Interest rates – live: Bank of England holds at 5.25% as Bailey says he will not bow to pressure to cut rates

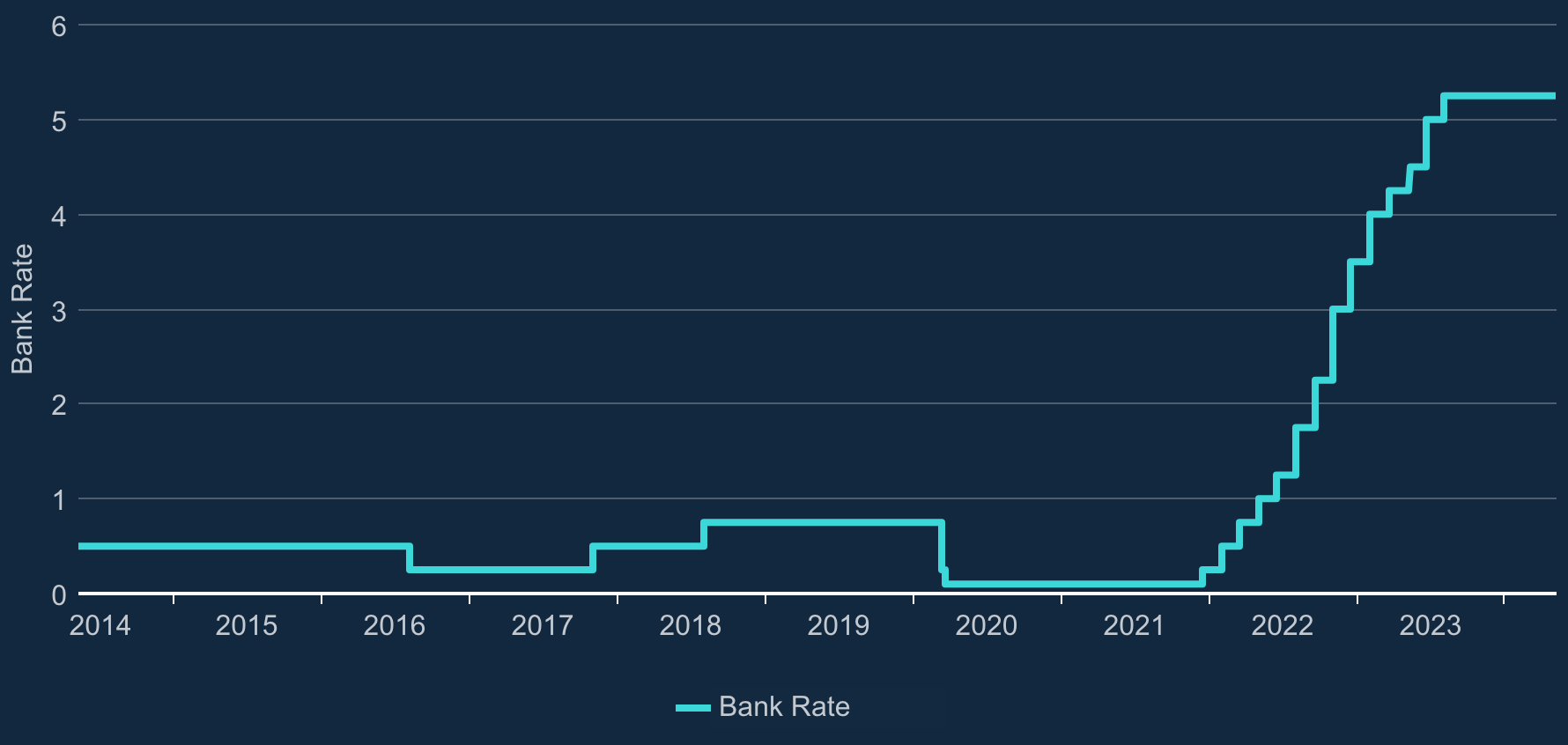

Bank of England’s base rate remains at 16-year high after Thursday’s decision

The Bank of England has kept interest rates at a 16-year high for at least another month, as governor Andrew Bailey said Threadneedle Street would not bow to political pressure to cut rates.

The BoE’s Monetary Policy Committee (MPC), announced its latest decision at midday on Thursday, opting to keep the current rate of 5.25 per cent – set last August – in a blow to those hoping for the first reduction since 2020.

High interest rates have saddled homeowners with soaring mortgage repayment costs, and are used as a tool to help bring down inflation.

While the rate of Consumer Prices Index (CPI) inflation fell to 3.2 per cent in March, experts had suggested that two key economic indicators – pay growth and services sector inflation – have remained more stubborn.

In positive news, the Bank improved its forecasts on Thursday to predict that CPI inflation would fall to 2.25 per cent next year and to 1.5 per cent in 2026, and said it expected the UK economy to grow by 0.5 per cent this year and 1 per cent in 2025 – slightly higher than previous predictions.

We’re pausing updates on the liveblog for this evening, thanks for following here.

You can read our latest reporting on the Bank of England’s announcement by clicking here, or else keep scrolling to catch up on the day’s events as we reported them.

Chancellor praises ‘finely balanced’ interest rates decision

Chancellor Jeremy Hunt said the Bank of England’s decision on rates was “finely balanced”.

Asked if he had been hoping rates would be cut ahead of the general election, Mr Hunt said: “I welcome the fact the Bank of England’s obviously thought about this very hard, they take this decision independently.

“And I would much rather that they waited until they’re absolutely sure inflation is on a downward trajectory than rush into a decision that they had to reverse at a later stage.

“What we want is sustainably low interest rates, and I think what’s encouraging is that the Bank of England governor, for the first time, has expressed real optimism that we’re on that path.”

Bank of England will not wait for US Federal Reserve to cut rates, says Bailey

The Bank of England will not wait for the US Federal Reserve to move on interest rates before it decides to cut rates in the UK.

Andrew Bailey, governor of the Bank of England, said: “There is no law that the Fed has to go first. Moreover, we have a remit and a target that is related to domestic inflation in the UK.”

He added that the Bank will always “take the rest of the world into consideration”, but only in regard to how it affects domestic inflation.

“But there’s no law which says we can only move after the Fed moves. That is not something that ever gets discussed in the MPC.”

Bank of England ‘getting very close’ to first rate cut since 2020, says economist

James Smith, ING developed markets economist, said: “The Bank of England is getting very close to its first rate cut. That much is clear from the latest policy statement which, while keeping rates on hold at 5.25%, has a distinctly more optimistic flair.

“It echoes recent comments from governor Andrew Bailey, who has been hammering home the message that the UK’s inflation outlook is quite different to the US.

“We’re still leaning slightly more towards an August start date for rate cuts, though it’s a close call. What isn’t in doubt is that the Bank is comfortable with moving ahead of the US Federal Reserve.”

Bank of England will not bow to political pressure to cut rates, says Bailey

The Bank of England will not bow to increased pressure from politicians to cut interest rates, its governor has said.

Andrew Bailey said: “We are an independent central bank. We have a very clear remit. It’s our duty to exercise our duty at all times. When we are sitting in a room as the Monetary Policy Committee, we never discuss politics ... It isn’t a consideration in that respect.”

It comes amid a period of heightened pressure from some MPs on the Bank to move faster on rate cuts in the run-up to a general election later this year.

When pressed on whether an upcoming election could influence how the Bank makes its decisions on rates, Mr Bailey added: “We will take the decisions at each meeting which are consistent with our remit. That’s our job and we will do our job.”

Inflation to fall before rising slightly before end of year, says Bank

The Bank of England has predicted that lower oil and gas prices mean that inflation is likely to drop to around 2 per cent in the coming months before rising slightly before the end of the year.

Inflation could fall noticeably below target without rate cuts, says Bailey

Here are more comments from Bank of England governor Andrew Bailey.

He told reporter: “It’s likely that we will need to cut bank rates over the coming quarters and make monetary policy somewhat less restrictive over the forecast period, possibly more so than currently priced into market rates.

“This will be consistent with ensuring that inflation does not fall noticeably below target at the end point of the forecast.”

Pound falls against the dollar

The pound fell against the US dollar and euro after the Bank of England signalled growing support for an interest rate cut among policymakers.

Sterling fell 0.3 per cent to $1.246 and was 0.2 per cent lower at €1.161.

Financial markets more pessimistic than Bank of England, Bailey indicates

Andrew Bailey has indicated that the financial markets are more pessimistic about the path for lowering interest rates than the Bank of England.

“With the progress we’ve made, to make sure inflation stays around the target, it is likely that we’ll need to cut bank rates in the coming quarters, possibly more so than is currently priced into markets,” he said.

The Bank governor said the committee has “no preconceptions” about how far and how fast it can lower interest rates, and it make a judgment based on the economic data it sees before each meeting.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks