How your money can be a force for good: an ethical banking guide

Fed up with Barclays and want to join a more noble bank? Martin Hickman presents three alternatives to the norm

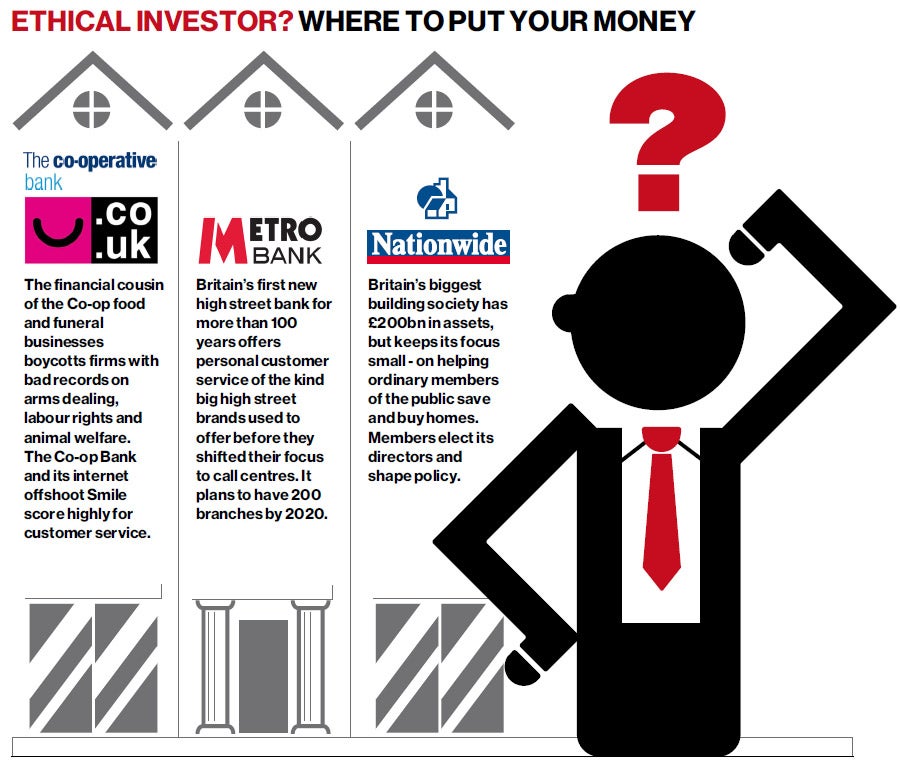

The Co-op/Smile

The personal finance arm of the Co-operative movement puts its money where its mouth is by boycotting unethical businesses.

Since its ethical policy was introduced in 1992, the Manchester-based bank has withheld more than £1bn of funding from "unethical" businesses and won't deal with companies that: manufacture or sell "indiscriminate weapons" such as cluster bombs; have poor records on labour rights such as employing children or opposing trade unions; develop high climate change emissions fuel such as tar sands; experiment on great apes, such as gorillas and chimpanzees (permissible in some countries).

The Co-op Bank is no minnow: it has 342 branches in the UK and had sales of £2.2bn last year. Its internet bank, Smile, is highly rated for customer service: accounts are managed online and through the Post Office network. In the latest Which? rankings, Smile scored 88 (second out of 19 major banks) and the Co-op 85 (fourth) for customer service.

Ethical Consumer magazine Best Buy

Which? recommended provider

Nationwide Building Society

The Nationwide (motto: "On Your Side. When You Need Us") is the biggest savings provider in the UK and one of the three biggest mortgages lenders.

As Britain's biggest mutual organisation, customers are "members" with a democratic right to have a say in the directors and policy. It sees itself as having a wider social mission and prides itself on responsible lending and for offering savings and customer accounts with better rates than its Plc rivals. Its accolades include an Investors in People Gold status for its commitment and practice; the UK's only national standard for excellence in community investment, CommunityMark; and it is one of only 38 UK firms to hold the standard awarded by Business in the Community. The Nationwide has 800 branches and had sales of £2.1bn last year. In the latest Which? customer service rankings, it scored 74 (sixth out of 19 major banks).

Ethical Consumer magazine Best Buy

Which? recommended provider

Metro Bank

The first new high street bank in the UK for more than 100 years. It started with four branches in London (Holborn, Earl's Court, Fulham and Borehamwood) in 2010 and now has 10 across Greater London.

It is still small, only 80,000 customers so far but recently raised £126m for expansion and within eight years plans to have more than 200 "stores" nationwide.

It aims to take custom away from the main high street ba nks by excelling in traditional customer service. Its branches stay open later than traditional high street banks – from 8am to 8pm on weekdays and for six hours a day at the weekends, its call centre is open round the clock and there is no need to make an appointment to speak to a manager. Metro Bank has not earned any ethical black marks in its short life so far.

Ethical Consumer magazine Rated fourth out of 30 UK banks for ethics

Which? too small to feature

How to switch:

Many people think switching banks will be a nightmare, but it's probably easier than you think. You can automatically transfer direct debits and standing orders to your new bank. Your old bank has three working days to provide the information to your new financial provider.

The whole business should be completed in a couple of weeks.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies