Julian Knight: After 350 years, Bankers at last get something right – scrapping cheques

How dare they? Those damned bankers, not content with getting the legal seal of approval on sky-high current account charges, paying themselves bonuses for doing jobs they wouldn't even have if it weren't for the taxpayer, they now, horror of horrors, want to get rid of the good, old, reliable cheque.

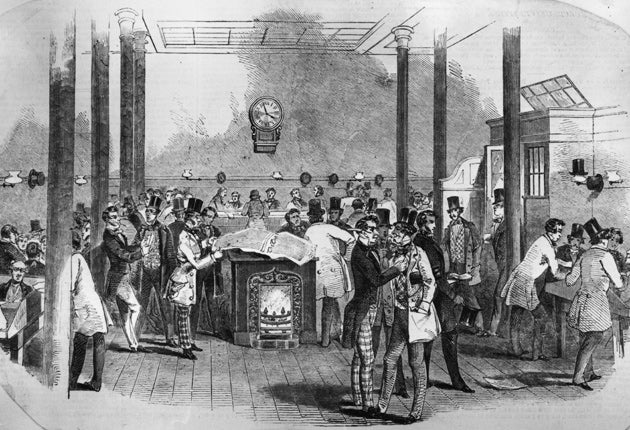

It's been around for 350 years, and apparently grannies like to send cheques through the post to their grandkids at Christmas. Imagine disappointing little Johnny as he will no longer be able to tear open that envelope to see a cheque for £10 fall out. What's worse, they're giving us a mere nine years' notice of the end of cheques. What are we meant to do? Pay by card, direct debit or even use those idiot-proof websites the banks have spent millions building for their customers?

In truth, I'm not unhappy to see cheques given a death sentence. Most retailers don't take them and they are a type of payment almost designed for fraud and theft (Plenty of grannies' cheques to Johnny never make it.) What's more, they're expensive to process and a complete hassle to cash.

The UK Payments Council, which has taken the decision to dispense with cheques, has attracted criticism for being a cabal of bankers – 12 of the 16 board members are from the big banks. But, I ask, who would you expect to be making this decision – the Dalai Lama? And as for those groups saying that people won't adjust, well, they have nine years to get used to it. Many opponents of the ditching of cheques are concerned about the effects on elderly people. OK, there are worries, but alternative payment methods can be found or existing ones made simpler. The view that millions of elderly people – given nine years' notice – won't be able to cope is patronising

Boil it down, though, and much of the criticism is simply about the fact that getting rid of cheques will make life easier and less expensive for the banks. Dare I suggest that this isn't always a bad thing that if they save £1.4bn a year by getting rid of cheques it could benefit consumers through lower costs? (The market does sometimes work, even in banking.) And even if it gets swallowed in profit, it may go to pay back the Government or help boost dividends on shares which in turn helps our pensions which – despite the financial crisis – are still heavily invested in banks.

Credit protection

As far as big-name firms going bust, this Christmas feels no different from last. OK, we haven't quite had the headlines that we saw with the demise of Woolworths and Zavvi, but we've still had Borders, Thresher, Globespan and even Coventry airport. For consumers, all this is a timely reminder that when making big purchases – over £100 – you should use a credit card. Under section 75 of the Consumer Credit Act, the card company is jointly liable, so if the retailer or airline goes bust, you can go to the card company to get your money back. It's one of the most useful protections that there is. The card issuers would love to kill it off but they can't, so make use of it and stay protected when splashing the cash this yuletide and in the January sales.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks