Hamish McRae: Fear factor? Let’s worry about stagnation rather than catastrophe

Economic View: We are not facing anything like as grave a crisis as we have twice in the past decade

Fear is back. It is very obviously back for the oil and commodity markets but it is also back for equity investors the world over. The plunge in energy costs ought to be positive for the world economy. After all, think what happened after the oil shocks, when prices shot up. But the immediate effect has been to set the markets into a tizzy. Will Russia default? What will that mean for the banks? Does the fall in demand from Russia tip Europe into recession? To what extent will the contagion shift to other emerging markets? And so on.

Yesterday the fear eased a little, for it was felt that in the face of such uncertainty the Federal Reserve would delay any tightening of policy. We will see. If you stand back, maybe the fear now is no more rational than the lack of fear, shall we say complacency, of the summer.

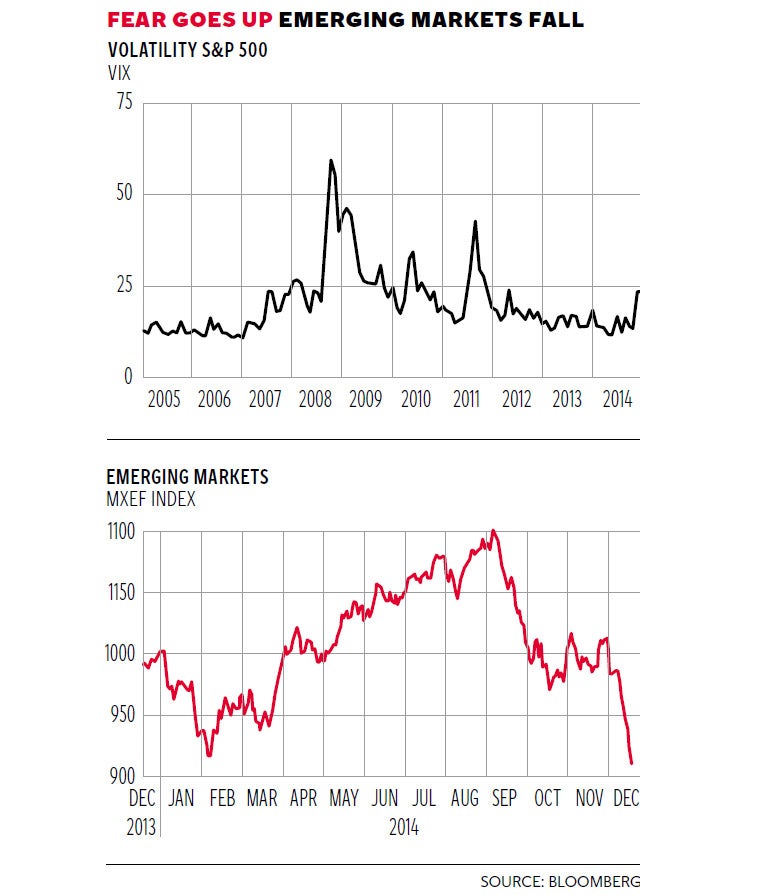

You can put present concerns into an historical context by looking at the “fear index”, more correctly the Vix index on the Chicago Board Options Exchange. It does not actually measure fear as such; rather it measures volatility of US equity prices. But as people want to protect against volatility, you could say it gives an indication of how concerned investors are.

So what has been happening? To set present fears in a longer context, have a look at the top graph, which shows the Vix over the past decade. As you can see there have been two clear peaks, one in the autumn of 2008 when it looked as though the world banking system might collapse, and another in the summer of 2011, when the eurozone was in dire trouble. Since then, and particularly last summer, fear fell back to levels not seen since the boom years of 2004 and 2005. Now we are back up, but – and this is important – not nearly to the levels of 2008 or 2011. Fear is relative.

It is also contagious. You can make a good case that present concerns show a more realistic approach to the world economy than the bland confidence of the summer. But if you take that view you have also to acknowledge that the market fall out of the past three or four weeks cannot be attributed simply to the fall in the oil price (which ought on balance to be positive) or to the travails of Russia (which is not that important an element of global trade). Something more is going on.

That something is a reassessment of the performance and potential of the emerging world, vis-à-vis that of the developed world, particularly the US. If you can make good money by investing in a developed economy with reasonable protection of property rights, why risk it in places where the investments may be stolen, or worse? You can see the impact of this reassessment on emerging market equity prices since the summer in the bottom graph. Everything that has happened in Russia reinforces that view.

That is just an index, bundling together a wide range of different investments in different countries. The countries of the developed world are a reasonably similar bunch, their large corporations remarkably so. Unilever is not so different from, Toyota not so different from General Motors. By contrast the countries of the emerging world, and their major enterprises, differ enormously. Take the Brics. It is a convenient and clever label, and it is true that they comprise the four largest economies outside the present developed world. But all four of them are utterly different and have utterly different economic prospects.

Contagion, however, is real. So what has happened in Russia has pulled down the whole edifice. Anyone arguing for investment in the emerging world was already finding it hard going. What has happened in the past few weeks has made it much harder.

So what happens next? Have another look at that top graph. We are not, if that is an accurate gauge of the mood, facing anything like as grave a crisis as we have twice in the past decade. That index is saying that there is not going to be a melt-down of the world banking system. There is not going to be a collapse of the eurozone, or at least not yet. Within Europe the problem of Greece remains and will get worse, but this time round there is no general fear that a Greek exit from the eurozone would immediately lead to other countries leaving, too. Europe may well experience another leg to its recession and events in Russia don’t help, but it is facing stagnation rather than catastrophe. What the fear index seems to be saying is that 2015 is likely to be a more difficult year than 2014. Well, maybe. Exactly a year ago the Vix index stood at 14. Okay, now it is 23. But on a long view 23 is not that high. The US economy is now in a secure growth mode, with real consumption boosted by the fall in oil prices and the rise in employment. Here we have real wages climbing sharply, thanks to low inflation and – at last – a recovery in money wages. What’s not to like about that? The world economy as a whole will grow by somewhere between 3 and 4 per cent.

The biggest question, surely, is how the plunge in energy prices will sustain this growth phase. We are now five or six years into the recovery. We started from a long way back but that of itself does not guarantee longevity for growth. By the time a recovery has been running for five or so years, it is getting a bit long in the tooth. So it needs an injection of added demand of some sort. It is plausible that this injection comes from cheaper energy. Because growth has slowed a bit in China, which cuts demand for energy and raw materials, growth can pick up in the US without being choked off by a rise in inflation.

That’s the core of it: we should not be fearful of the plunge in the oil price because it injects additional real demand into the world economy. Expect the fear index to subside.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies