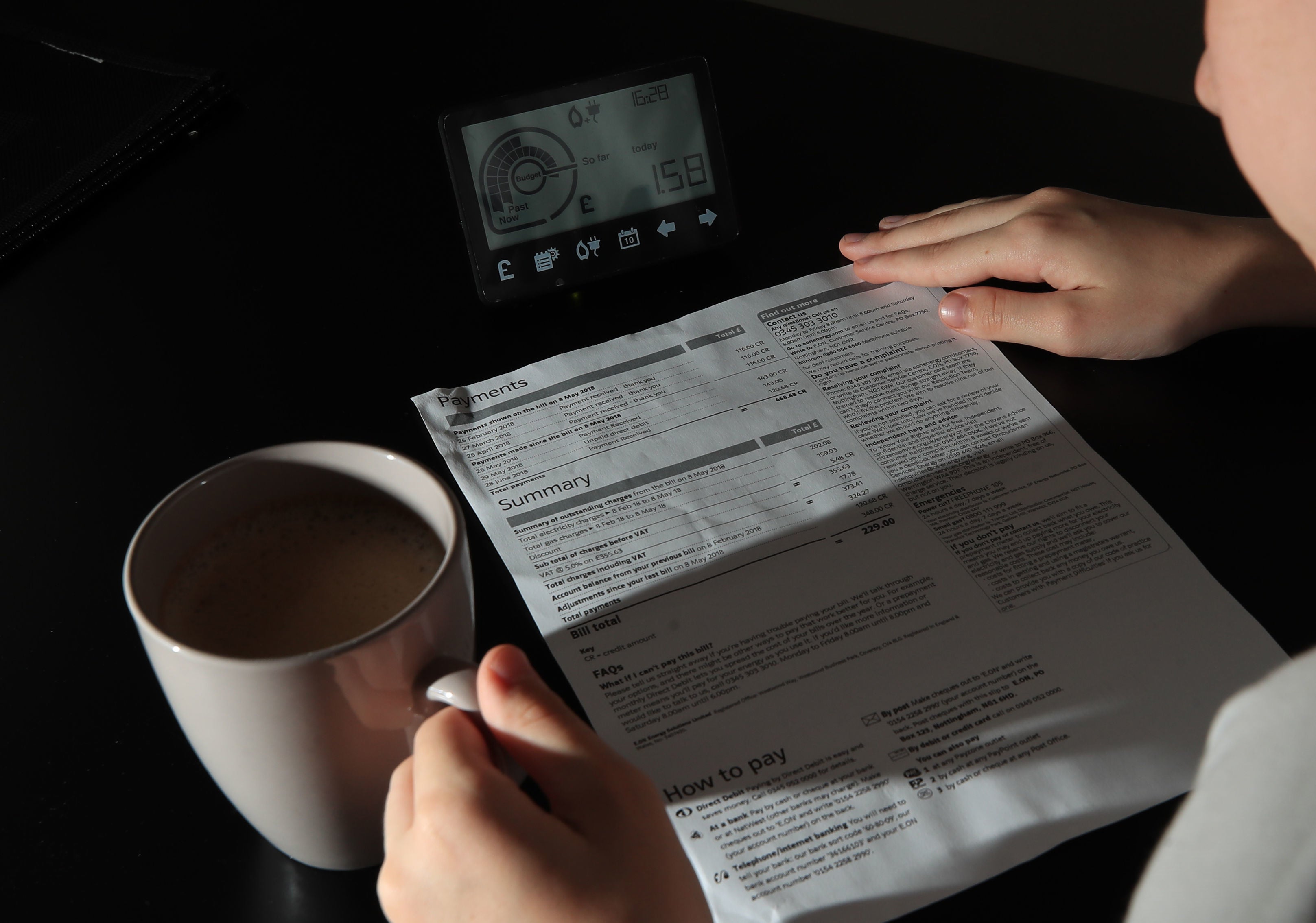

UK households hit by record rise in energy bills as price cap jumps to £1,971

£693 per year increase for UK energy customers

Millions of UK households will see their gas and electricity bills jump by more than 50 per cent in April after energy regulator Ofgem announced a record-breaking increase to its price cap.

The cap, which sets a maximum amount suppliers can charge 22 million retail customers, will rise from £1,277 to £1,971 for a household on average usage. It means a £693 per year increase for the average customer.

Prepayment meter customers will see an increase of £708 from £1,309 to £2,017.

Following the announcement, Rishi Sunak laid out a support package he said would “take the sting” out of the energy price shock.

The “vast majority” of households would receive rebates totalling £350 this year, he said. All domestic energy customers will receive an upfront discount of £200 from October, with the government meeting cost in full. Customers will repay the amount in £40 installments over the next five years.

Households whose homes are rated A to D for council tax will receive a £150 discount on their tax bill in an attempt to remove the “sting” out of rocketing energy bills. Eligibility criteria for the £140 warm homes discount will be extended so it covers one third more people, Mr Sunak said.

Suppliers and charities had also called for more targeted support for people in the greatest need, including an reversal of the recent universal credit cut.

Without financial help, some two million more people were forecast to be plunged into fuel poverty this year, meaning 6 million people in total would be struggling to heat and power their homes.

Charities have warned of an "inevitable" rise in destitution as people on the lowest incomes become unable to afford other essentials such as adequate food and clothing.

Alison Garnham, chief executive of Child Poverty Action Group said Mr Sunak’s “piecemeal” measures would not protect low-income families.

“Surging energy prices are only the start of the crisis and what’s needed is comprehensive help with across-the-board price rises,” she said.

“The most efficient way to help households is to increase benefits to match inflation and anything less than a rise by at least 6 per cent will leave families in a desperate situation.”

A sharp rise in the price cap was made all but inevitable by turmoil in international gas markets. Soaring wholesale gas prices, propelled by rising demand in Asia and a lack of supply coming from Russia, have pushed wholesale prices to unprecedented peaks in recent months.

A higher price cap will allow suppliers to pass on some of the soaring costs that they are paying for gas.

Market prices indicate that there is more pain to come for consumers, with energy expected to remain expensive for at least two years. Increasing prices have led to bumper profits at oil and gas companies, including Shell which announced on Thursday that it would return $8.5bn (£6bn) to shareholders.

Experts forecast that the cap for consumers will jump again to more than £2,300 in October.

Rachel Reeves, Labour’s shadow chancellor, branded the government’s plans as a “buy now pay later” scheme that would heap costs onto taxpayers. “Labour will keep bills low with a windfall tax on North Sea oil and gas producers with booming profits,” Ms Reeves said.“In the midst of a cost of living crisis, the government’s proposals will leave families in Britain paying hundreds of pounds more as a result of the breathtaking rise in energy prices. It will be of little comfort to many.”w

Households face a further squeeze from a 1.25p increase in National Insurance contributions in April and rising interest rates. The Bank of England announced it had hiked its key benchmark rate from 0.25 per cent to 0.5 per cent on Thursday, meaning higher repayments for people on tracker and standard variable rate mortgages.

Jonathan Brearley, chief executive of Ofgem, said: “We know this rise will be extremely worrying for many people, especially those who are struggling to make ends meet, and Ofgem will ensure energy companies support their customers in any way they can.

“The energy market has faced a huge challenge due to the unprecedented increase in global gas prices, a once in a 30-year event, and Ofgem’s role as energy regulator is to ensure that, under the price cap, energy companies can only charge a fair price based on the true cost of supplying electricity and gas.

He added that Ofgem is working to stabilise the market and, over the longer term, to “diversify our sources of energy which will help protect customers from similar price shocks in the future.”

Ofgem will tomorrow announce further measures aimed at increasing financial resilience in the energy market.

The regulator has been heavily criticised for allowing dozens of suppliers with limited experience and expertise into the market and failing to ensure that companies had adequate capital and did not take excessive risk.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks