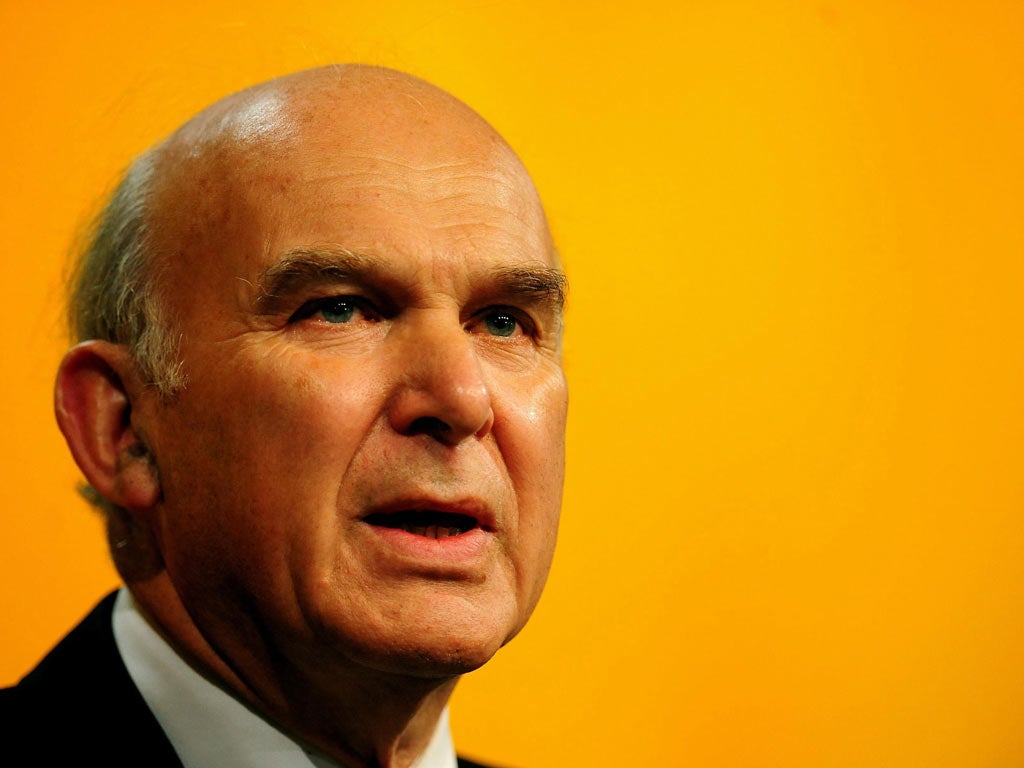

Business Secretary Vince Cable today said he will continue to look into whether any Royal Bank of Scotland directors should face disqualification following today's report into the bank's failure.

The 452-page examination carried out by the Financial Services Authority (FSA) into why the lender needed a £45.5 billion rescue confirmed that none of the directors will face enforcement action from the regulator.

But Mr Cable, whose department is in charge of bringing disqualification proceedings, has asked his legal team to provide further advice on what course of action is open to him in the light of the review.

He has already been given "underlying evidence" from accountancy firm PricewaterhouseCoopers in February but was advised this was insufficient to proceed.

Meanwhile, FSA chairman Adair Turner said a debate was now needed to change the rules to make bankers more accountable and to ensure that executives and boards strike the right balance between risk and return.

He suggested a "strict liability" approach, making it more likely that a failure like RBS's would be followed by "successful enforcement actions", including fines and bans.

Other suggestions included that senior executives and directors of failed banks could automatically be banned from future positions of responsibility, or that a significant part of their pay is deferred or lost in the event of failure.

He added: "By one means or another, there is a strong argument for new rules which ensure that bank executives and boards place greater weight on avoiding failure."

The FSA will publish a discussion paper on the options in the new year.

The other main recommendation thrown up by the report was that banks should be forced to get "explicit regulatory approval" before making any major acquisitions.

This was in response to RBS's disastrous £50 billion acquisition of Dutch lender ABN Amro, which stretched its resources and was a major factor in its downfall, leaving it more than 80% owned by the taxpayer.

However, the report said many of the most important changes had already been made in the wake of the credit crunch.

It said that under recently introduced international banking rules, known as Basel III, the acquisition of ABN would not have been allowed to happen because banks are now required to hoard more money to help stave off a collapse.

And, while the regulator's report admitted that it had failed to do a good enough job monitoring the bank's activities, it said the system had been changed with the FSA being split to create two new regulators, a Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA).

The Government has also established a Financial Policy Committee (FPC), with the responsibility to identify and respond to emerging systemic risks.

PA

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies