Hamish McRae: For those about to suffer from cuts the mood is surprisingly upbeat

Economic Life: The way in which the private sector has tried to keep its labour force together has been really impressive... the direst predictions have been proved wrong

The long trudge back to normality continues, but it is a march of two steps forward and one step back. Yesterday saw no change in interest rates either here in the UK or in the eurozone, but it would have been pretty astounding for there to have been any other outcome.

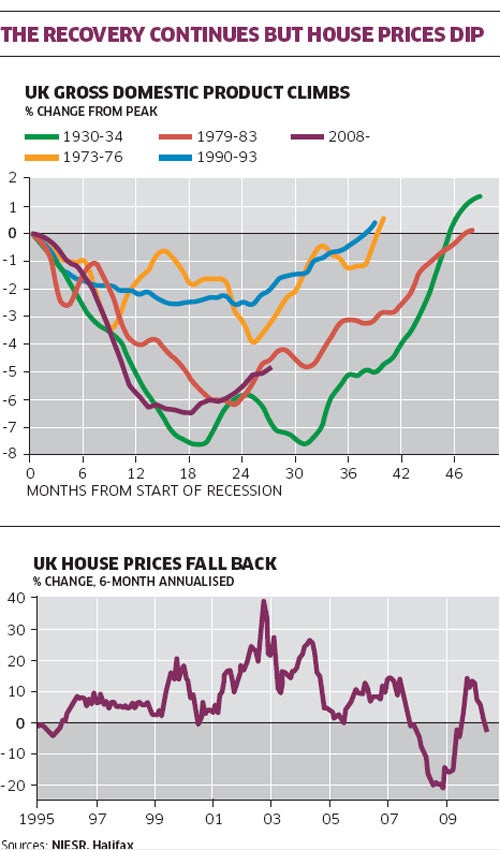

There were some soft figures on UK house prices (another monthly fall in the Halifax index) and there were some rather better ones on manufacturing production. The International Monetary Fund (IMF) in Washington downgraded its growth forecast for the UK next year to just over 2 per cent, but here the National Institute of Economic and Social Research (NIESR) estimated that the economy grew by 0.7 per cent in the three months to the end of June. Translated into an annual rate, that means 2.8 per cent, which not bad at all.

So what should we make of all this? I think it is important not to over-analyse each little bit of data as it comes along, unless the figures are in some way surprising. The financial markets worldwide have recovered a little of the nerve that they lost last week but some sort of second dip, both here and elsewhere, remains probable.

I have put the graph of the NIESR's comparison of this recession with previous ones up again just so we keep this thing in perspective: pretty similar to the early 1980s, not as bad as the 1930s, but materially worse than the 1970s and 1990s. The NIESR's comment that it does not expect output to regain the level of the past peak until 2012 makes a lot of sense. I have also shown the Halifax house price index on a six-month on six-month basis, which as you can see has gone negative. That is significant. GFC Economics notes that, when prices have been falling, the Halifax index has been a better indicator of the trend than the Nationwide one, which is still positive. This leads into a debate, which we are going to hear a lot of in the coming months: whether you can have a continuing recovery without rising house prices.

I think the answer must be yes. In the early 1990s, the economic recovery long preceded the housing one. House prices did not really start to climb until 1996, a clear three years into the recovery. But if you can remember that period, there was not much of a feel-good factor in the early 1990s even after growth had restarted.

That downbeat sensation is what, I suspect, we will continue to experience in the months to come. Expect flat house prices, a squeeze on living standards and maybe some rise in unemployment. The figures will say the economy is growing (despite the odd bump downwards) but it won't feel like it. There will be an especially dangerous period in the early part of next year, when the rise of VAT to 20 per cent hits home.

To point all this out is not very uplifting. There are, fortunately, some potential positive surprises in the UK and it might be helpful to sketch half a dozen of those now. One would be continued evidence of companies adapting to the very different labour market by maintaining employment and maybe increasing their hiring. Looked at the other way, the way in which the private sector has tried to keep its labour force together – using short-time and pay freezes to hold down wage bills – has been really impressive.

The direst predictions of the rise in unemployment have been proved wrong, though of course the rise that has taken place has been miserable for the people involved. I was impressed by the KPMG report this week, which showed really quite strong employment intentions. It is at least plausible that hiring in the private sector will be able to offset job cuts in the public sector.

A second possible positive surprise would be that the housing market will experience a long plateau rather than go back to the roller-coaster it has been on for so long. Given the increase in supply of homes coming on to the market following the ending of those silly home information packs, the shortage of mortgages and the fact that every month that passes means more fixed-rate deals needing to be refinanced, you might have expected a much softer market than has in fact been the case. Booming house prices are a social ill; collapsing prices are no better; but a "Goldilocks" market – not too hot, not too cold – would be a very good thing for the country.

A third possible positive surprise would be that the country manages the forthcoming budgetary cuts well. That is not the popular perception or expectation, of course, and it is very hard to do this well. But chatting with people involved in the early stages of the process, or those likely to suffer from it, I have been impressed by the positive attitude being taken.

This isn't just a government thing because it won't be the Government that does most of the detailed application. In any case, when the Government cuts a contract, the bit of the economy that suffers is the private contractor. So the question as to whether this can be done well will be determined as much by the country as a whole as by Whitehall and Westminster.

Fourth, even the VAT increase may be managed in such a way as not to damage demand. Germany managed to increase VAT without hitting consumption (mind you, consumption was pretty low relative to GDP to start with); Japan by contrast managed to stop its recovery in its tracks by hoisting sales tax. I suppose our own experience of the temporary 15 per cent VAT rate points more to German experience than Japanese. Cutting the rate did not do much to boost demand and putting it back up again didn't do much to cut it. So maybe we will get away with it.

Five, the cheap(ish) pound is helping. It is certainly helping the tourist industry, particularly in London and the South-east. It is supporting inward investment and not only in top-end property. It is supporting manufacturing obviously, but also any service industry with an export potential.

We do have experience of the medium-term impact of the 1992 devaluation (in which the pound was kicked out of the ERM) and that was pretty positive. For the moment the overall effect of the devaluation has been modest; the positive surprise is that it might build into something quite big.

And finally the Government has got ahead of the markets with its emergency Budget, and so is able to borrow cheaply and restore international confidence in the country. That has the direct effect of holding down long-term interest rates not just on gilts but for company borrowers too – and to some extent for home buyers. The surprise would be that thanks to this, it may be able to ease up a little on its deficit-reduction programme. It can't do that in years one and two but I could see it being cut a little more slack in years three, four and five. We'll see.

The big point here is that what is happening is normal. Normal, in a recession, is not nice, and we have barely begun the climb back. There will in all probability be a bump later this year or early next, a double-dip of some sort. But the mood of business is surprisingly upbeat, and we should take cheer from that.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments