Why it's vital to get the numbers right as you pick a new or used car

As we say goodbye to the dreaded 13 plates Kate Hughes shows the effect of factors like insurance and depreciation

The next car number plate period, now just a couple of weeks away, will not only be a huge relief for all those of a superstitious nature, but is also set to be the catalyst for a massive increase in new car sales.

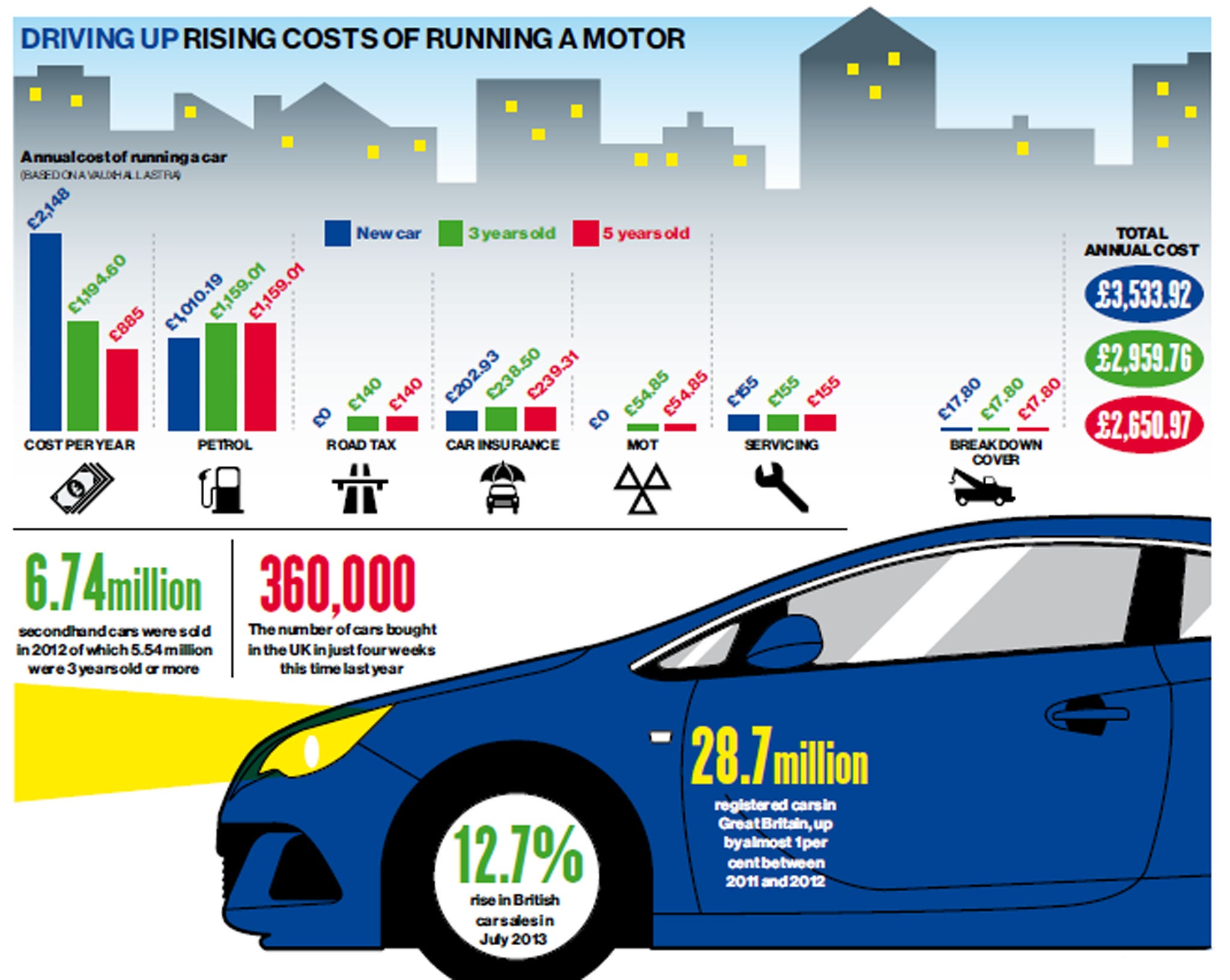

As plates switch from displaying the dreaded 13 to a much more benign 63, the Society of Motor Manufacturers and Traders (SMMT) is expected to reveal that the number of new car sales in September jumped dramatically compared with previous months, buoyed in part by the typical increase in buyers keen to have the latest plate. In any given month, the SMMT estimates that 140,000-150,000 new cars are registered in the UK. In March and September, that number more than doubles and this time last year we bought 360,000 cars in just four weeks.

Between them, these two months account for around 40 per cent of all the new car registrations every year. This year, though, sales are already 10 per cent up on 2012 and July saw the 17th consecutive rise in monthly new car numbers. So September is shaping up to be a record-breaker, says Jonathan Visscher from the SMMT, which has significantly raised its forecast for 2013 registrations to 2.216m vehicles. Already revised up once this year, that figure could still be a very conservative guess.

"Confidence is a big thing when it comes to buying a new car, and with retail figures up, manufacturing figures up and RPI heading in the right direction, people feel better about spending their money," he said.

"But the difference between our domestic economic circumstances and those on the Continent is also having an effect. Providers of affordable credit and attractive finance packages are far more likely to want to offer their deals to the British public rather than Europeans so there are lots of options out there for new car buyers."

At the same time, contrary to what you might expect from a nation counting the pennies, the used car market continues to shrink. The total number of cars on our roads, lanes, in garages and car parks, on front drives, and half up the pavement has risen to a new record high, with the latest RAC figures showing that by the end of 2012 we had 28.7m registered cars in Great Britain, up 1 per cent between 2011 and 2012. The most common car remains the Ford Focus with 1.4m and the Ford Fiesta at 1.3m. And while the financial crisis slowed the pace of growth, it didn't stall it.

But figures from credit agency Experian show that the number of nearly new cars on Britain's roads has been steadily declining since well before the cracks started to appear in the global and domestic economy.

In 2005, 7.842m second-hand cars were sold, 5.942m of which were three years or older. By 2012, that figure was down to 6.743m, of which 5.545m were three years old or more.

"Better fuel efficiency and other savings like road tax banding, no maintenance costs and no MOT for the first three years are often key considerations for people deciding to buy a new car rather than a second-hand one," Mr Visscher added. "All that could make planning your finances easier and the leasing deals available mean it's a safe way to spend the money as, at the end of it, the dealer takes the car away and you get a new one.

"The car scrappage scheme, now closed, introduced people to the benefits of new cars and with a typical replacement cycle lasting three years, the consumers who took advantage of that scheme are now after their next car."

But deciding whether to buy new or used is far from a no-brainer, not least because of the infamous depreciation effect that could wipe away a third of the value of a new car or more in the first three years. It simultaneously makes the purchase of the latest thing less attractive and picking a nearly new option more compelling.

Meanwhile the country's financial figures may indeed have turned a corner, but it will be some time before that truly trickles down to have an effect on our wallets. Understandably, more one in four adults prefer to buy both second-hand and online, according to research from Standard Life.

But assume that purchase price is the most important factor at your peril. The problem is there's rarely a universal rule and the make and model has a significant bearing on whether you should go new, nearly new or a bit older to stretch your cash. Plus the deposit you pay and the final payment amount on a new car can depend on your negotiation skills. Break it down into how much it'll cost you a month to have on the road, and life gets easier to compare.

Our graphic shows how the different elements can hit the cost of a Vauxhall Astra but the same is true of other motors, says Moneysupermarket. Its analysis shows that the annual running costs for a Ford Fiesta, for instance, are £1,134, including petrol, servicing, breakdown cover and insurance. You won't pay anything for road tax or MOT on a new car and with these costs taken into account for a three year old and five year old model, a new Fiesta is more than £500 cheaper to run.

As for monthly finance costs, you're looking at an average of 4.9 per cent on a £9,695 car, which comes out at £109. The older cars may be a little cheaper to purchase, but with higher interest rates, it's only £4 a month more expensive to finance than a five year old model.

Not so the more upmarket BMW 3 series. Filling up the tank will set you back an average of £1,177 a year and insurance is typically £2,760 making annual running costs an average of £3,955 for a new motor. But a shiny new one is the cheapest deal, coming in at almost £1,000 cheaper to maintain and run a year than a five year old version.

But the monthly finance costs turn the tables given the £31,300 price tag and typical APR of 4.9 per cent. Every month you'll typically pay £349 for a new one, £266 for a three year old version and £242 for a five year old car, which quickly erodes the gain you made on the running costs, making it the most compelling deal.

It's the same story with the Peugeot 208. You'll pay £1,030 in running costs and a further £169 a month, or £2,028 a year in typical finance costs on a new one. At three years old the running costs climb to £1,761 but the finance comes down to £1,404, and at five years, the running costs increase slightly to £1,778, but the finance plummets to £68 a month at 8.3 per cent APR on a far cheaper car, which is £816 a year.

"For some people the thought of buying a brand new car might seem like the most expensive option but we know in some cases the offers available from dealers for new vehicles are very competitive and there can be examples of buying a new car working out cheaper than purchasing an older model," said Peter Harrison, car insurance specialist at Moneysupermarket.

"The vehicle you choose to buy affects the cost of car insurance you'll pay, so it is well worth researching your options to find out which cars come with cover you can afford. It then may be worth digging a little further to compare whether the cost of cover increases or decreases if you're toying between buying a brand new car or an older version of the same model. Consider all the costs of running a car before taking the plunge so you know exactly what you're in for to help you choose one you can afford – and keep on the road."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies