Hamish McRae: There is an inconsistency, and it's probably the GDP

Economic Life: Fretting about a double dip when the evidence says there wasn't one is plain silly

Recession, higher inflation – but falling unemployment, very low pay rises and 100,000 more jobs. It does not quite hang together, does it? Yesterday saw two big chunks of new information about the British economy, the monthly labour statistics and the Bank of England's quarterly inflation report. So as a welcome relief from the anguish across the Channel, let's try to see what can sensibly be said about what seems to have been happening here.

There is a genuine inconsistency here. Assuming there has not been a sharp fall in output per person, then either the employment figures or the previously published GDP figures must be wrong. Since the labour force surveys have in the past been much more reliable than the GDP ones, the commonsense conclusion is this: if more people are working and more hours are being worked then we cannot be back in recession. All this earnest debate about a double dip is therefore based on a false premise.

We will have to wait another couple of years before this is confirmed but I am pretty confident that will be the case. Growth has been disappointingly slow and I suspect there may well have been a quarter of negative growth some time last year. But recession, defined as two quarters of negative growth? That cannot be right.

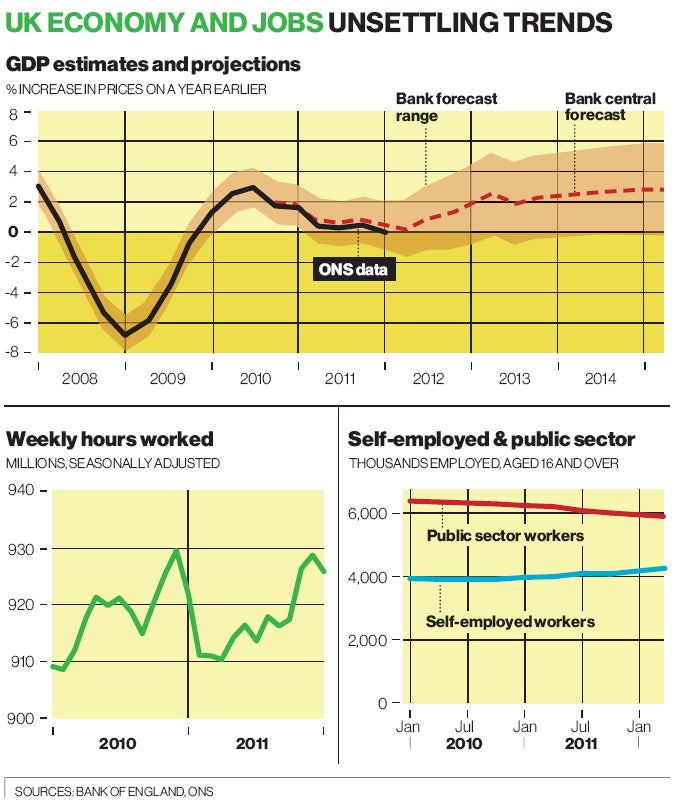

This certainly seems to be the working assumption of most of the private economic forecasters, and now the Bank of England seems also to take that view. You can make a guess at what it thinks has been happening and what it expects to happen by looking at the central point of its fan chart on growth, shown here. The graph also shows the official data, and as you can see, the ONS thinks year-on-year growth has stopped. The rise in the early part of last year has been offset by the fall in the final quarter and the first quarter of this year.

The Bank, however, takes a somewhat more optimistic assessment of what has happened and I have highlighted the centre point of its fan chart to show that. This would be consistent not only with the labour force survey but also the reports from the business community and from the Bank's agents.

You can see from the next graph that the hours worked in the economy seem to have picked up again. The figure has not risen as much as one might expect and the explanation for that is probably that many of the jobs being added are part-time. In a nutshell, the private sector is taking on labour faster than the public sector is shedding it, but it is replacing full-time posts with part-time ones and with self-employment.

That points to another fascinating detail. As you can see from the third graph, the number of government employees has been falling pretty steadily, while the number of self-employed has been climbing equally steadily. It is true that many of the self-employed are working part-time and for many this may be an involuntary shift: people working for themselves because no one else will take them on. But the fact remains that if this trend were to continue, it is plausible that in a few years there will be more self-employed than state-employed. On my quick tally this would be the first time this has happened since the Second World War, a seismic social shift with consequences for how we organise everything from pensions and labour legislation downwards.

Back to the big numbers of the economy, and the pointless debate about the alleged return to recession. There are many reasons to be worried about the slow nature of the recovery and about what might happen next. But fretting about a double dip when the bulk of the evidence says there wasn't one is plain silly. So now to the genuine concerns.

There are at least three. First and most obviously, there is inflation. Again and again the Bank's forecasts have been wrong and after a while you begin to wonder whether inflation will ever get back to target. As of now the UK Government has been able to finance itself at ever-cheaper rates and it is almost as though investors have stopped caring about UK inflation. So there is no market pressure to do anything. Real incomes are being squeezed relentlessly and so ordinary individuals have reason to want to put pressure on the authorities. Not only are living standards being compressed but real growth is slower as a result. But their voice is not really being heard against the noise from the business lobby for continued low interest rates and quantitative easing.

But at some stage, unless inflation comes down pretty fast, things could suddenly move against the country. Were we to lose our safe haven status and government funding costs rose, there would be a problem indeed.

The second big worry is whether the Government is itself inhibiting growth, not by correcting the public deficit, which has to be done, but rather by detailed anti-growth policies.

It might seem shocking to say that the Government is deliberately damaging growth but that seems to be the view of a fair portion of the business community. This is not the place to go into the detail of their complaints, but trying to run a country without the broad support of the business community is tough, even in good times.

Finally there is Europe. We can have no influence over the outcome of the eurozone's troubles but we are affected by them. The only possible thing to do, and mercifully we are doing it, is to prepare for any outcome. It may be implausible that Greece dumping the euro would do serious damage to the world economy. As Jim O'Neill of Goldman Sachs points out, in terms of economic activity China creates another Greece every four months. But it could do a lot of damage to Europe's banking system, and we might be caught in the crossfire.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies