David Blanchflower: The Bank of England should get ready for more downside surprises

The national statistic Average Weekly Earnings (AWE) has shown absolutely no evidence at all of any wage growth for a couple of years

The Monetary Policy Committee’s raptor in chief, external member Martin Weale (MW), in his most recent speech drew the astonishing conclusion that the “margin of spare capacity is now small and it is currently being used up rapidly”, despite the fact that the underemployment rate – which adds together unemployment and the number of extra hours workers want – being around 7.5 per cent and there is no credible evidence of any wage pressure.

Apparently MW based his belief on the following evidence: “Most of the businesses I talk to discuss settlements in the range of 2 to 3 per cent.” MW concludes that the tightening of the labour market means “instead of waiting to see wage growth pick up, I think it is appropriate to anticipate that wage growth.”

So let’s look at the evidence.

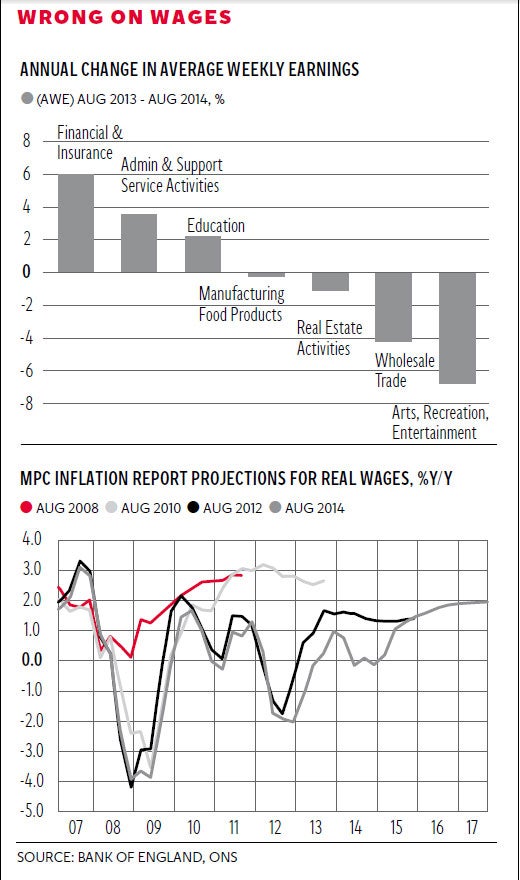

The national statistic Average Weekly Earnings (AWE) has shown absolutely no evidence at all of any wage growth for a couple of years. Indeed, the level in August 2014 is up only one pound since December 2013 – from £478 to £479 – and up seven pounds from the £472 in August 2012. In the latest data release the AWE grew by 0.8 per cent.

The first chart reports data for seven of the 24 sectors for which data is available – I include only those sectors with growth of over 2 per cent or negative growth. Six industries had wage growth of over 3 per cent, but another six had negative wage growth. A mean of 0.8 per cent includes some sectors with high positive wage growth as well as others with negative. Of the 24 sectors, 12 had higher growth rates than the mean and 12 had lower rates. A mean of 1 per cent is entirely consistent with some individuals having wage growth of 10 per cent as well as some workers having falls of 10 per cent; the danger is to assume they tell you much of anything about the mean.

The evidence of low nominal wage growth is even more stark in the Labour Force Survey data which is a random sample of employees, in contrast to the AWE which excludes all workers in firms of fewer than 20 employees. Both the AWE and the LFS exclude the self-employed, whose real earnings in the last year have fallen by around 20 per cent.

In the LFS mean earnings fell by 0.6 per cent, and there were nominal falls in wages in nine of the 15 identified sectors. But even in the LFS five sectors had wages growing above 3 per cent, with wage growth especially marked in Information and Communication. In contrast wages in Professional, Scientific and Technical Activities fell by 10 per cent.

It is perfectly conceivable to have some sectors with rising wage growth at a time when nominal wage growth is negative. The danger is drawing conclusions from a non-random sample of three men and a dog that MW appears to have met while wandering around the (southern parts?) of the country. So I beg to differ, and so does the Bank of England’s chief economist, Andy Haldane (AH).

It is no coincidence that AH masterfully countered the MW hogwash with a speech of his own a few days later. Timing is everything. When I disagreed with the former governor Mervyn King, my usual response was to come out with a speech or write a paper to make public my counter-view, on immigration, wage growth, decoupling and much more.

Haldane identified two countervailing forces he called the “ecstasy” and the “agony”. The ecstasy is based on six main bits of evidence. First, recent revisions to GDP suggest that the UK experienced both a shallower recession, and a somewhat stronger recovery, than previously believed. Second, UK growth is reasonably well-balanced between consumption and investment, although net trade continues to disappoint. Third, CPI inflation, at 1.2 per cent, has fallen below the Bank of England’s 2 per cent inflation target, reducing the squeeze on households’ real disposable incomes. Fourth, borrowing costs remain at exceptionally low levels. Fifth, asset prices have risen, with equity prices up over 50 per cent since 2009. Finally, employment is up 1.8 million since the recession trough and 750,000 in the past year.

But this has to be set against the flies in the ointment, the agony. On the net the agony is in the ascendant. AH suggests the evidence for his agony is threefold. First, annual real wage growth has been negative for all bar three of the past 74 months and is currently running at minus 1 per cent. Second, productivity remains 15 per cent below pre-crisis trend level and was broadly unchanged in Q2 2014. Third real interest rates are around zero and have been there for close to four years.

Of particular note is the second chart from AH, showing the forecast of real wage growth by the MPC – which AH says has been forecasting sunshine tomorrow in every year since 2008 – but sadly the “heat wave has failed to materialise as the timing of recovery has been repeatedly put back”.

Importantly, Haldane asks whether these downside surprises are likely to continue. In contrast to MW his answer is yes, not least because the rising demand for labour has been more than offset by a rise in the supply, pushing down on wage growth. This includes displaced skilled workers forced to take jobs for which they were over-qualified, rising participation rates driven in part by the abolition of the default retirement age, concerns about the adequacy of pension and saving income and changes to the benefits regime alongside increases in immigration. Haldane’s stark conclusion is “I am gloomier”. He goes on to explain why: “This reflects the mark-down in global growth, heightened geopolitical and financial risks and the weak pipeline of inflationary pressures from wages internally and commodity prices externally. Taken together, this implies interest rates could remain lower for longer, certainly than I had expected three months ago, without endangering the inflation target”.

Thankfully the MPC’s latest Inflation Report in November is likely to reflect the views of its chief economist, who runs the forecast team.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks