the time of the fund's launch in 2010, during the depths of the global financial crisis, the huge appeal of Mr Bolton was seen as a vote of confidence in his skills and the prospects for China, and perhaps a triumph of fund management marketing departments.

Many observers poured cold water on the Fidelity offering, questioning the fees structure and whether or not Mr Bolton, who had precious little experience in the Far East, could produce the same returns as he had done for years in the UK and Europe. But nevertheless, investor cash just kept on pouring in.

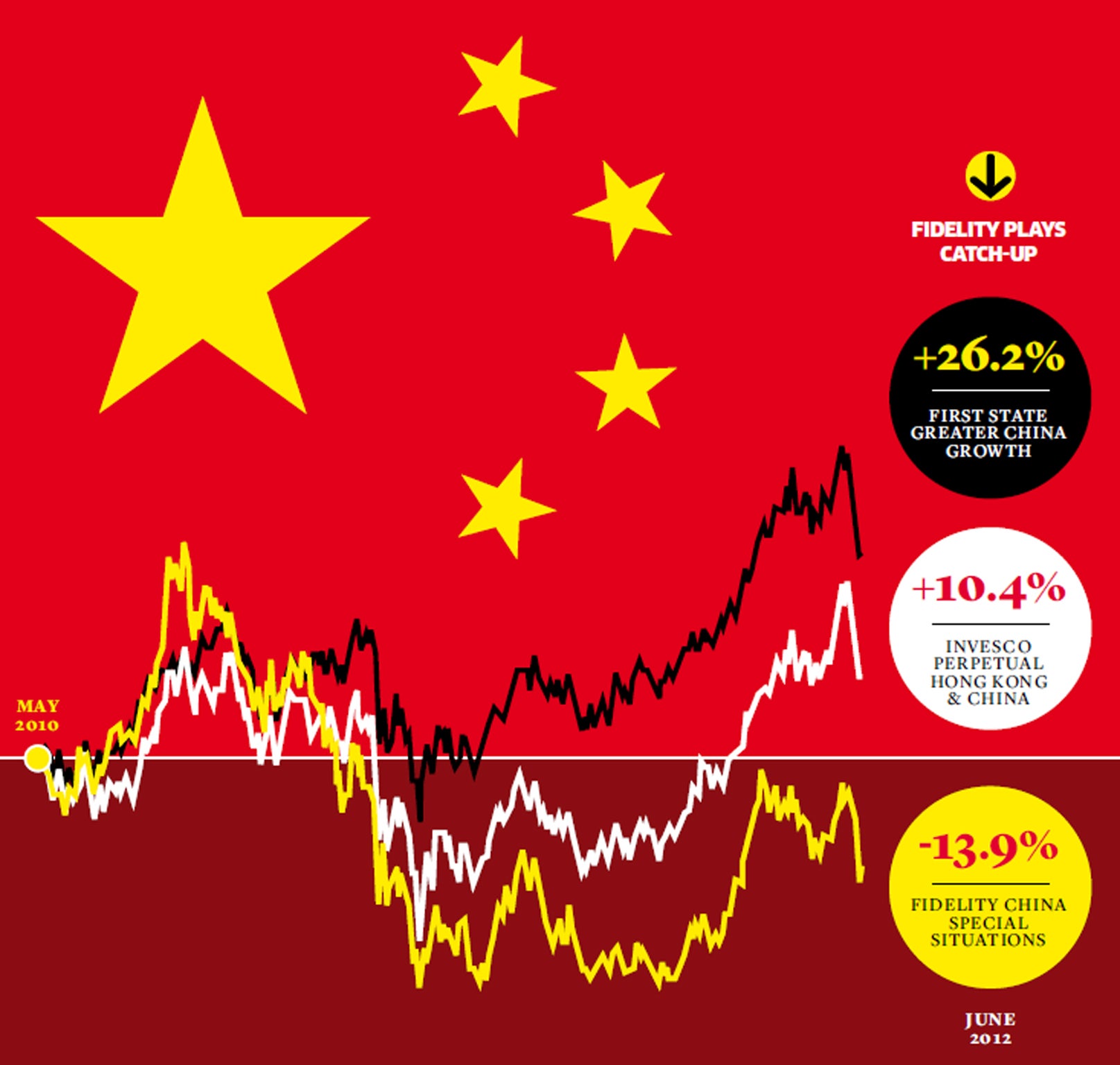

To date, these investors have not been well served. Though he was working in what Patrick Connolly from Chase de Vere brands "one of the worst-performing sectors over the past three years" – China – Mr Bolton's fund has even underperformed that benchmark.

In total, the fund is down by 13 per cent since launch (effectively down much more when inflation is factored in), against an average growth of 8.45 per cent across the sector.

"Continued talk of a slowdown in the Chinese economy, alongside global economic issues and negative investor sentiment have proved an ongoing drag on stock-market performance," Mr Connolly added.

Now Mr Bolton – age 63 – is going into retirement, to be succeeded by Dale Nicholls, who has a crucial 17 years of experience of Asian markets.

He will have his work cut out turning around the massive Fidelity fund.

"Chinese companies are culturally very different in terms of how they work, the way they manage relationships and their levels of corporate governance, meaning you can't always believe what they say or what is in their accounts," Mr Connolly said.

With these warning words in mind, it's difficult to see how Mr Bolton could have bucked the general market torpor in China, particularly as his style of management is based on getting under the skin of a company and its management, which in itself requires full disclosure and relies on cultural similarity.

"For one thing, he didn't speak the language, and while the same was true in Europe, the nuances, body language and culture of the Chinese are a lot different, and a lot can be lost in translation, which is an important consideration when you are meeting management and trying to gauge if they are fit for investment. It won't have helped his gut feel and instinct which has been so invaluable to his performance in the past," Darius McDermott, the managing director of Chelsea Financial Services, said.

But what should investors in the Fidelity fund, and more widely China, be doing now, considering the underperformance of the sector?

Mr Bolton himself has promised to do his "damnedest" to get returns in his remaining nine months in charge of the fund.

He added that he did not regret his Chinese sojourn: "I remain a great bull on China and hope that over the next nine months some of that might be rewarded," he said.

Mr McDermott reckons that, in a poor market, the Fidelity fund was also set for a bit of a fall: "The trust does have a small and mid-cap bias and has gearing, so it was always going to underperform in falling markets against a much wider benchmark."

Nevertheless, the Fidelity has drawn closer to the pack of late and Mr McDermott reminds investors with money in the Fidelity fund: that "the handover is going to be over quite a few months".

"In the past, when Mr Bolton has stepped away from funds, he has managed the transition well and the new managers have normally had a good 12 months on taking the reins. I therefore see no reason for investors to panic.

"We will rate the trust a 'hold' for existing investors until we have met the manager and had the opportunity to assess whether we think he will be a good pair of hands for the longer term."

However, for new investors who are interested in China, Mr McDermott says that they should try to gain access to the world's second-biggest economy through a general emerging-market fund rather than a country-specific one.

"Most investors will be better off investing in a generalist EM fund as it will be less volatile less risky," he says. "If investors are keen to invest in China then the fund I like is the Invesco Perpetual Hong Kong & China fund."

For some, though, it is far too early to gauge whether Mr Bolton has been a failure in China, and funds invested in the country are a very long-term investment play, according to Brian Dennehy of Dennehy, Weller and Co, who added: "I believe his approach will ultimately work well, but that will only become clear some time after he has returned to the UK.

"China is going through a transition which will appear painful on an economy-wide level but, counter-intuitively, there will be growing opportunities at a company level, exploitable through a fund focused on under-researched small and mid-caps."

Mr Dennehy suggests investors in China should look at drip-feeding their money into the sector rather than risking everything with large lump-sum investing which relies on getting the timing correct.

"Investing monthly in China is ideal, and this Fidelity fund would certainly be recommended for that purpose," Mr Dennehy says.

And long-term, the Chinese economic story is still an extremely appealing one.

"In China, growth is slowing but the economy is rebalancing – 6-7 per cent annual GDP growth is still very healthy and valuations are near to historic lows, which presents opportunity," Tim Cockerill, head of collectives research at IFA firm Rowan Dartington says.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies