David Blanchflower: The recession deniers have gone strangely quiet this month

Economic Outlook: We are in the slowest recovery for a century, with no end in sight

Last week our "do-nothing" economic policy makers did absolutely nothing once again. The Queen's Speech contained exactly zero that could possibly help to return the economy to rude health. Zippo in there to help the more than a million unemployed youngsters who are presumably an essential part of David Cameron's heartless "efficiency" drive. George Osborne is now stultified into inactivity as he put all his eggs into the already failed austerity basket and internal feuding from left and right means he has little room to escape his self-imposed economic straitjacket.

Far from being a master strategy to shrink the state, the austerity Budget now looks to have been a catastrophic strategy that has also slowed the private sector to almost a dead halt.

On Thursday the MPC added to the sense of hopelessness by sitting on its collective hands and allowing their asset purchasing programme (QE2) to come to an end. There may well have been more than one dissenter, but we won't find out for a couple of weeks. My replacement David Miles is the most likely opponent but may have been joined by others including Martin Weale and maybe Adam Posen.

The MPC decided to sit pat despite the fact that we know from the Office for National Statistics that the UK economy is in a double-dip recession.At the same time, the potential downside risks from the euro area have dramatically increased as Greece struggles to form a government and Spain has effectively nationalised one of its major banks. As a result of all this turmoil, the pound has strengthened against the euro, which will serve to push down on UK growth and inflation.

On the morning of the MPC decision, members of the committee would have known the March industrial production numbers, which fell by 0.3 per cent month on month, leaving output 0.4 per cent lower in Q1 2012 as a whole than in Q4 2012, which confirms that the underlying trend remains down. Samuel Tombs at Capital Economics has pointed out that this matches the estimate used in the Office for National Statistics' preliminary estimate of Q1 GDP, which means there is still no reason to expect overall GDP growth to be revised up.

The 0.9 per cent rise in manufacturing output in March merely reflected a bounceback from February's 1.1 per cent fall. In addition, April's CIPS/Markit report on manufacturing, Mr Tombs suggests, points to further falls in output ahead. And then, on Friday, the ONS published data on output for the construction sector, which is collapsing again with new infrastructure work down 15.9 per cent. The ONS says this is consistent with GDP for Q1 of 2012 being revised down by 0.1 per cent. Meanwhile the Nationwide Consumer Confidence Index fell by nine points in April. The recession deniers have become strangely quiet.

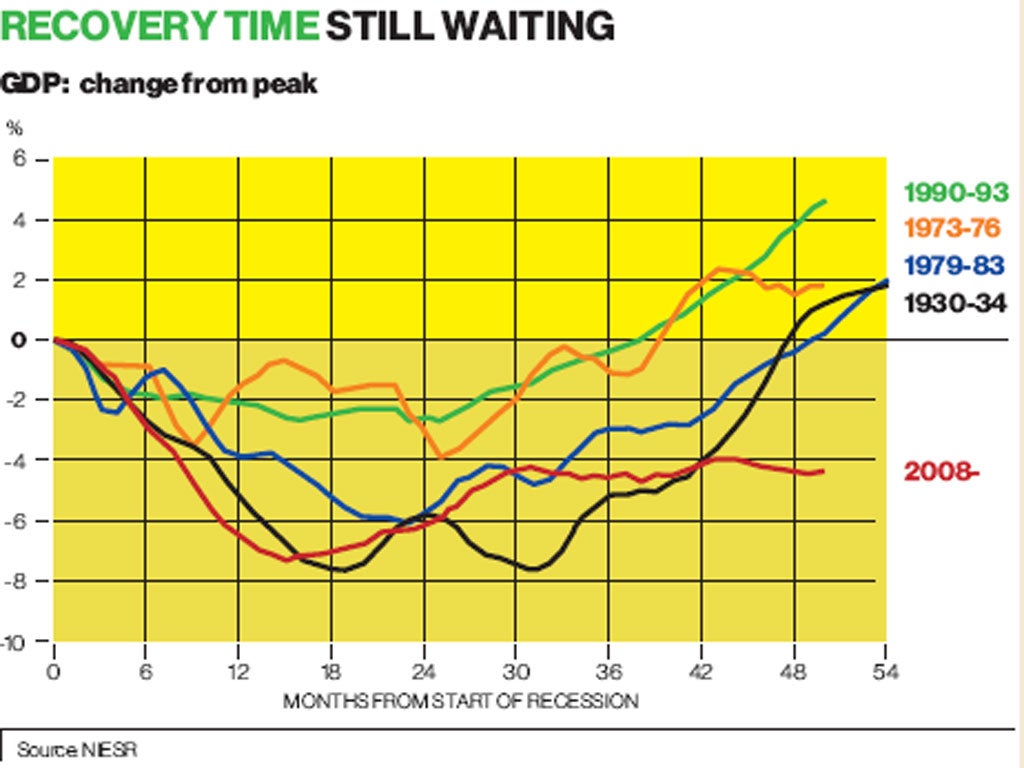

As is clear from the chart above, which shows how the major recessions have evolved, we are in the slowest recovery for a century, with no end in sight. There is no recovery, period. In output terms the Great Depression had restored all its lost output in 48 months whereas under the Coalition not even half has been restored over the same time period. In both the 1930s and the current recession, output dropped by approximately 7 per cent but we still have more than 4 per cent to be recovered. The European Commission this week forecast that output would grow only 0.5 per cent in 2012 and 1.7 per cent in 2013, so that would mean after 70 months output would still be below the 2008 starting level.

The Great Recession has now transmogrified into an L-shape and shows no sign of being over any time soon. It hasn't helped that in every Inflation Report forecast since August 2008, the MPC has continued to insist that recovery will be V-shaped.

Here are a couple of examples of the downward revisions of the MPC's growth forecasts. In August 2010, the MPC forecast that annualised median GDP growth in Q1 and Q2 2012 with £200 billion of quantitative easing and constant interest rates at 0.5 per cent would be 3.1 per cent and 3.2 per cent respectively. By August 2011, it was forecasting 2.0 per cent and 2.2 per cent. But by February 2012, after an additional £125bn of QE, the forecasts had dropped to 1.1 per cent and 0.7 per cent respectively. As noted above, the preliminary estimate for Q1 of this year is -0.8 per cent annualised, which looks headed even lower. Expect further big growth-forecast downgrades from the Bank this week and for many months to come as growth disappoints

The MPC focused on targeting inflation, expecting that would bring stability, and look what happened. Now is the time to consider switching to a dual mandate that would includes growth, which would give much needed flexibility. I am now of the view that the Treasury would probably have done a better job setting interest rates than the MPC achieved. Between 1997 and 2007, the path of rates would have been approximately the same. Whichever of the two bodies had set rates would have been driven by market discipline.

Interest rates would probably have been higher in 2007 as the housing boom was raging and house price to earnings ratios approached unsustainable levels. Alistair Darling has made it clear he would have cut rates earlier in 2008 if it had been left to him, and there is no reason to disbelieve him. I suspect if Osborne was making the decision right now, he would – correctly in my view – have done more QE.

The Chancellor must be having second thoughts about giving away all that power to the Bank of England. I will report back next week on the May Inflation Report, which should make interesting reading. Still no growth plan.

David Blanchflower is professor of economics at Dartmouth College, New Hampshire, and a former member of the Bank of England's Monetary Policy Committee

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks