What the Budget might mean for you

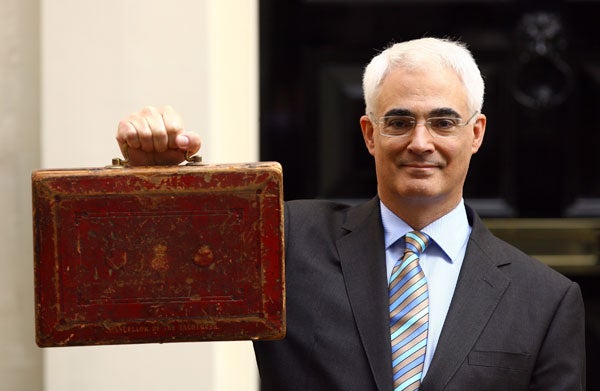

Next Wednesday's pre-election Budget is unlikely to introduce much bad news. Vote-winning will be the name of the game but Chancellor Alistair Darling may well include some surprises, not least an increase in capital gains tax. There has been speculation that the Chancellor will increase the rate from 18 per cent to the rate of income tax.

"An 18 per cent capital gains tax rate is not sustainable long-term where income tax rates are as high as 50 per cent, not least because the difference in rates increases the temptation to turn income into capital," says Andrew Hubbard, director of tax policy at RSM Tenon. "We believe the Chancellor will initiate a review of CGT and this will lead to a U-turn in policy and capital gains tax will return to being payable at an individual's highest marginal rate of tax."

But such a move would be a retrograde step, says David Kilshaw, head of private client advisory at KPMG. "The CGT rate affects business investment and thus job creation. The change in April 2008 to 18 per cent was a major upheaval and it would be unhelpful to amend this again so soon."

The Chancellor could be tempted to raise VAT to 20 per cent, bringing the UK in line with the rest of the EU. The move would generate £8-10bn but would hit the average person by about £2 a week. The good news is that zero rates on food, housing, public transport and other crucial areas are unlikely to be abolished, despite calls from some right-wing think tanks. It would be foolish to hit the low-paid so close to an election.

We already know about the additional higher 50 per cent rate of income tax which is being introduced from 6 April, so there is unlikely to be any more tinkering with rates. However, if Mr Darling is tempted to introduce a 1 per cent increase, it would cost an someone earning an average salary an extra £254 in tax each year. But chances look slim.

However, there could be further changes to the pension relief threshold. "The new rules introduced in last year's Budget are hideously complex," says Mr Hubbard. "The principle that higher rate relief should be restricted or abolished is a political decision which is unlikely to be reversed. A consultation on restricting all reliefs to basic rate is likely."

We also know that fuel duty will rise by inflation plus 1p on 1 April which is likely to add around 2.5p to 3p a litre. The RAC has cautioned the Chancellor against making further rises. "Motorists have faced tax rises since the end of 2008, which has helped take petrol prices back towards the 120p a litre mark," the RAC points out. "We hope the Chancellor defers the next fuel duty increase to help prevent prices escalating."

Mr Darling may be tempted to raise £9bn by increasing alcohol duties by 10 per cent. Doing so would see the duty for wine rise from £1.61 to £1.77, beer from 39p to 42.9p, and spirits from £6.14 to £6.75. But such a move would be very unpopular.

One possible change is the scrapping of the higher rate of tax relief for Gift Aid contributions. The Government has published a research document which considered a number of options the effect of any would be to deny full relief to those who pay tax at higher rates. The Budget is a chance to indicate which option is preferred.

Get busy before the end of the tax year

Whatever happens in next week's Budget you should be planning to take action ahead of the end of the tax year. What should you be doing now?

Elsewhere in this week's section we have pointed out the importance of making use of your ISA allowance. If you fail to do so by 5 April, you will lose the 2009-10 allowance.

Even if you currently have no funds available to put in an ISA you could still act, says Adrian Lowcock, senior investment adviser at Bestinvest. "Look at your existing investments and consider selling them and repurchasing the assets back inside an ISA," he says. "With the first £10,100 of gains free of tax, this can be a good way of tidying up your portfolio and making it more tax efficient."

He also suggests it is a good idea to transfer assets to your spouse. "If your partner doesn't pay tax or is on a lower tax band, then transfer cash savings or any unwrapped income-generating asset into their name can mean paying less tax on it."

Finally you should use your capital gains tax allowance: "With £10,100 per person per year of tax-free gains it makes sense to use this allowance before the next tax year starts and the incoming government decides to review the CGT rules," advises Lowcock.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies