Hamish McRae: We're all in a two-speed economy; it's no fun – but not as bad as it's painted

Economic View

It is a two-speed world economy, as we have known for a while, with the emerging economies racing ahead of the developed ones. And now we can see that it is, and will continue to be, a two-speed British economy too. That was one of the messages of the Budget last week. You can call it rebalancing but the plain truth is that since growth will have to come from investment and exports rather than consumption, rebalancing will be no fun at all.

A number of us have made the point in the past few days that the Chancellor's deficit-cutting plan only works if the economy is growing above its long-term trend in a couple of years' time. The Office for Budget Responsibility did cut its forecast for this year and next but stuck to the view that, come 2013 and beyond, the economy would be growing strongly. Some other forecasters think it is still too optimistic, and we will have to see.

But it is the source of that growth that will affect us in our daily lives. There has been a huge amount of stuff about "the squeezed middle", the middle-income people who will have to bear the brunt of the more general squeeze on the economy. I am afraid that has to be so, because you cannot squeeze the people at the bottom of the income scale and there are not enough people at the top. But if you think in terms of overall consumption, what has to happen is that most of the resources developed by the growth that is taking place have to go to paying off debts, national and personal, and there will not be much left over to boost living standards. Actually, this year and next it may well be worse than that: living standards, already falling a bit, may have to fall further.

That is already evident in our two-speed economy. Most of the business community is very positive about the future. Expectations for investment are up; companies in services and manufacturing expect to increase their workforces; exports are doing pretty well. By contrast we have some rather worried retailers and, according to opinion surveys at least, some of the most pessimistic consumers in the world.

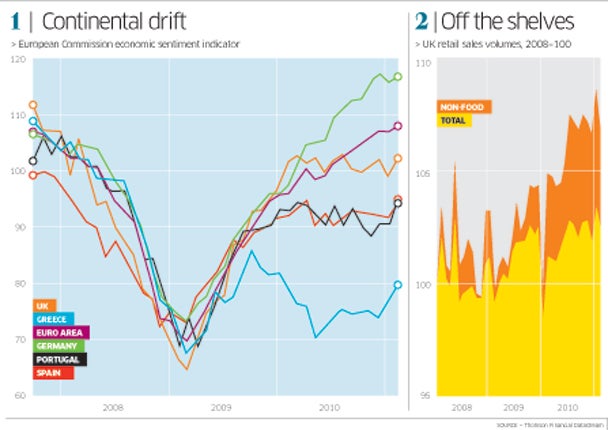

The reality is not quite as bad as it is painted. You can see what has been happening to retail sales in the small graph. Overall sales fell in February as you might have expected, given the rise in VAT, but they are still up year-on-year, and well up on February 2009. Non-food sales came off too, but the general path over the past couple of years has been pretty solidly upwards. There is a problem of course with fuel prices: because we have to spend more to fill up the car, there is less cash for other things. You could summarise it by saying that we are indeed seeing a squeeze on living standards but not a collapse.

The trouble is that during the boom years we got used to an increase in consumption of around 3 per cent a year; we will in two years' time be getting at best an increase of half that.

A two-speed world, a two-speed Britain ... and a two-speed Europe. The eurozone has been struck by a seemingly inevitable slow-motion series of financial collapses: Greece, Ireland and now Portugal. Portugal has yet to apply for its bail-out but it simply cannot afford to finance itself at the rates of interest available on the financial markets, so its new government will have no option but to get a set of subsidised loans from Europe and the IMF.

Yet Germany bounds on. The very latest Ifo survey of business opinion is down a little, but the country is still the most positive in Europe about its prospects. The main graph shows the European Commission's indicator of economic sentiment, showing the sharp contrast between the different parts of the EU, with the UK, which had been recovering its spirits at much the same rate as Germany, becoming a little more muted as the magnitude of the task has sunk in. David Owen, chief economist at the investment firm Jefferies, points out that this survey has a close correlation with GDP, and these numbers would be consistent with the strong growth in Germany, the weaker growth in Britain, and the dire mood in the fringe eurozone countries.

This leads to the question: how long can a two-speed eurozone be sustained? There was a summit last week, the outcome of which got rather swept aside in Britain by the Budget. The idea of a permanent fund in the eurozone that can bail out members that get into trouble is now agreed. (The present arrangements expire in 2013.) The European Stability Mechanism will have ¤500bn available to rescue countries, which should be enough for an Ireland or a Portugal, but not for a Spain or an Italy. Germany's Commerzbank, commenting on the plan, notes that the eurozone is becoming more of a transfer union, where the strong agree to bail out the weak, using their access to cheap finance on the markets to offer subsidised loans to countries that cannot borrow at such cheap rates.

There are, however, a number of problems with this, which the bank notes. One is that voters in the donor countries do not necessarily stand behind the fund. Another is that even with this support countries might still not be able to cover the interest on all their debts, in which case the ESM could not carry on lending. And a third is that since the ESM loans would get paid back first, a country might find it even harder to borrow elsewhere.

The main point for the UK is that Europe has come up with a patch, which will hold for a bit. Better than ever continuing disruption, for the eurozone remains an important export market for Britain. But it changes nothing in the medium-term and British self-interest is still to diversify exports away from an inevitably slow-growing region, towards faster-growing ones. As for the value of the euro, the problem remains that all the major currencies – dollar, euro, sterling, yen – have unattractive features, hence the boom in commodities and other "real" assets that give some protection against inflation.

If you stand back, I think what we have got in the past few days is confirmation of what we already knew: the long slog back to solvency. That path looks just a touch steeper than it did. But the business community, oil and banks apart, seems a little more upbeat and that is good. We need business, as well as luck, on our side.

Global economic growth could depend on the world's largest cities

Cities are all the rage – or to put it more precisely, people are becoming more aware that the key to sustainable global growth is for existing large urban agglomerations to become more effective generators of wealth and for the new great cities of the world to develop in a sustainable way.

There are several ways of getting a focus on this. One is to look at how the great cities are developing and might contribute even more. Professor Ed Glaeser, of Harvard University, has a new book Triumph of the City, which argues that cities are the key to economic success and environmental sustainability. Not only are people much more productive in cities; they use less energy per head. In extracts from the book in our sister paper The Independent last week he argued that one way for the UK to improve its economic performance was to focus on its most successful area, the London region, encouraging people to move to it and improving its infrastructure to meet their needs.

Now McKinsey Global Institute has produced a new study Urban world – mapping the economic power of cities in which it argues that 600 cities will generate 60 per cent of world growth between now and 2025. More than 440 of these will be in the emerging world and middle-weight cities – up to ten million –, of which 100 will be in China, will be particularly important.

Some people will be troubled by this, just as some have been troubled by the fact that last year for the first time in the history of our species more than half of us lived in cities. But if there are to be another two billion people before population growth tops out, then the only way to accommodate them is to have them live in cities. You then get into a debate about how to make cities nicer places that meet the aspirations of citizens, which is surely a more uplifting proposition than trying (probably unsuccessfully) to crush their growth.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks