Hamish McRae: Markets look on the bright side as a little fragile confidence returns

Economic Life

The mood of the world economy darkens further; the mood of the financial markets lifts a little. You would expect financial markets to turn upwards some months before the world economy but the considerable rally since early March has taken the bears by surprise.

There really is no end in sight for the downturn; the best that can be said is that the rate of decline may be slackening. The world's banking problems are not yet fixed, for further capital will clearly be needed by both US and continental European banks. We will get an indication of the former very soon as it is reported that several major US banks will not pass the "stress test" of the authorities without further funds. Meanwhile, the US economy has had a dreadful first quarter, shrinking at an annual rate of more than 6 per cent.

So there is a lot more bad economic news in the pipeline, and there is no assurance at all that there won't be another downward leg to the recession, even if there is indeed a recovery later this year. That leads to the inevitable questions: is this another bear market rally, and should investors follow that traditional maxim: "sell in May and stay away"?

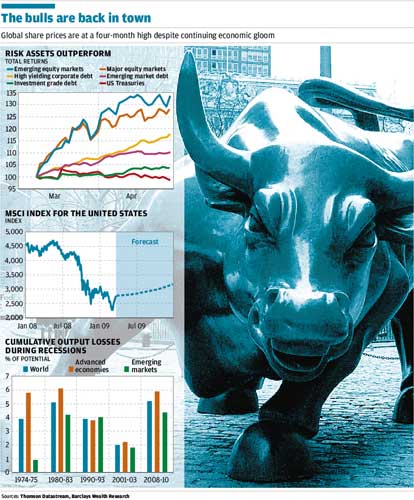

The rise in the appetite for taking on risk has been remarkable, and it would be pretty odd if that were not to some extent reversed in the weeks ahead. You can see the way in which risky asset classes have outperformed safe ones in the first chart. Top of the league have been shares in emerging markets; next come mainstream markets; the more risky corporate bonds have done better than the investment grade ones; and down at the bottom comes the return on US Treasury securities, generally deemed the safest assets of all, though some of us would differ on that.

This sort of performance is what you would expect as confidence gradually seeps back. Mike Lenhoff at Brewin Dolphin, who drew my attention to this, notes that the markets have been paying far more attention in recent weeks to forward-looking indicators, such as business sentiment, rather than backward-looking ones, such as the first quarter GDP figures for the US and UK.

You could further add that the market impact of swine flu has been limited, even on Mexican stocks, which is pretty remarkable, though the very fact that risk appetite has returned leaves the markets vulnerable to it withering away again. But there is no doubt that the mainstream view now in the investment community is that confidence will continue to recover, albeit gradually.

That gradual profile is well caught in the next graph, from Barclays Wealth, the asset management division of the banking group. (Separate point: Barclays' shares have done very well in recent weeks.) The graph shows the scale of the crash in US equities and charts a possible recovery profile. Note that even if that recovery proves more or less right, all that happens this year will be for markets to get back to the level they were at last autumn. All that ground lost in the crash of last summer has still to be regained. It is a fair measure of the despair into which markets had fallen to see it as encouraging if share prices get back to a level that would have seemed catastrophic a year ago.

Still, it is encouraging that Barclays should be prepared to do some neck-sticking-out. So far shares have done somewhat better than that chart, which was prepared a few days ago, has projected. Indeed, world share prices are now at a four-month high. I suppose what the markets are trying to say is that this is simply a bad recession and that the notion of a 1930s-style depression has receded.

Carrying on that theme, it is also beginning to become possible, if you are brave enough, to make some estimates for the likely magnitude of the recession. The bottom chart gives Barclays' estimates of that, for the world economy as a whole, for the advanced economies and for the emerging economies too. As you can see this is clearly going to be of a similar order of magnitude to the early 1970s and 1980s recessions for the developed world, and materially worse than the early 1990s or early 2000s experiences. For the emerging economies it looks like being a similar broad order of magnitude as the 1980s and 1990s, but much worse than the 1970s and 2000s. For the world as a whole it may just be the worst since the Second World War, but not outside our broad experience.

These numbers pretty much square with my own judgement. I still think when all is done and dusted that the UK will not have done as badly as it did in the early 1980s, though we did have a very rough time then. For many, this may seem optimistic, given all we have been told about this being the worst recession since the Wars of the Roses or whatever. There seems to be a desire in the Government to talk up the recession because that excuses its mismanagement of the country's finances. Looking at those bar charts at the bottom, the authorities have a right to declare that what is happening is somewhat worse than they reasonably expected, but it is not beyond all past experience.

What might break this burst of bullish sentiment? Here are three possible candidates.

The first would be if markets are lulled into expecting that the economic recovery will be sustained and find it isn't. There may well be a bounce this summer as the collapse in inventories reverses itself, but underlying consumer demand worldwide will be muted, for there are still a lot of debts to be worked off. In practical terms, the world housing market has yet to hit bottom, and until that happens consumers will rightly be cautious. There will also be the little matter of tax rises and public spending cuts here in the UK, but also to a lesser extent elsewhere.

The second would be for there to be a return of inflation, requiring a rise in interest rates before the world economy is strong enough to sustain this. Right now that seems far-fetched. Commodity prices and the oil price remain, if not depressed, certainly muted. Wages in the private sector at least are being contained. Other asset prices remain depressed too. But eventually all this money pumped into the world economy will have to find a home. We have never done these unconventional monetary measures before, so we have little idea of their long-term consequences.

The third would be for there to be continued and serious disruption to world trade. We know that trade has taken a huge hit, but we don't know whether globalisation is intact or whether it will go into reverse, with all the human misery that would entail. We know that cross-border banking flows have collapsed, but we don't know whether that will lead to a wider withdrawal from cross-border investment.

In short, the whole system remains very fragile, and it may get more fragile yet in the months ahead. We are not through this one yet at all – even if the sky is a little lighter than it was eight weeks ago.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments