5 charts that show the UK economy is in the middle of a 'lost decade'

The damage of the financial crisis on the UK economy has been bigger than anyone feared seven years ago

Support truly

independent journalism

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether $5 or $50, every contribution counts.

Support us to deliver journalism without an agenda.

Louise Thomas

Editor

The damage wrought by the financial crisis on the UK economy has been immense – and bigger than just about anyone feared seven years ago.

Previous recessions in the 1990s, the 1980s and the 1970s were followed by periods of relatively rapid above-trend growth as the natural resilience of the economy kicked in. But not this time.

In almost every year since the 2008-09 recession official forecasts have pencilled in an imminent bounceback, a re-emergence of the old pattern. Yet in almost every year they have been disappointed.

And now, seven years after the so-called “Great Recession” ended, the realisation is dawning that the UK economy seems to be in the midst of a “lost decade”. Here is the story of the lost decade in charts.

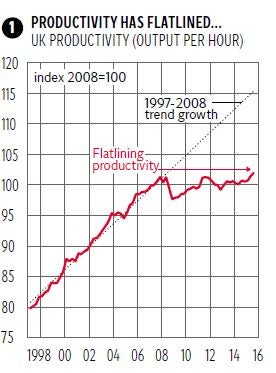

1) Productivity

The motor of economic growth and rising living standards is rising productivity. This is the amount of output the entire economy produces for each hour worked. Rising output per hour pushes sustainable increases in GDP and also allows workers’ wages to rise without setting off damaging inflation. But since 2008 productivity has gone sideways. If output per hour continued growing at the same trend rate as the period after 1997 the UK’s productivity would have been 10 per cent higher.

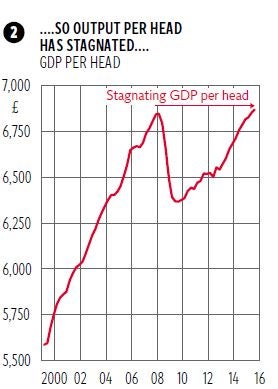

2) GDP per head

GDP has risen, rather weakly, since the financial crisis. But adjusted for the expanding population there has been virtually no growth since 2008.

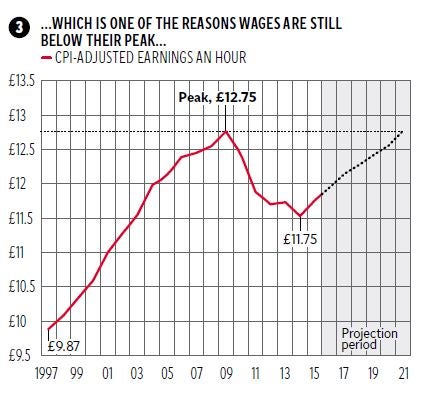

3) Wages

Flat-lining productivity and GDP per head are the central reasons wage growth has been exceptionally weak. Average wages peaked at £12.75 an hour in 2009. Today they are still £1 lower than that. According to projections from the Office for Budget Responsibility they will not return to the 2009 level until 2021.

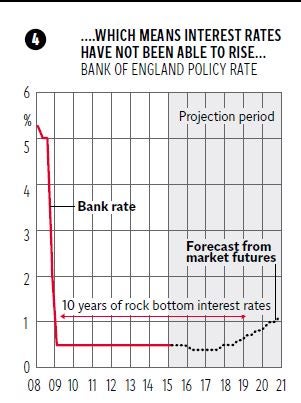

4) Interest rates

The Bank of England cut interest rates to their effective floor of 0.5 per cent in 2009 in order to cushion the impact of the recession and to stimulate borrowing and spending. The expectation of financial markets after the recession ended was the Bank would have to raise rates to stop inflation taking off. But the economy never picked up sufficient velocity. And the Bank has felt unable to raise rates. With annual consumer inflation falling to just 0.3 per cent, well below the Bank’s 2 per cent target, financial markets do not expect the Bank to put up rates until 2019.

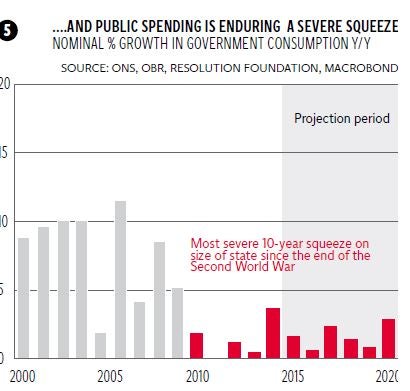

5) The size of the state

The austerity imposed by the Coalition in 2010 and continued by the Tories since 2015 will impose a decade of contraction in the size of the state relative to the size of the economy. While spending on pensions and welfare has been rising the things the state has been doing itself has been contracting severely. This has imposed a massive squeeze on public services.

… And next?

Some economists are openly wondering if the UK is in the grip of a “secular stagnation” as a result of gross imbalances in supply and demand, not just in the UK but the global economy. Others wonder if debts incurred before the crisis will need to be written off before the recovery can begin in earnest. Yet some feel the gloom is overdone and the UK will embark on a period of strong productivity growth. We should hope the latter group are right.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments