Hamish McRae: It’s not a question of if, but when... interest rates have been kept artificially low for long enough

Economic View: Monetary policy has become easier without the Bank of England doing anything

Everyone knows we are going to get higher interest rates. The market consensus now is that the first increase will come either in November this year or in February next – it cannot be later than February because that would be running into the election period, and traditionally the Bank does not like to change rates at that time. After the Bank of England Monetary Policy Committee minutes were published yesterday the balance shifted a bit more towards this November, to coincide with the publication of the quarterly Inflation Report. But in reality three months either way doesn’t really matter to most people. What matters is how far and fast they go up afterwards – where rates will be in three or five years’ time.

The mainstream view, encouraged by Mark Carney, the Governor, is that rates in the future will be lower than they have been generally in the past. If the old normal was for the Bank rate to be 4-5 per cent, the new normal will be 2-3 per cent. The rationale for this is that because so many people have taken on so many debts any rise in interest rates has more effect on total demand. Or put another way, the country can’t stand as high interest rates as it used to.

There is sense in that, though it will not delight battered savers, and will increase the pressure for people to do something else – anything else – with their money rather than put it in a bank. The long-term distortion to our financial system resulting from artificially low rates will be something that we will live with for many years. The longer we go on with such low rates the greater the damage.

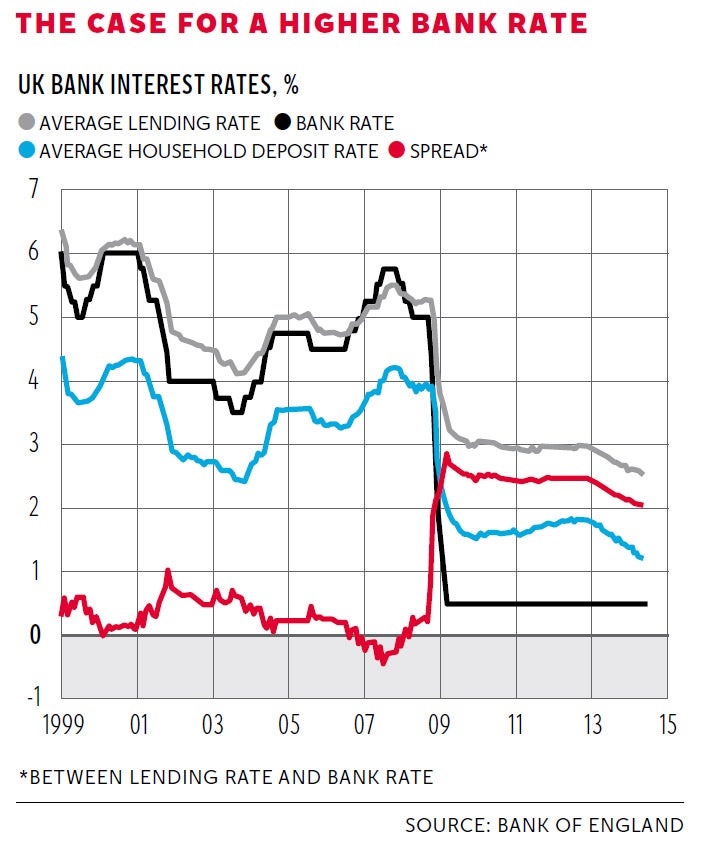

There is, however, another objection to the idea that official rates have to stay low, which is that the effective rate for borrowers will come down relative to any particular base rate. The easiest way to get one’s head round this is to think back to the old normal. As you can see in the graph, in the run-up to the crisis for most of the time bank rate was around 5 per cent (black line), deposit rates were between 3-4 per cent (blue line), and the average household borrowing rates between 4-5 per cent (grey line). So the gap between borrowing rates and bank rate was effectively zero (red line).

Now look at the situation since the crisis. Bank rate is 0.5 per cent, deposit rates between 1-2 per cent and borrowing rates around 3 per cent. The spread between bank rate and borrowing rates shot up to just under 3 per cent. You could say that borrowers failed to reap the full benefit of the very low bank rate, while depositors were not punished as severely as it would seem. Note these figures are average deposit rates and average borrowing rates, and some depositors and borrowers will have done worse or better.

Now look at what has been happening over the past 18 months. Base rates have stayed at 0.5 per cent, but the average deposit and borrowing rates have nudged down by half a point. Monetary policy has become easier without the Bank of England doing anything. Simon Ward, the economist at Henderson, argues that this narrowing of the spread would justify the Bank already having started to increase rates. Indeed, he believes the Bank should have done so. If the spread continues to narrow (if the red line continues to fall), it would follow that there is more scope for increasing the Bank rate than at present appears to be the case. The new normal may turn out to be more like the old normal after all.

Does this mean that the rest of us should forget any guidance about the long-term levels of rates and rely on our own common sense instead?

I think that really depends on what happens to inflation. Both the UK and US are mopping up slack in their respective economies pretty fast, the UK faster than the US. Both the Bank of England and the Federal Reserve have emphasised unemployment as a key indicator to look at alongside inflation. But in neither country is there any real sign, in the official figures at least, of falling unemployment leading to pay pressures. What is clear on both sides of the Atlantic is the widespread positive outlook from the business community. You can catch that in the flow of good earnings now coming through in the US, and the very solid reports from the Bank of England agents here in the UK. (The profitability, at least expressed in sterling, of large UK companies, has been squeezed by the rise in the pound.) Business both here and in the US could stand a rise in rates, particularly if that were associated with an increase in the availability of bank finance.

That leads to a final point. We are building a safer banking system here in the UK, in America, and in Europe. You can argue about the detail, about how much more needs to be done, particularly in Europe, where banks play a larger role in financing business than they do in the US or the UK. The thrust of policy, however, is undeniable. But a safer banking system is one that lends less money: less in relation to bank capital of course, but though capital is being increased, there is less lending overall. Companies have had to learn how to grow without much help from the banks. A safer banking system is leading to a more resilient business community.

It also may be nudging individuals towards being more resilient too: more cautious about borrowing, more eager to pay off debts, more determined to save for their pensions and so on. You can see bits of this already, in particular the paying back of mortgage debt while rates remain low, a complete reversal of the equity take-out of the late 1990s and the first part of the 2000s. So maybe the country will be able to stand higher rates after all.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies