Questions Of Cash: The team that lost and the fan that lost out</I>

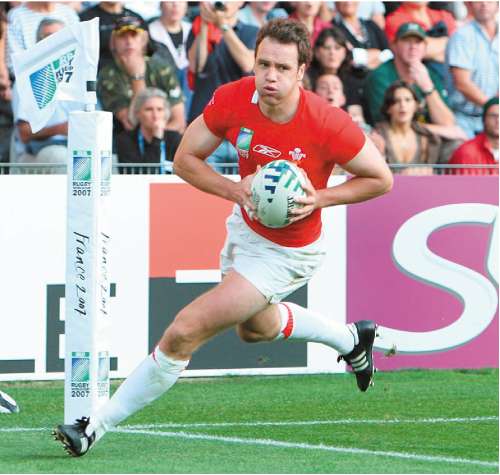

Q. I bought tickets for the Rugby World Cup from Ticketmaster, with an option for the quarter finals if my team qualified. Sadly they did not, so I was due a refund. My team exited the World Cup at the end of September and I was told I would get a refund by mid-December. This was delayed to mid-January. I contacted Ticketmaster to inform them the card I used to book the tickets had been cancelled because it had been subject to a fraudulent attack and gave them details of my replacement Egg card. Yet Ticketmaster attempted to make a payment in January to my old credit card. Egg has no record of this payment. I spent weeks ringing Ticketmaster and Egg, making more than 20 calls – each said the other had the money. Eventually Egg tracked down the payment – Ticketmaster had the money as it had bounced back within the payment system. Ticketmaster denied this until I got proof from Egg. Ticketmaster now acknowledges it has the money, but says it will take another 28 days to process the payment. AR, by email.

A. Ticketmaster told us: "The vast majority of eligible customers received their refunds for the Rugby World Cup in January." Ticketmaster says it had deliberately attempted to refund the payment to the card on which you purchased the tickets, as this is regarded as best practice to avoid fraud. Some card issuers will process this even where a card has been cancelled and transfer the payment on to the current card, says Ticketmaster. But it accepts that it did not handle your refund in an acceptable way. It posted your payment promptly upon our intervention and will send you a further £50 as compensation.

Q. I wrote to Alliance & Leicester at the beginning of January, asking several questions, some of which were answered, and enclosing a £250 cheque for my monthly deposit to my Premier Regular Saver – which was earning 9.6 per cent. A&L has not banked that cheque, nor sent me the form to re-establish my monthly standing order. Several further letters and phone calls have been ignored. JD, London.

A. The Premier Regular Saver account is an incentive product, aimed at persuading people to switch their current account to an A&L Premier Current Account. It is attached to rules limiting its use, one of which is that only one deposit a month is permitted. As you had already made use of your monthly deposit allowance, your cheque was not paid into your account. A&L says that it returned the cheque to you, but it would seem this did not arrive. A second condition of the account is that deposits can only be made into a Premier Regular Saver account for one year. A&L volunteered the information to us that to continue to take advantage of the high savings rate, you need to close your account, wait three months and then open a new Premier Regular Saver and linked Premier Current Account. It seems to us that this level of complexity – not to mention the advice by the bank on how to get round its own rules – is likely to cause confusion, which it has in your case. A&L's inability to reply to your letters for three months, along with its failure to provide a savings account that is easy to use while providing a good rate of interest, has persuaded you to move your accounts elsewhere.

Q. I have a Nationwide flex account and Monthly Income 60+ account. When I asked for a PIN for the Monthly Income account, the number turned out to be the same as for the flex account. It looks as if my PIN is not genuinely secure. Nationwide says that the PIN is only known to me, but it seems that Nationwide must record it centrally. RF, Northampton.

A. Nationwide refutes the suggestion. Its spokesman says: "PINs are generated randomly and so it is pure chance – 1 in 9,999 – that our customer has been given the same PIN for his two accounts. His PINs are secure but, if he has any concerns, he can always request new ones." So, for every 10,000 customers with two accounts, one is likely to be given a PIN the same as that on another account. On this occasion, your number came up.

Q. My mother is divorced and owns a property worth £400,000. My and I sister currently live with her. If anything happens to her, would her children be liable for inheritance tax? If so, how can we avoid paying this? What is the threshold for inheritance tax? HA, by email.

A. Lisa Macpherson, national director of tax at accountants PKF, says: "The IHT threshold is £312,000 for 2008/9. If your mother was to die in that year, this figure would be deducted from the total value of her estate and the balance taxed at 40 per cent. Assuming the property was her only asset, a charge of £35,200 would arise. If your mother was to gift severable shares in the property to you and your sister, so that you owned it as tenants in common, this would reduce the value of her estate, provided she survived seven years from the date of the gift. For her security, she should only give away up to 50 per cent of the property. For this to be tax effective, you must both occupy the property with your mother. You may pay up to your shares – based on the percentages you and your sister then own – of all the ongoing property costs, but must not pay any more than this level, otherwise your mother's gift will be treated as 'subject to a reservation' and will not be effective for IHT purposes. Alternatively, an insurance policy could be purchased to cover the cost of the likely IHT liability."

Questions of Cash cannot give individual advice. Please do not send original documents. Write to: Questions of Cash, The Independent, 191 Marsh Wall, London E14 9RS; cash@independent.co.uk.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks