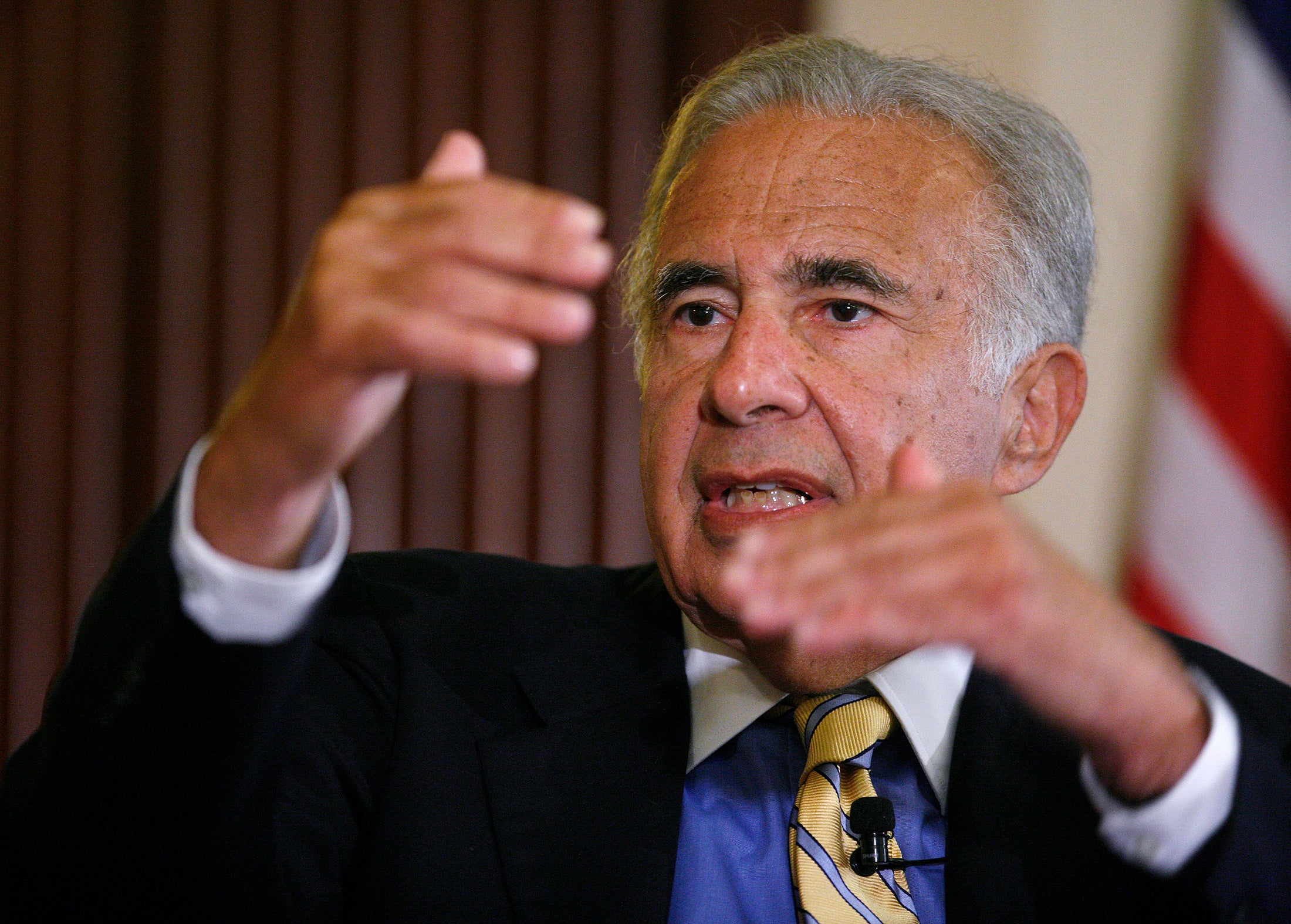

Carl Icahn sends letter to Apple shareholders pushing for bigger share buyback

Apple has released activist investor Carl Icahn’s letter to shareholders, setting out his case for a bigger share buyback programme that could see as much as $50 billion handed back to investors this year.

Icahn has been calling for an increase to the share repurchase programme since he disclosed a stake in the company last August, initially pushing for as much as $150 billion to be returned to shareholders.

The billionaire took to Twitter earlier this week to voice his opinion, say the iPhone maker was “doing great disservice to shareholders” by not buying back more stock at its current price.

Last night Icahn revealed he had thrown more chips behind Apple, building up a $3.6bn stake in the technology firm, his single biggest investment.

Overnight Apple also filed Icahn’s letter to shareholder with the Securities and Exchange Commission in the US. The letter will force a non-binding vote on the issue at Apple’s AGM in February.

So what’s Icahn’s case? Well, unlike other loudmouth investors such as Dan Loeb, Icahn sees all upside:

"Over the course of my long career as an investor and as Chairman of Icahn Enterprises, our best performing investments result from opportunities that we like to call "no brainers." Recent examples of such “no brainers” have been our investments in Netflix, Hain Celestial, Chesapeake, Forest Labs and Herbalife, just to name a few.

In our opinion, a great example of a “no brainer” in today’s market is Apple. The S&P 500’s price to earnings multiple is 71% higher than Apple’s, and if Apple were simply valued at the same multiple, its share price would be $840, which is 52% higher than its current price."

The business is undervalued by the market and Apple should push for the right price by buying back stock. Not only is it undervalued, Icahn thinks the outlook for the business is nothing but roses. For one thing, he's a strong believer in the power of the cult of Apple:

"The naysayers question whether Apple will be able to participate in growth without sacrificing pricing and gross margins, especially with competition from Google, Samsung, Microsoft, Amazon and Chinese manufacturers. Our response to them is that the answer is already evident to us from the continuing loyalty of Apple’s growing customer base"

What’s more , it’s not only customer loyalty that will keep the company on the up – Icahn is predicting big things from Apple in 2014:

"Tim Cook keeps saying that he expects to introduce “new products in new categories” and yet very few people seem to be listening. We’re not aware of a single Wall Street analyst who includes “new products in new categories” or new services in any of their financial projections, even though Apple clearly has an impressive track record of such new category product introductions"

Icahn speculates that these new products will most likely be either an Apple TV, smart watch or, interestingly, a new payment system. Icahn predicts that Apple could shift 25 million TVs in a year and “such a debut would add $40 billion of revenues and $15 billion to operating income annually.”

Not only is Apple undervalued and the pipeline for growth strong, the company also has plenty of money. Icahn says it is “perhaps the most overcapitalized company in corporate history” – it can afford to give a bit back to investors.

He stresses in the letter though that this is not a quick cash grab by a corporate raider – he’s in it for the long-term and says “a share repurchase is not simply an act of “returning capital to shareholders” since it is also the company effectively making an investment in itself.”

So will the shareholders bite? Even if Icahn’s motion to up the buyback is approved it won’t be binding on the board, but it will certainly add to pressure. There’s a possibility there may be pre-emptive action from boss Tim Cook when Apple report earnings on Monday.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies