FTSE 100 hits new all-time closing high

The index's strong performance comes despite the terrible performance of retailer Next whose shares closed over 14% lower

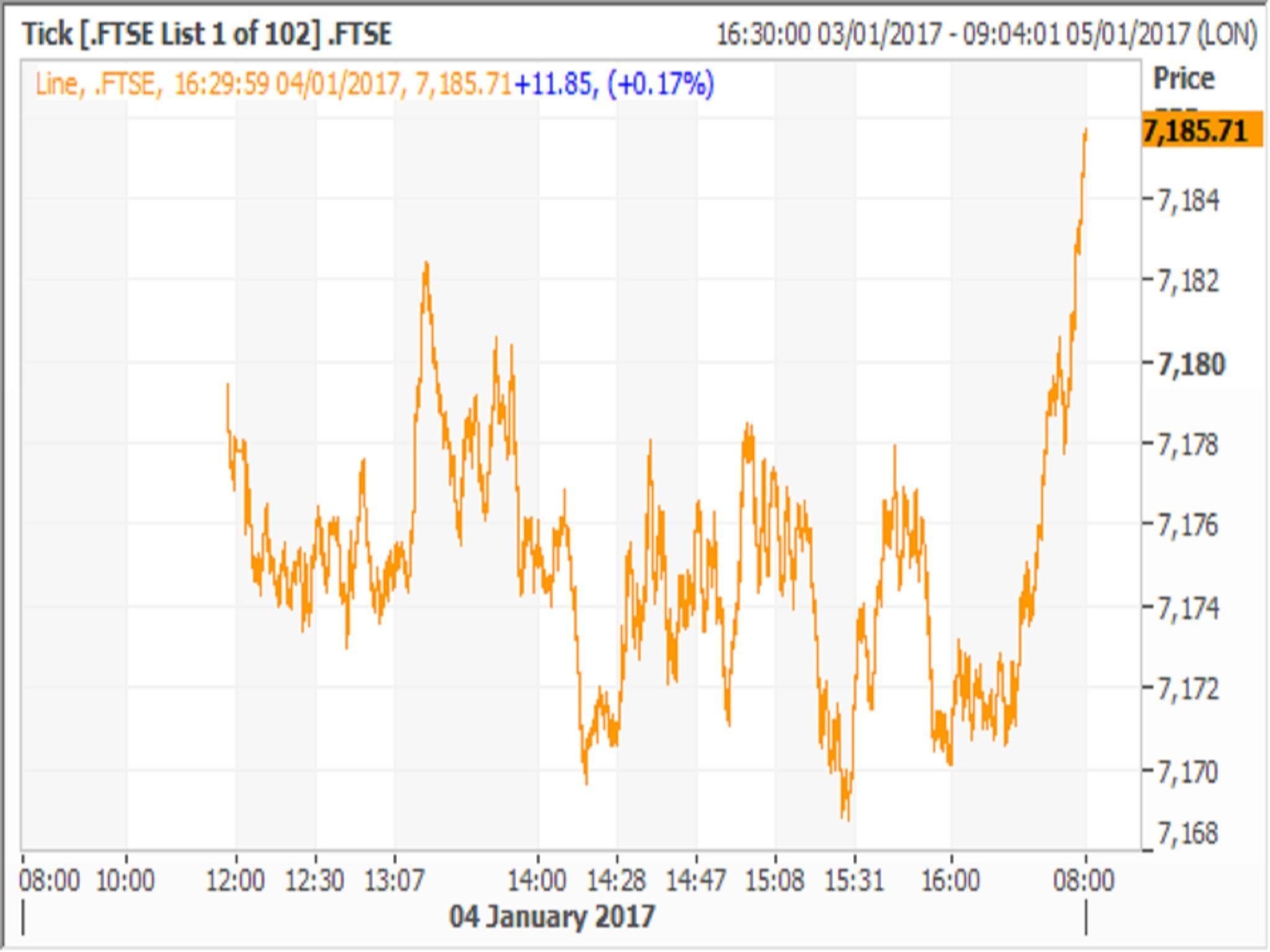

Britain's benchmark stock index, the FTSE 100, has continued its streak of records, hitting a new high on Wednesday.

The index closed 2016 with three consecutive record high closes — on December 28, 29, and 30 — and extended that run on Wednesday, gaining 0.17 per cent to close at 7,7189.74, edging past the previous record close of 7,177.89 which was set on Tuesday.

The FTSE 100 rise comes despite a slump in retail stocks. High street retailer Next cut its profit forecast for the financial year after a difficult trading period caused shares to dive by 14 per cent.

The news hit the retail sector with rivals Marks and Spencer plunging 6 per cent and Primark owner AB Foods dropping by 3.7 per cent.

However, UK housebuilders, including Barratt Developments and Taylor Wimpey, rallied to the top of the blue-chip index after Deutsche Bank told investors the sector’s “appealing value” is “too significant to ignore”.

UK shares are also continuing to benefit from the slump in the value of pound against the dollar since the country voted to leave the EU in June.

Sterling’s post referendum slump has boosted the FTSE 100 as many companies make a significant proportion of their profits abroad.

In currency markets, on Wednesday sterling rose 0.5 per against the US dollar but fell nearly 0.2 per cent against the euro.

However, the pound is down about 11 per cent against the euro since the EU referendum in June, and is about 18 per cent weaker against the US dollar.

While the FTSE has reached a new record in sterling terms, when measured in dollars it is still around 4 per cent down over the last twelve months.

Across Europe, the French Cac 40 and German Dax both closed flat.

Additional reporting by PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments