Hamish McRae: We can't carry on living off all this free money from QE

Economic Life: Because this policy has been around for three years we have come to think of it as normal

It is three years since interest rates were cut to 0.5 per cent and the bank of England's programme of quantitative easing was announced: 5 March 2009. What was introduced as an emergency policy of monetary stimulus has become the norm. Do not expect any change in it today. Indeed there has been some discussion that there may be yet another bout of QE in May. Market expectations would suggest that the Bank's official rates will be only a little above 1 per cent in another three years' time, way below expectations for inflation. Capital Economics, among others, thinks that there may be another three years of 0.5 per cent Bank rate.

Because this policy has been around for three years we have come to think of it as normal. Actually it is highly abnormal for we are in effect using a wartime policy in peacetime. The only similar periods over the past two centuries have been during the 1930s after the depression (for a large extent a delayed consequence of the chaos of the First World War) and the 1940s and 1950s after the Second World War.

Once something that is sold as temporary becomes permanent you would expect two things to start to happen. It would become less effective as people adjusted their behaviour to it; and the costs of the policy would become more evident. We are getting increasing signs of both, though the evidence, as you would expect, is still uneven.

The effectiveness first. We have had time to look at the consequences of the two complete bouts of QE and there are two bits of evidence that suggest the first had more effect than the second. One is the fall in gilt yields was smaller around the second bout than the first. The other was the impact on house prices was much smaller too, for the first bout coincided with a turn in the market whereas the second does not seem to be associated with any substantial change in the market.

What about the costs? The problem here is that the lags are so long and the other factors so large that is hard to be sure about what costs should be directly attributed to QE and what negative effects would have occurred anyway. As far as the impact on inflation is concerned the Bank and others have crawled over the numbers and there is not much point in adding to that bit of the debate here except to make one point. Simon Ward of Henderson, among others, has argued that successive rounds of QE may result in a deterioration in the split between real growth and inflation: we get more inflation and less real growth as successive QE rounds increase long-term inflation expectations.

What is, however, beyond dispute is that the policy has had an immediate impact on pension funds, as a result of the lower yield on gilts. That is the result of the mechanical link between bond yields and annuity rates. The National Association of Pension Funds says it supports QE but adds: "the latest bout of £125bn of money printing has blown a £90bn hole" in the industry's side. You could say QE has resulted in a transfer from companies and pensioners to taxpayers.

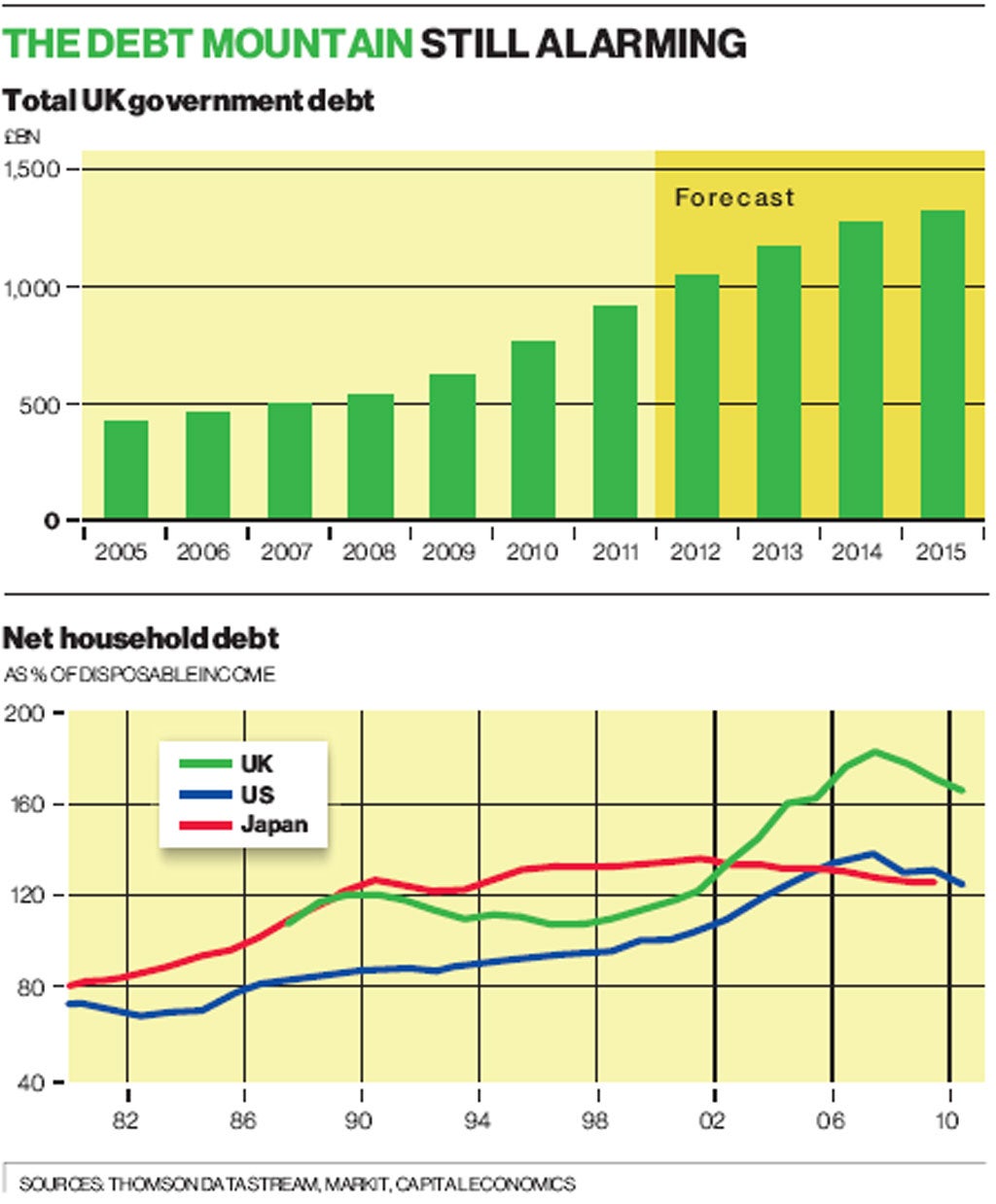

But it is the long-term change of behaviour that interests me most. If something is free there is a temptation to waste it, raising the obvious concern that money is being wasted. Matthew Lynn at Strategy Economics argues just this. He notes that the surge in public borrowing (top graph) has more than offset the modest decline in personal borrowing (green line on the bottom graph).

"Near-zero interest rates in the UK, the US and the eurozone," he writes, "have moved from being a temporary response to an extraordinary collapse in economic confidence to being a permanent policy tool, just as they have in Japan. Slowly but inevitably, that is starting to change the way that investors, borrowers and savers behave. It has created an economy in which money is effectively free, and in which cash has no appeal. Over the medium term, whilst presenting opportunities for investors, that will distort the real economy."

You can start to see this happening. Savers are moving money out of bank deposits and putting them into anything that will give a real yield, such as equities, or give them some protection against inflation, such as gold. The scramble for deposits has led to the two semi-nationalised British banks, Royal Bank of Scotland and the Halifax arm of Lloyds, increasing their mortgage rates. So in a way the market is doing what the Bank ought to be doing: tightening monetary policy. Or rather it is somewhat offsetting the effect of printing money.

But if I am worried about the long-term effects of QE I am even more worried about what happens when QE is reversed. We have these huge public debts, still rising through to 2015. We have household debts that are huge too, certainly by comparison with the US and even Japan (blue and red lines in the bottom graph). The safe-haven status of the UK, coupled with all the money being printed, has enabled us to scramble along. But we are doing so by undermining the position of savers. This cannot be sensible or indeed moral.

Now you could say that all this is a response to a past policy failure, and those two graphs do highlight two massive policy errors. The first was that the national debt was allowed to rise even in the boom years of 2005-07; the second, that personal debt was allowed to surge from 2002 onwards. But that does not excuse the uncritical attitude to QE.

I sense this is starting to change. There is still a strong "let's just print more money" lobby and the present balance of the Bank's monetary policy committee reflects that. But as we become aware that a temporary policy is becoming a permanent one, the voices of concern will sound louder.

Meanwhile, we must change our habits, for the more ineffective we can make the QE policy, the quicker we will force the Bank to change it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies