Hamish McRae: Why Italy needs to vote for austerity

Economic View

Italy goes to the polls amid the bleakest economic outlook for a generation. German business confidence shot up to the highest level for more than a year. And there you have it. There are two economies in Europe: the south is facing something of a catastrophe, with economies shrinking year after year, while the north is staging a decent recovery.

The reasons are so widely appreciated that there is not a lot of point in going over what has gone wrong. What matters is what happens next. That is hard to call because outcomes are determined more by politics than economics. But I think the best way to understand what is happening in southern Europe is to see it as a laboratory test for austerity, austerity that is far more severe than anything contemplated here in the UK.

If you look at the eurozone as a whole, economic activity declined by 0.6 per cent last year and according to European Commission forecasts is expected to fall by another 0.3 per cent this. But that conceals huge differences within the region. For example Germany is expected to grow by 0.5 per cent this year while Spain is predicted to contract by 1.5 per cent and Italy by 1 per cent. The Greek economy will have declined for six years in a row.

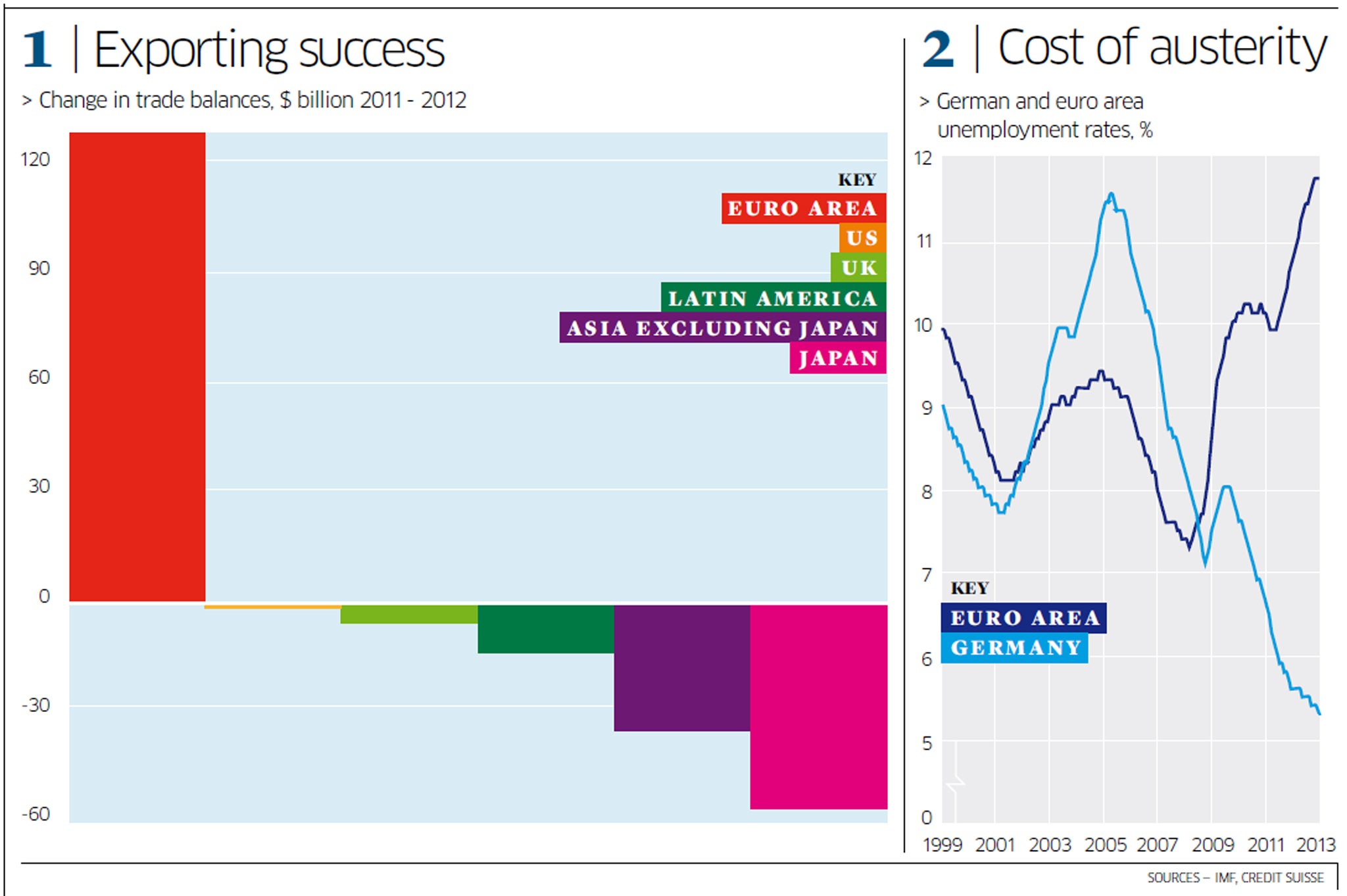

You can catch a glimpse of the social costs of this divergence in the right-hand graph, which shows unemployment in the eurozone as a whole and in Germany – the former would look even worse were Germany excluded. But note something else. Back in 2005 Germany had dreadfully high unemployment. It coped with this in a number of ways, including fiscal conservatism, but principally by holding down its wage costs and introducing labour market reforms – measures designed to counter the fact that Germany had entered the euro with the mark at a rather high rate.

People who argue now that Germany is getting great benefit from euro membership because otherwise it would have a less competitive exchange rate should note that Germany's lower costs are the result of many years of hard grind.

It follows that the course the southern European countries should follow now is that taken by Germany then. Austerity works, at least when coupled with structural reforms. In a sense that is already happening. Imports into southern Europe have collapsed while exports have not done too badly. The result is that the eurozone as a whole has massively increased its trade balance with the rest of the world. You see that in the main graph. Every other region in the world has moved in the other direction. This cannot continue indefinitely, though the timing and course of any correction is hard to call.

Credit Suisse reckons that the continuing trade and current account surpluses will push the euro up and that the most likely response to that will be even looser monetary policy. That might sustain a recovery but a weak one. That will probably turn out to be right. It would mean, however, that the euro would become more of a southern European currency, with the ECB acting more in the interests of its weaker members rather than that of its stronger ones.

That will create huge tensions, for it would imply a devaluation of the euro both externally (through a lower exchange rate) and internally (through higher inflation in the core countries). That runs against the ECB's mandate to ensure price stability and more generally the promise to the German people that the euro would be as good as the deutschemark.

So what gives? My instinct is that the most likely path is things will muddle along for quite a while yet. The two countries that matter most are Italy and Spain. What happens in Greece is of profound concern to people there but the economy is not big enough to unseat the rest of the eurozone. Assuming that there will be some growth in Spain and Italy, starting in 2014, it will be possible to sustain the austerity programmes in both countries until growth gradually returns and takes the pressure off. The real crisis will be in five years' time when the world economy hits its next cyclical downturn.

That at least seems to me to be the most likely outcome. But it depends on a number of things coming right, starting with these Italian elections.They are essentially about sustaining political support for austerity. If that support is still there – and there is a separate debate about the political make-up to sustain support – then one hurdle is passed. Everyone breathes again. On balance, I expect that will happen.

But if that support is not there, and we may not know for some months, then the rest of the eurozone has to decide what to do. The experience of the past year is that the European Central Bank will do "whatever it takes" to save the euro. Put crudely, it will print the money. But that only buys time and there will be another round of anguished talks about the terms under which the rest of the eurozone will support the country.

So if Italy's present austerity programme is abandoned there will have to be some sort of bailout. It is hard to see the form this will take but help for the banking system on the lines of that extended to Spain would be the first place to look. But we are not there yet.

You see the point. The eurozone as a whole is running a current account surplus. The sovereign indebtedness of the bloc as a whole is pretty much the same as that of the US and the UK, and vastly better than that of Japan. So the problems are manageable. But it is not an integrated region in economic outcomes as you can see in that chart on unemployment.

To correct this different performance requires Spaniards and Italians to behave like the Germans and the Dutch. The Italian vote is one test of the extent to which this is likely.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks