Nine million people face tougher tax penalties

HMRC investigators have sharpened up their act when checking the UK's self-assessment forms – so double-check yours, says Neasa MacErlean

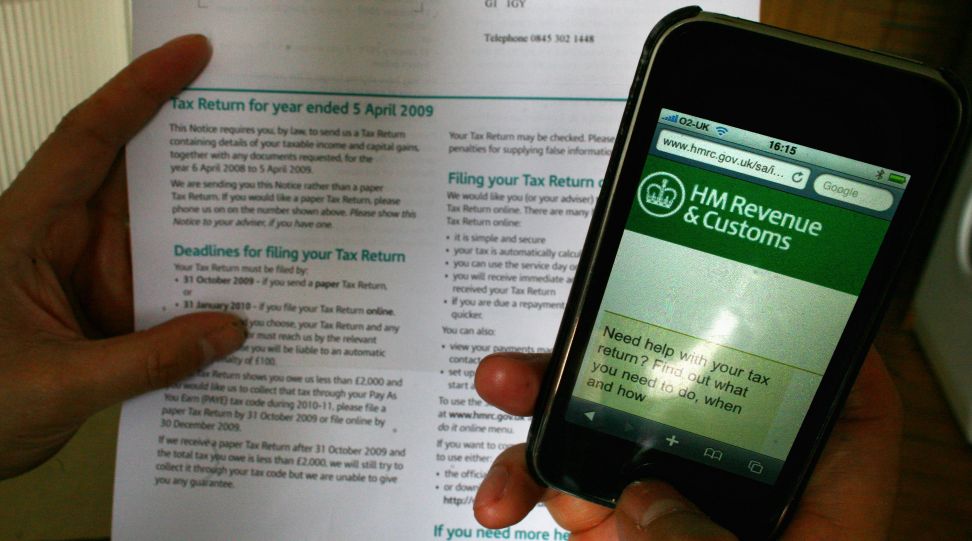

About four million people have been working on producing their tax returns over the holiday period, or have yet to file them before the 31 January deadline. But all taxpayers need to be particularly careful that their returns are accurate this year. Her Majesty's Revenue & Customs (HMRC) is taking advantage of a new, tougher penalties system and is also using its technology far better than in the past to spot people understating their tax liabilities.

Each of the nine million tax returns submitted every year are thought to be subjected to about 400 logic and comparison tests. These analyses have become far easier for HMRC to do, now that seven million forms come in online. They can be checked against others and against previous returns from the same person at the click of a mouse. HMRC is also getting better at comparing information from different sources, such as matching up the interest that a bank says it has paid to an individual with the declaration of interest made by that same individual on their return. HMRC's software will also flag up unusual situations to its investigators, such as that of a 67-year-old who is not receiving a pension.

John Cassidy, a tax investigations partner at the accountant PKF, says: "If something is wrong on your return, you've got a much higher chance of being spotted now. HMRC have always had tons of information, but they have been pretty bad at using it. But now they have got better."

And Anita Monteith, tax manager at the Tax Faculty of the Institute of Chartered Accountants in England and Wales, warns: "They are sophisticated and getting more so." One particular kind of analysis that HMRC concentrates on is comparing the self-employed to their peers. The kind of question they will consider, says Mr Cassidy, goes like this: "If you are a chip shop at one end of the street, why aren't you making as much as the chip shop at the other end?"

If your profits have gone down for a particular reason (because you were unwell, perhaps, or because you lost a major contract), then it is worth keeping a note of these reasons in case HMRC asks you later."

Since the Finance Act 2008 became law, HMRC has had greater flexibility in writing to taxpayers to ask them individual questions about their affairs.

"You've got to be pretty careful if you are asked one of these questions," says Mr Cassidy. "HMRC has limited resources. They are not going to waste them asking questions if they don't think it is going to yield more tax."

HMRC is now using new penalties, though fines are banded and set as a percentage of any tax underpaid, depending on the lack of care, deliberate negligence or dishonesty on the part of the taxpayer. From later this year, people can be fined for returning their tax details late, even if no tax is owing. With less money flowing into the Exchequer during the downturn, Mr Cassidy thinks HMRC will be more vigilant in getting all the tax income it can legitimately claim. "In the past couple of years, their money has gone down and, therefore, they need to find the hidden tax," he explains.

Mistakes are very easily made on tax returns. The accountant BDO has seen many individuals switch out of ordinary bank and building society savings accounts, because they were receiving interest of less than 1 or 2 per cent per year and into money market funds. But these funds are taxed on a much more complex basis than bank interest, says BDO's senior tax partner Stephen Herring. "People need to be really careful that they put them down on the return correctly. They can get a penalty if they underpay," he adds.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Conversely, these low interest rates mean that some of the country's one million buy-to-let landlords could be in for a shock. In many cases, their monthly mortgage payments will have gone down, leaving them with a greater taxable profit and, therefore, a bigger tax bill. Tina Riches, of the Chartered Institute of Taxation, says: "This is certainly something that people should watch out for. They can get quite a nasty surprise." Another area of perennial confusion is pension contributions. Workers should check with their employers if they are not totally sure they understand which figures need to go into which boxes on the tax form. BDO is also concerned that some high earners may fall foul of the "anti-forestalling" provisions which prevent them obtaining tax relief on more than £20,000 or, in some cases, £30,000 of contributions. The rules are explained in the notes to the tax return and those affected need to read them if they are completing their own applications. While there have been problems in the past about online filing of tax returns, the experts say the system is working smoothly now.

"It all seems to be going reasonably well," says Ms Riches.

Anyone who still has to set up online access with HMRC must hurry, according to Ms Monteith, because it takes at least a week to get the password and set up the electronic facility. Mr Herring also urges people to take action now. "If you file your tax return on the last day, or a couple of days before, [HMRC] are taking a more jaundiced view of it if you have made an error." This means that you would be more likely to get fined as you could be deemed as acting without due care if you use too many estimates, do not get your figures right and do not read the HMRC guidance.

Taxpayers should not forget about tax issues once they have filed their tax return, however. HMRC usually sends out tax codings in January, although this may be delayed to February this year. Many tax codes that were sent out in early 2010 were incorrect, as HMRC data inputting measures about people's individual circumstances have not worked properly.

So people could get codes that are too low or too high for their situation if, for instance, a source of pension income is being missed off or if an employment contract is still thought to be continuing after it finished.

"There will still be a lot of wrong codings," says Paddy Millard, chief executive of the charity Tax Help for Older People. "It will be years before that is out of the system. People need to be very much on the ball when looking at codings that seem odd."

Breaking the code: Are your deductions correct?

Only one in 50 people who were due to be sent statements last autumn telling them they had underpaid tax have appealed against the rulings. Most of the 1.38 million people who have not challenged the statements will start repaying in April, when monthly deductions will be made from their pay or pensions through their tax code.

They will receive new tax codes by post later this month or in early February. The codes are not easy to understand but, if tax has been underpaid, this should be stated clearly. Since the average underpayment is £1,500, the typical person will find deductions from his income averaging £125 per month for the tax year starting in April.

For most people, the arrival of a new tax code will be the first notification, after the original letters, about the sums due. Paddy Millard, of Tax Help for Older People (THOP), is surprised more have not complained. "This is going to shake up a lot of people," he says of the coding notices. "People should be getting their act together. It is a second chance." Useful information on how to challenge an HMRC notice is on the websites for both THOP and its sister body, the Low Incomes Tax Reform Group (LITRG). About 1.4 million individuals were told last year that they had underpaid tax and had a liability to make good the shortfall.

Towards the end of last month, only 18,734 people had appealed, according to HMRC. Of those, nearly a third (5,809) have seen their challenge accepted.

THOP is seeing a 50 per cent immediate success rate on its letters challenging HMRC. It keeps on fighting in most cases, so that 50 per cent success rate is likely to rise significantly as it gets into further correspondence with HMRC. Mr Millard believes many people who received HMRC notices deserve to have their liability cancelled. He and his staff find the HMRC response bizarre. "It's utterly inconsistent," he says. "It's impossible to see a pattern from one letter to the next."

Since most cases are handled by HMRC's office in Birmingham, the inconsistent response is not because different regions take different views. Mr Millard's experience suggests that two people with exactly the same circumstances could be judged entirely differently by the tax office, with one being let off and one having to pay.

Useful links

* HM Revenue & Customs: www.hmrc.gov.uk/individuals

* Low Incomes Tax Reform Group: www.litrg.org.uk

* Tax Help for Older People (which gives free advice to pension households with annual income of less than £17,000): www.taxvol.org.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks