US Fed's decision on interest rates will have to take account of China's slowdown

Economic View

So at 2pm Eastern Daylight Time the Fed will announce its decision on interest rates. Were it to make that decision purely on domestic grounds there would be a clear case for an increase, not overwhelming (because headline inflation is still depressed by the falls in energy and commodity prices), but pretty clear. If it does not move it will be because of international conditions: a global slowdown associated with the decline in growth in China. But how real, and how worrying, is this slowdown?

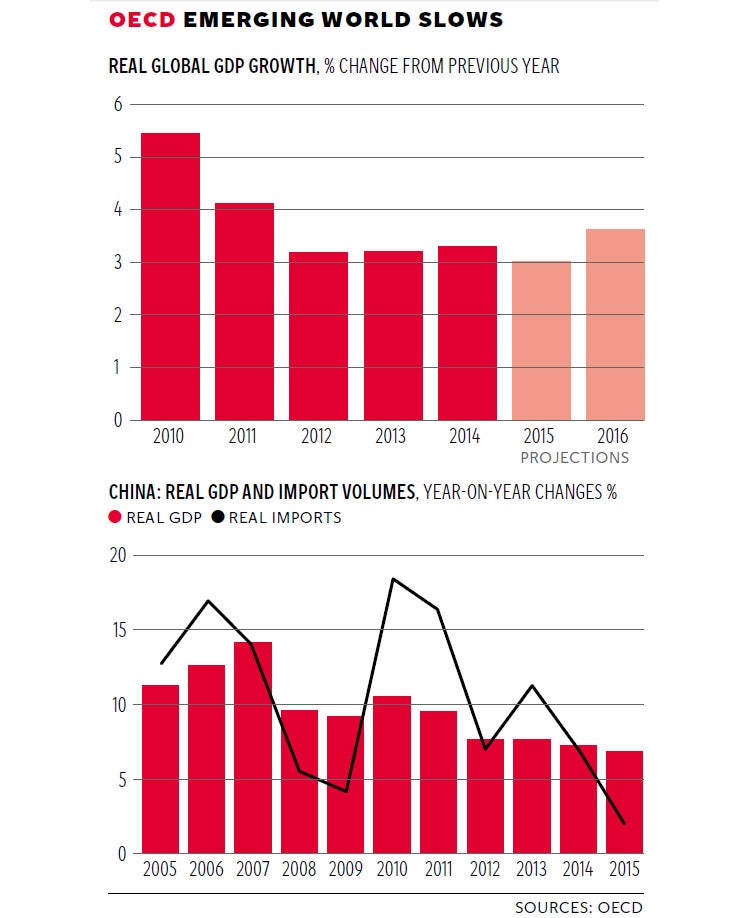

As it happens the Organisation for Economic Co-operation and Development in Paris has just published its latest forecasts in the Interim Economic Outlook. The subtitle is Puzzles and Uncertainties, which neatly sums it up. The central message is that global growth will slow this year to about 3 per cent, which as you can see from the top graph is actually slower than any time since the recovery got under way in 2010.

The reason is almost entirely the shading down of growth in China. As you can see from the bottom graph, Chinese growth has been declining for some time, but is still – according to official statistics – about 7 per cent a year. But look at the black line. That shows the change in imports into China, and though it is still just positive, it is the lowest for at least a decade. These, to be clear, are volume imports rather than money ones, so they are not artificially depressed by the fall in commodity prices.

This says two things. One is that these weak imports will be damaging the countries, particularly in South-east Asia, that rely on the Chinese market. The other is that actually Chinese growth may be quite a bit below the 7 per cent figure claimed. It could be more like 4 to 5 per cent – still strong by the standards of most countries, but not by the standards of the past. The OECD calculates that such a slowdown could wipe off some $750bn (£484bn) from the world economy over the next two years – it estimates that a 2 percentage point decline in Chinese domestic demand could knock 0.4 per cent off global growth in 2016, and 0.5 per cent in 2017. (The official OECD growth forecast for China this year is 6.7 per cent, and next year 6.5 per cent.)

In the developed world, by contrast, things are reasonably positive. It increased its growth forecast for the US this year to 2.4 per cent and said the recovery there “warrants an upward rate path, but at a very gradual pace”. The UK is also expected to grow at 2.4 per cent this year, slowing slightly to 2.3 per cent in 2016. The eurozone is put at 1.6 per cent this year, rising to 1.9 per cent next.

To sum up, the OECD view reflects the centrist global one among economists that there is some sort of slowdown happening, triggered by what’s happening in China, but it is not catastrophic for the developed world as a whole. The risks are on the downside, particularly for the emerging world.

What should we make of this? We have become accustomed to there being a generally sluggish recovery in the developed countries and a generally booming one in the emerging world. Now we have to reassess that. For example two of the Brics are in trouble, big time. We all know about Russia. The World Bank thinks its economy will decline by 3.8 per cent this year. Another Bric, Brazil, is also facing recession, with the OECD projecting just a fall of 0.7 per cent in GDP next year. Only India seems secure in its boom, with growth of 7.2 per cent this year and 7.3 per cent next. What is pretty much beyond dispute is that India has now passed China in the growth stakes, as many people have expected it would.

Does this mean that our mental model of the world economy is out of date? Well, not really. There is little dispute that the emerging world, taken as a whole, will continue grow much faster than the developed world. It is just that the huge gap in performance evident since the late 1990s has narrowed somewhat. The Bric story is tarnished, but then it was always a slightly artificial grouping of what happened to be the four largest economies outside the developed world bloc. Whereas developed countries have broadly similar economic structure and broadly similar political and institutional arrangements, the four Brics were and are quite different in just about every way. That is especially so in demographic outlook, with Russia at one end of the ageing scale and India at the other.

There are two big questions about the extent to which a slowdown in China will matter to the rest of the world. The first is whether the Chinese authorities can manage the transition. It is complex, for this is not just about headline numbers. There has to be a transition from export-led growth to domestic-led growth; from investment-driven activity to consumption-led growth; from manufacturing to services; from a young society to an old one; and inevitably from what is still, to some extent, a command economy to a market one. It is tricky, and the stunning successes of China since 1978 do not ensure continued successes now.

The second question is contagion: will the slowdown in China help or hinder the rest of the world? It is an inevitable mathematical fact that slower growth in China will initially mean slower growth for the world. But as we adjust to that there will be benefits. These will include lower energy prices and less damage to the environment. To some extent, though you cannot quantify this, slower growth in China will create more space for growth elsewhere. I would not go as far as to say slower growth in China is a short-term negative but a long-term positive, but you can see there is some truth in that assertion. As for the impact on the Fed decision – well, let’s see what they say.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies