Rise of US fracking causes seismic shift in North Sea oil

Shale oil has seen America replace Saudi Arabia as the world’s biggest producer, but it has also caused prices to plunge and, as Environment Editor Tom Bawden reports, that could spell disaster for the mature North Sea industry

The mood in the North Sea oil industry is the most depressed it has been since records began, as soaring production in the US drags down prices – a development so profound that it has created "tectonic shifts" in global energy production and consumption.

The falling oil price has hit the industry’s confidence so badly that two-thirds of North Sea operators have been forced to cancel projects in the region, while half have reduced staff training, according to an alarming new report from the Aberdeen & Grampian Chamber of Commerce.

The oil price has tumbled from $115 a barrel last summer to around $65 now, as advances in fracking technology have enabled US shale oil production to soar at a time when growth in global demand has slowed.

The combination of rising production and falling demand has contributed to a "watershed year" for the industry in 2014, according to a separate report from BP, which will have severe repercussions for the North Sea in the coming years.

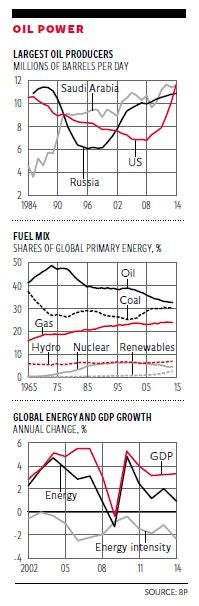

The BP report says an increased global emphasis on tackling climate change and a slowing Chinese economy have reduced demand for fossil fuels, as rising shale oil production in the US meant the country overtook Saudi Arabia to become the world’s biggest oil producer last year.

"The eerie calm that has characterised energy markets in the few years prior to 2014 came to an abrupt end last year," said BP’s chief executive, Bob Dudley.

"These events may well come to be viewed as symptomatic of a broader shifting of the tectonic plates that make up the energy landscape, with significant developments in both the supply of energy and its demand."

Spencer Dale, BP’s group chief economist, said: "We are truly witnessing a changing of the guard of global energy suppliers. The implications of the shale revolution for the US are profound."

The US overtook Russia as the world’s largest producer of oil and gas combined last year, as a result of the shale revolution, BP said.

These developments could mark the eclipse of the oil industry in the North Sea, where much of the easily accessible reserves have been extracted and the remainder will be relatively expensive to recover.

Some 76 per cent of North Sea operators are less confident about their North Sea activities than they were a year ago – a massive decline in optimism since the previous Chamber of Commerce survey six months ago, when the figure was 46 per cent, and the lowest level since the survey began in 2004.

The dive in confidence comes despite a small rebound in the oil price from its low in January of less than $50. This is because operators have given up hope of a significant rebound and accepted that prices are likely to remain depressed for several years, meaning that many projects could be cancelled, according to James Bream, research and policy director at Aberdeen & Grampian Chamber of Commerce, which conducted the research with the law firm Bond Dickinson.

"We have seen high numbers of redundancies already and the concern is that the worst is yet to come," he said. "Confidence levels are at an all-time low and we are now experiencing our first 'recession of confidence'."

That term is an allusion to the technical definition of an economic recession, defined as two successive quarters of declining output.

Experts have forecast that tens of thousands of jobs could be lost in the North Sea with majors such as BP, Shell and France’s Total among those laying off staff, reducing investment or closing operations.

Last month Fairfield Energy shocked its staff by announcing plans to decommission its Dunlin Alpha platform early, blaming the depressed oil price and “challenging operational conditions”.

This came after the North Sea explorer Trap Oil cancelled several exploration licences – including the Savannah, Valley and Nutmeg prospects – because it was unable to bring in partners to share the costs in the face of low prices.

Meanwhile, Glasgow-based Weir Group became the latest victim of the price slump yesterday as the maker of pumps and valves for the oil industry announced a 34 per cent decline in orders during the first five months of the year, compared with the same period in 2014.

However, there is some good news for the industry, as its decline speeds decommissioning, the process of dismantling aging oil platforms.

Uisdean Vass, of Bond Dickinson, said: “Decommissioning is the bittersweet positive in the survey. Academics have been predicting an imminent spike in decommissioning for years but that spike is now well and truly upon us. It could be very important in maintaining the value of activity in the North Sea – but the inevitable downside is that it hastens the decline of offshore exploration and production.”

The BP report – its 64th annual Statistical Review – contained some good news for the environment. It said total emissions from all kinds of fossil fuels grew by just 0.5 per cent in 2014, the slowest annual growth for more than 15 years – with the exception of 2008 when the economic slowdown due to the financial crisis was at its peak. That compares with an average increase of 2 per cent in recent years. However, BP said the trend of lower emissions might not last when Chinese industrial production began to accelerate again.

Renewable energy was the fastest growing form of power, accounting for one third of the increase in energy use during the year – although it still accounted for only 3 per cent of the total, the report said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments