Brexit may be Scotland's chance to steal London's finance crown

Garnier, a Conservative member of the UK Parliament’s Treasury Committee, says that a so-called Brexit might make it worthwhile for Scots to go it alone to usurp London’s position.

For all the uncertainty Scotland faces with the cloud of Britain’s exit from the European Union, there could yet be a silver lining, according to UK lawmaker Mark Garnier.

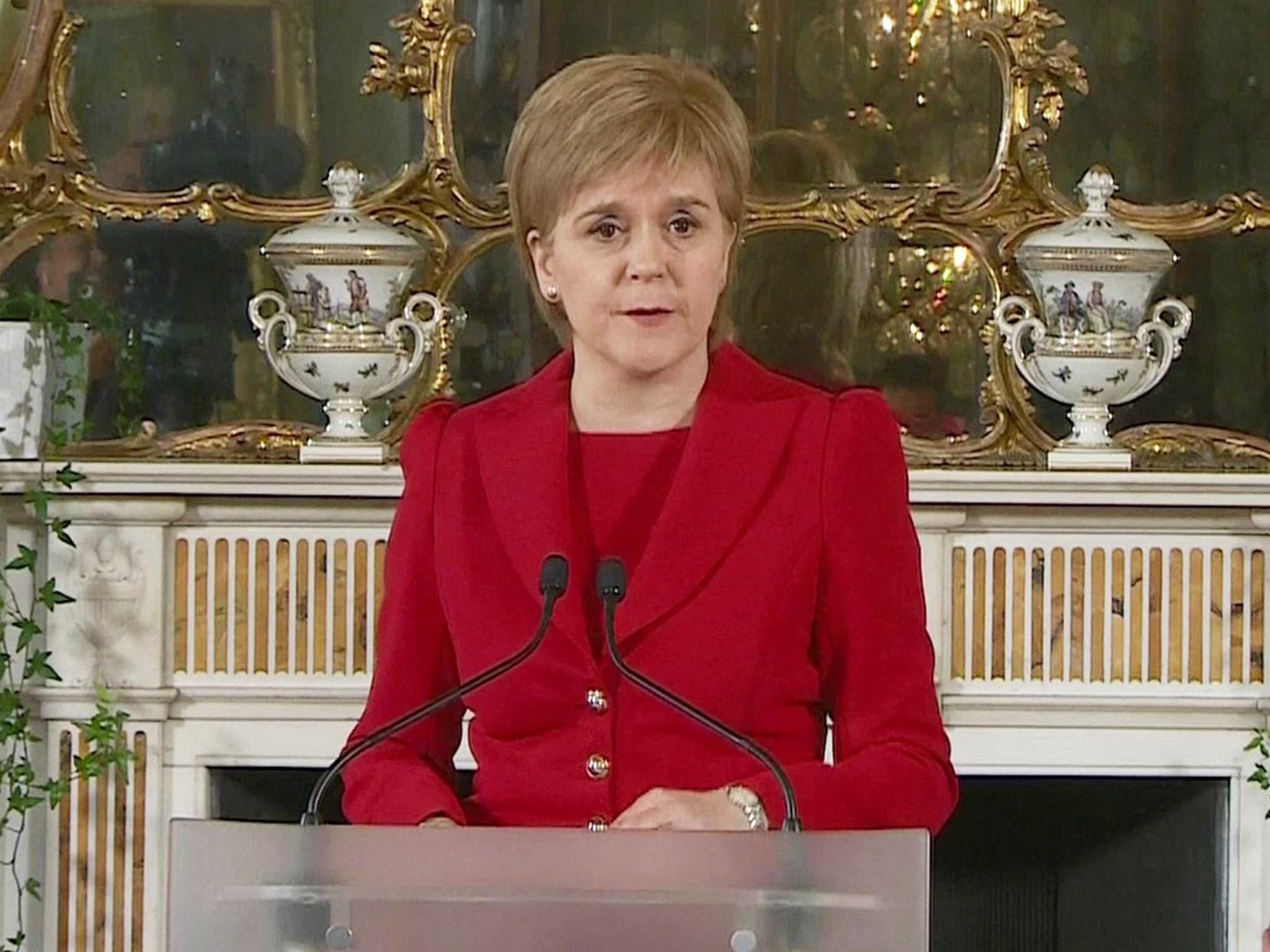

As Friday’s vote showed a clear split between English seeking to leave and Scots preferring to remain, Scottish First Minister Nicola Sturgeon described a second independence referendum north of the border as “very much on the table.”

Garnier, a Conservative member of the UK Parliament’s Treasury Committee, says that a so-called Brexit might make it worthwhile for Scots to go it alone to usurp London’s position.

“If I was Nicola Sturgeon trying to find an alternative purpose and role for Scotland, you could do an awful lot by trying to snaffle that financial services hub from London,” Garnier, a former banker, said in an interview.

“That’s exactly what I would be trying to do in terms of trying to build a financial services hub that would be the natural successor to London by leaving the union of the United Kingdom and staying within the European Union.”

An online poll in the Sunday Post newspaper published this weekend showed 59 per cent of Scots now favor independence, less than two years after they voted with a 55 per cent majority to stay part of the UK.

Since then, the Scottish National Party’s economic case for a viable fiscal setup based on North Sea oil revenues suffered the setback of a slump in the price of crude.

Financial Base

“Scotland has clearly not got the natural resources revenue that it thought it had two years ago,” Garnier said.

“But what it has got is a lot of that stuff which makes London attractive as a base of financial services, including quite a lot of money already run up there out of Edinburgh. So it already has the beginnings of a financial services hub.”

In the referendum last week, 62 per cent of Scots voted to remain the EU, compared to more than 53 per cent in England who wanted to leave. Quitting the bloc raises the prospect of British bank, insurers and others losing the so-called passporting rights allowing them access to region’s single market.

“It was pretty clear how Scotland wanted to stay,” Garnier said. “If Britain comes out of the single market and we don’t have passporting rights then the attractiveness of London as a financial hub reduces, because a lot of it is to do with it being an access point to Europe.“

EU referendum - in pictures

Show all 18Scotland can claim many of the benefits of the rest of the UK, albeit with some drawbacks, Garnier said.

“It’s got broadly speaking the same rule of law, the regulatory regime is the same so they could pick that up and carry on with it if they’re clever, and they speak English,” he said. “It’s not a bad place, perhaps a bit damp, but you can live with that.“

© 2016 Bloomberg L.P

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies