Hamish McRae: What will the Chancellor do now to make cutting the deficit add up?

Economic View

It has been billed as good news for the Chancellor. We have just had another set of monthly accounts, the last before the Autumn Statement, showing that this year the fiscal deficit is likely to come in below target. We are only just over half-way through the financial year and the big revenue months are still to come, but it looks as though we will be some £10bn-£15bn inside the number that seemed likely in March.

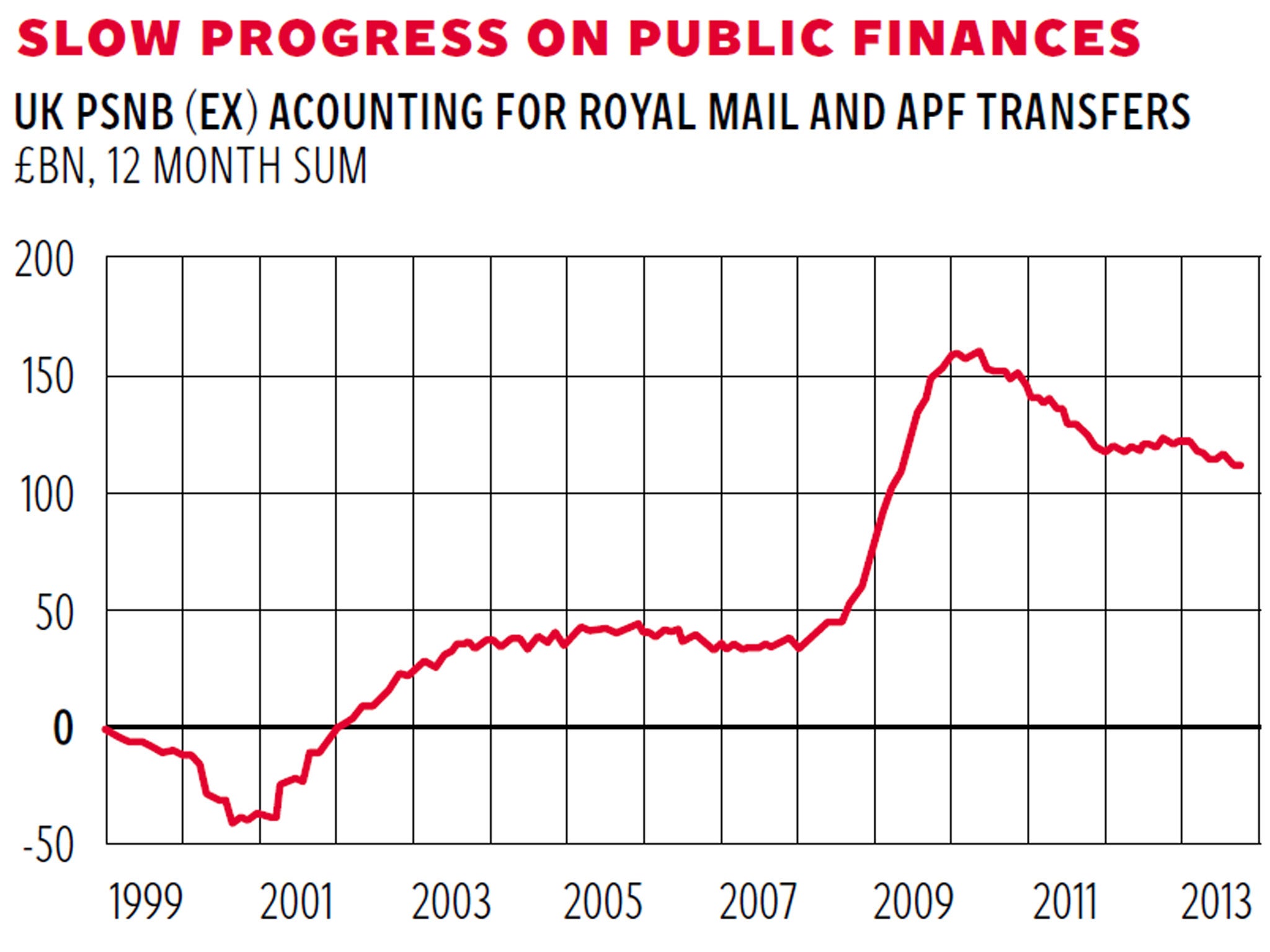

But see this "good news" in context. Our public finances are still in a terrible mess – just slightly less of a mess than they seemed to be at the time of the Budget in March. Getting the country's finances back to an acceptable deficit was supposed to be a four- year job. That slipped three years to become a seven-year one – running well into the next parliament. Now we have clawed back six months or so. In the first year we did reasonably well, cutting about a quarter of the deficit. Then we got stuck, with it only inching down. Now we are on the move again, but there is still a huge way to go. (See graph) Germany, by contrast, is in fiscal balance, a point that Britons and Americans who criticise German economic management might like to note.

The encouraging news is that tax revenues are coming up quite well. Usually in the early stages of a recovery revenues come up fast so this should be of little surprise, but the pause in growth at the end of 2011 and early 2012 meant they rose a little slower that projected. If you look at the three largest categories of revenue and compare with the first seven months of the last financial year, income tax and capital gains are up 5.4 per cent, VAT up 5.8 per cent, and National Insurance a slightly more disappointing 2.1 per cent. So, overall, not too bad a picture compared with the recent past.

The only big tax that is down is corporation tax, down 2 per cent, but we will know more about that by January, for much of it is paid in big lumps at the end of the year. Profits ought to be coming up at this stage so these poor results may be simply reflect conditions a year ago, or there may be structural changes taking place in the way companies try to cut their tax bill. Clearly the Chancellor hopes that by cutting the headline rate of corporation tax, revenues will rise rather than fall, but we will not have any feeling for that for several years. On the other side of the account total current spending is up 2.1 per cent, somewhat below inflation so there is a bit of a squeeze in real terms. Social spending has been controlled quite well, up only 1 per cent companied with last year but there is one charge that the Government cannot escape: the rising interest bill it has pay.

Notwithstanding the still very low interest rates, it paid £5bn in interest in the month of October, up from £4.4bn in October last year. That is just one month. Multiply by 12 and you see the burden – and that is before rates go up.

Those are the numbers; what of the politics of all this? We will see in just under two weeks' time how George Osborne chooses to play it and there will be a couple of obvious things to look for. One will be to what extent a slightly better-than-expected fiscal position allows an easing of the tax burden, or whether the focus will be on speeding up the still-slow correction. If the present progress is maintained next year, he could go into the election having done three-quarters of the job of cutting the deficit, rather than about two-thirds. Alternatively he could use a little bit of the extra room to make some tweaks to taxation – give people a glimpse of the sunlit uplands beyond the present squeeze.

The reason for doing so is that living standards overall are probably still falling – probably rather than definitely because though wage growth is still below inflation, people do have other sources of income and if you allow for that, living standards have broadly stabilised.

The other thing to look for will be the extent to which the Chancellor is prepared to make a bet on strong growth continuing. The new forecast from the Office for Budget Responsibility will show that it expects above-trend growth next year and beyond. The language that the Chancellor uses to acknowledge this will give a signal as to the pitch his party will be making at the election for he is, after all, an acutely political animal. So do you emphasise the growth, or do you stress the scale of the correction still to be done?

The politics are fascinating because they go to the heart of what people really want from fiscal management. Do people still want, to use the nasty word, "bribes"? Do they want tax cuts and/or higher public spending? Or is that old politics and what people now want what Gordon Brown initially promised, which was "prudence"? In other words, is cutting the deficit not merely a necessary evil but actually a popular programme? We know that attitudes to welfare spending have changed radically over the past 30 years, with a clear majority of all voters now believing that such spending is too high. But we don't know whether there has been a parallel shift in attitudes to government borrowing. We may start to catch a sniff of the way the wind is blowing in the next few months.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks