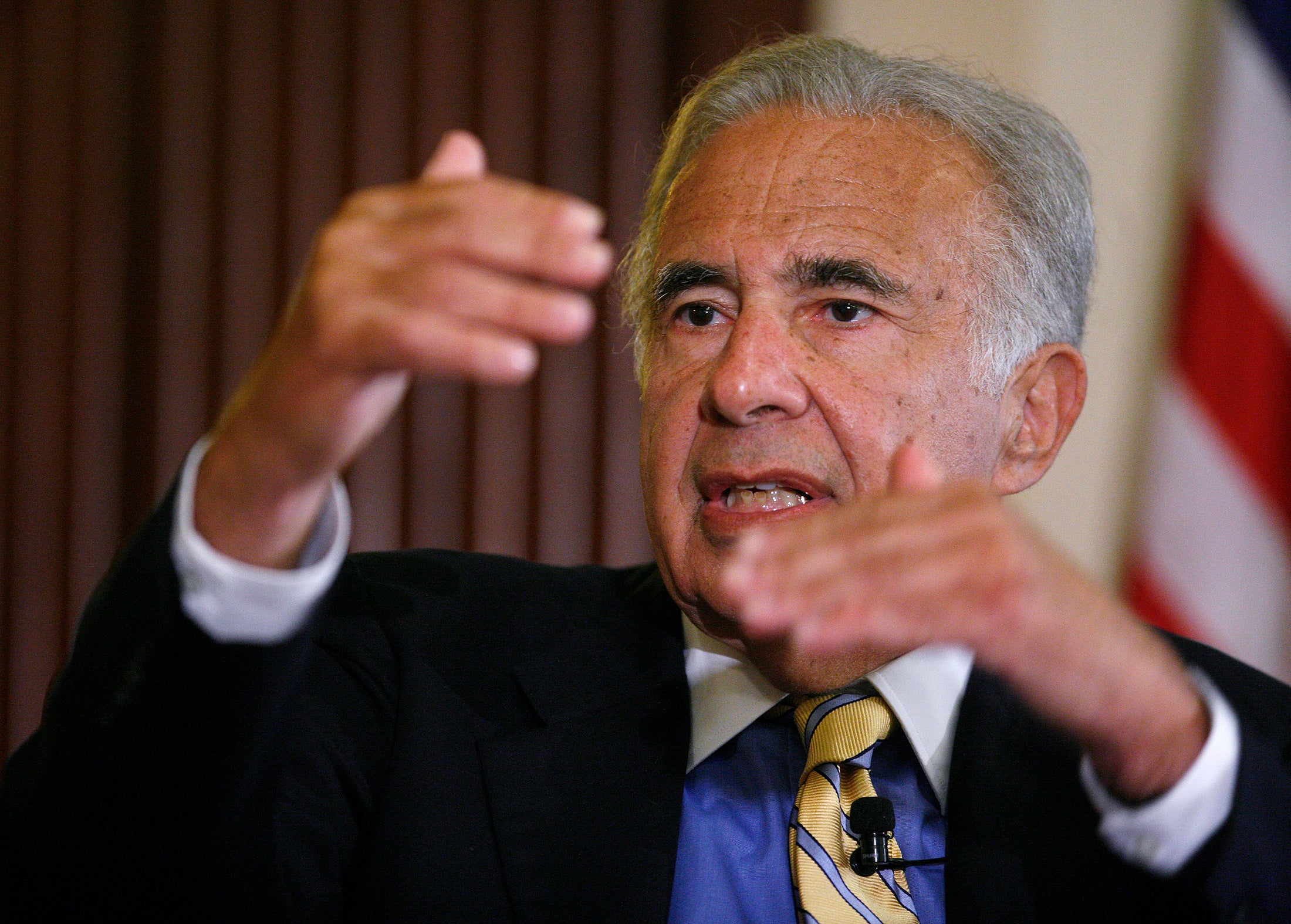

Corporate raider Carl Icahn demands Apple acts to double share price

Icahn argues stock 'dramatically undervalued' and should be trading $200

One of the most powerful investors on Wall Street yesterday declared Apple’s shares – already near record highs – should be twice their current value.

Activist investor Carl Icahn, who has a $5bn-plus stake in the tech giant – sent an open letter to chief executive Tim Cook saying that, while he loved the company and its prospects, it should buy back far more of its shares.

He explained that the market “misunderstands and dramatically undervalues” the maker of iPhones, iPads and, now, iWatches.

Buying back the shares now at what he considers to be their low price – from those investors willing to sell – would mean far better returns in the longer term for those who stay loyal. Apple has $133bn on its balance sheet which it could delve into to fund the share repurchases.

“We forecast such impressive earnings growth over the next few years,” he wrote. “The more shares repurchased now, the more each remaining shareholder will benefit from that earnings growth.”

The Apple campaign is Mr Icahn’s latest battle following a big success last week when eBay announced it would spin off its PayPal business following months of pressure from him to do so. Last year, Mr Icahn was unsuccessful in his bid to block a buyout of Dell by founder Michael Dell and a private equity firm.

Early this year, Mr Icahn, 78, pulled back from is efforts to make Apple accelerate buybacks after the company revealed it had bought back $40bn of stock over 12 months. And in April, Apple increased its share repurchase authorisation to $90bn from the $60bn announced last year, which Apple called “the largest single share repurchase authorisation in history.”

However, the impatience of the corporate raider Mr Icahn is once again clear – perhaps because the stakes are higher with his Apple investment. He said his 53 million shares in Apple represented the largest investment position his firm had ever taken.

Stock buybacks reduce the number of shares outstanding, increase earnings per share – and sometimes lift the stock market price of the remaining shares.

“We ask you to present to the rest of the board our request for the company to make a tender offer, which would meaningfully accelerate and increase the magnitude of share repurchases,” said Mr Icahn in the letter. “While we recognise and applaud the company’s previously-increased share repurchase authorisation, we ask you to consider our advice once again (to the benefit of all shareholders) and consider accelerating share repurchases again via a tender offer.”

Apple, which has a current stock market value of more than $608bn, is due to hold a “special event” on 16 October in Cupertino, California, when it is expected to unveil new iPads and updates to its iMac line of products.

Mr Icahn was glowing in his praise of Apple’s performance and its prospects, predicting the company was poised to take market share from Google’s Android in the premium device with the iPhone 6.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies