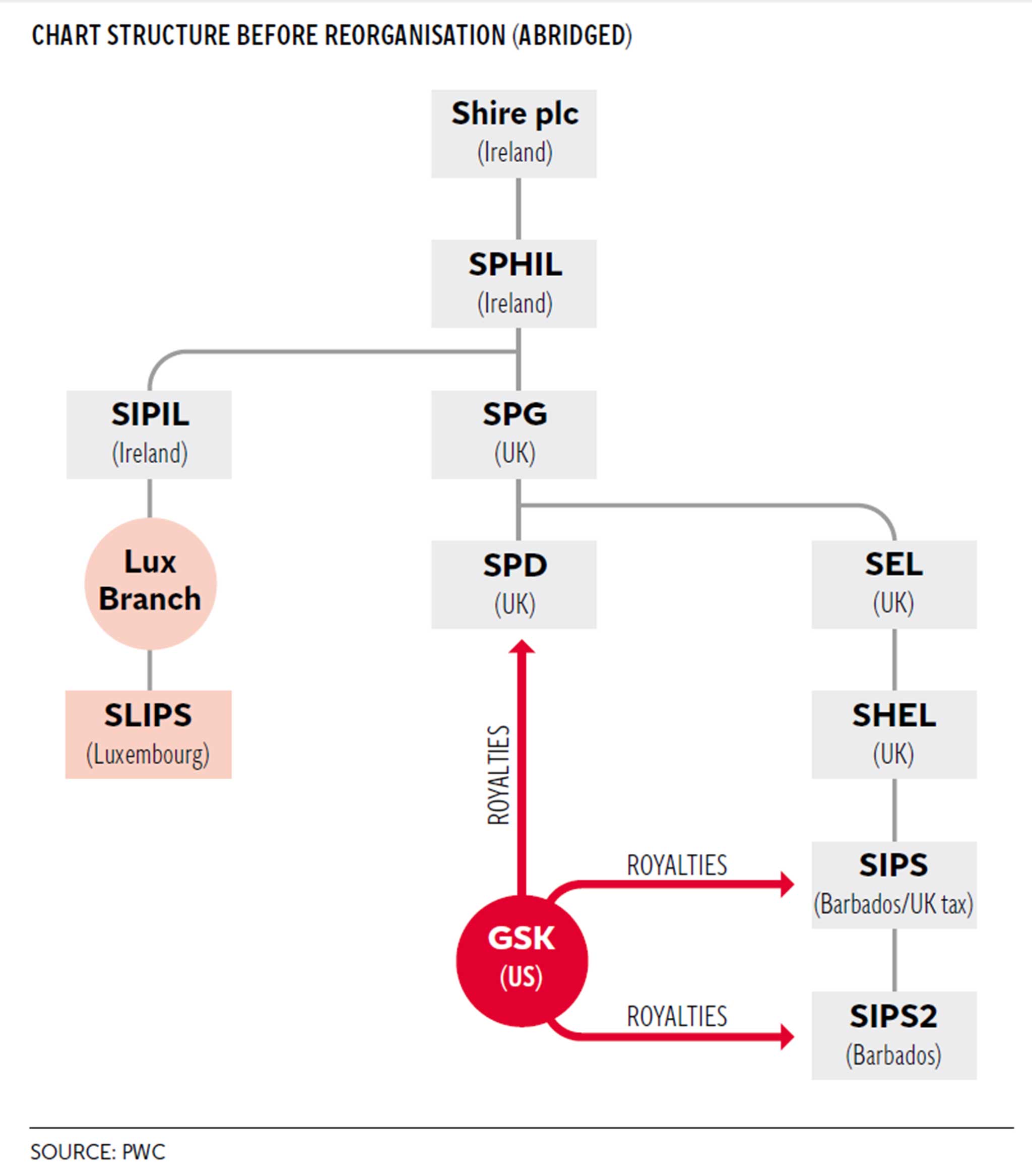

The chart that lays bare Shire pharmaceuticals' complex tax arrangements

Shire is a global pharmaceutical company, incorporated in Jersey but domiciled in Ireland for tax purposes. It has around 5,600 staff worldwide, the majority in the US but only two in Luxembourg, where it paid tax at a rate of only 0.0156 per cent on its profits, the Public Accounts Committee said.

Neither PwC nor Shire could demonstrate that the company’s presence in Luxembourg was designed to do anything other than avoid tax, said the committee.

Shire told the MPs: “It is not necessarily a question of comparative efficiency. We could have the lending in and lending out in all sorts of other jurisdictions. It is just a good location”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks