A year into the crunch, £30,000 wiped off average house price

Annual rate of fall now 14.6 per cent, survey by Nationwide shows

The average British home has seen almost £30,000 wiped from its value since the market peaked this time last year, according to a survey from the Nationwide Building Society.

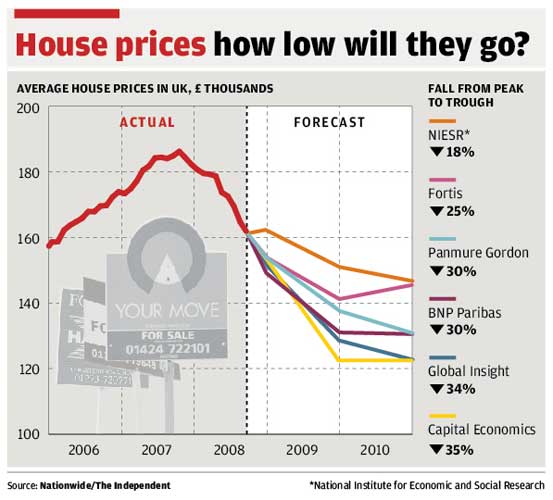

House prices reached an all-time high in October 2007, with the typical home selling for £186,044; that has slumped to £158,872. Many households have seen more money lost on their home than they managed to earn from their jobs over the past 12 months. House prices are falling at an annual rate of 14.6 per cent, up from 12.4 per cent in September; values fell by 1.4 per cent in October alone, or about £95 a day.

Few are surprised by the decline. This week, the Bank of England reported that the number of new mortgage approvals continues to run at about 70 per cent below last year's levels. The credit crunch is restricting the supply of new mortgages, although there has been some easing in the money markets lately, which should feed through to mortgage offers.

Those banks where the Government has recently taken a stake – including Royal Bank of Scotland, NatWest, Halifax Bank of Scotland and LloydsTSB – may expand their lending activities. Still, the return of the 125 per cent mortgage and the six-times-salary mortgage seems many years away.

Recent months have also witnessed the demand for mortgages fall away, as buyers stay on the sidelines watching prices fall. The Nationwide points out that the number of completed transactions, as a percentage of the total number of mortgages, has fallen to its lowest level since 1974. The dire state of the housing market has led to calls for deep cuts in interest rates.

The Bank of England's Monetary Policy Committee will announce its decision next Thursday, with the widespread expectation of a cut in rates of 0.5 or 0.75 of a percentage point, with more to follow in the new year, although the sharp decline in the exchange rate of the pound may stymie that strategy.

Oliver Gilmartin, senior economist at the Royal Institution of Chartered Surveyors, said: "Tighter lending criteria may have been the protagonist driving the fall-off in sales volumes over the last year to historic lows but buyers' expectations and confidence appears to have played an equally important role. Aggressive interest rate cuts starting with at least a half percentage point next week will help ease affordability constraints."

Economists are in broad agreement about where prices will go from here: down – by about 10 to 25 per cent from where they stand now, bottoming out in late in 2010 or 2011.

Ed Stansfield, property economist at Capital Economics, the most pessimistic of the forecasters, said: "Despite the fact that house prices are falling at their fastest pace on record, the housing market remains fundamentally overvalued by almost any measure. So as the economic downturn gathers pace, we still think that there is plenty of scope for the rate of house price deflation to accelerate."

The credit crisis: Latest developments

* Slump in consumer spending causes the US economy to shrink at its fastest rate since 2001

* Motorola and American Express announce 10,000 job cuts worldwide

* European consumer confidence slips to its lowest level for 16 years

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies