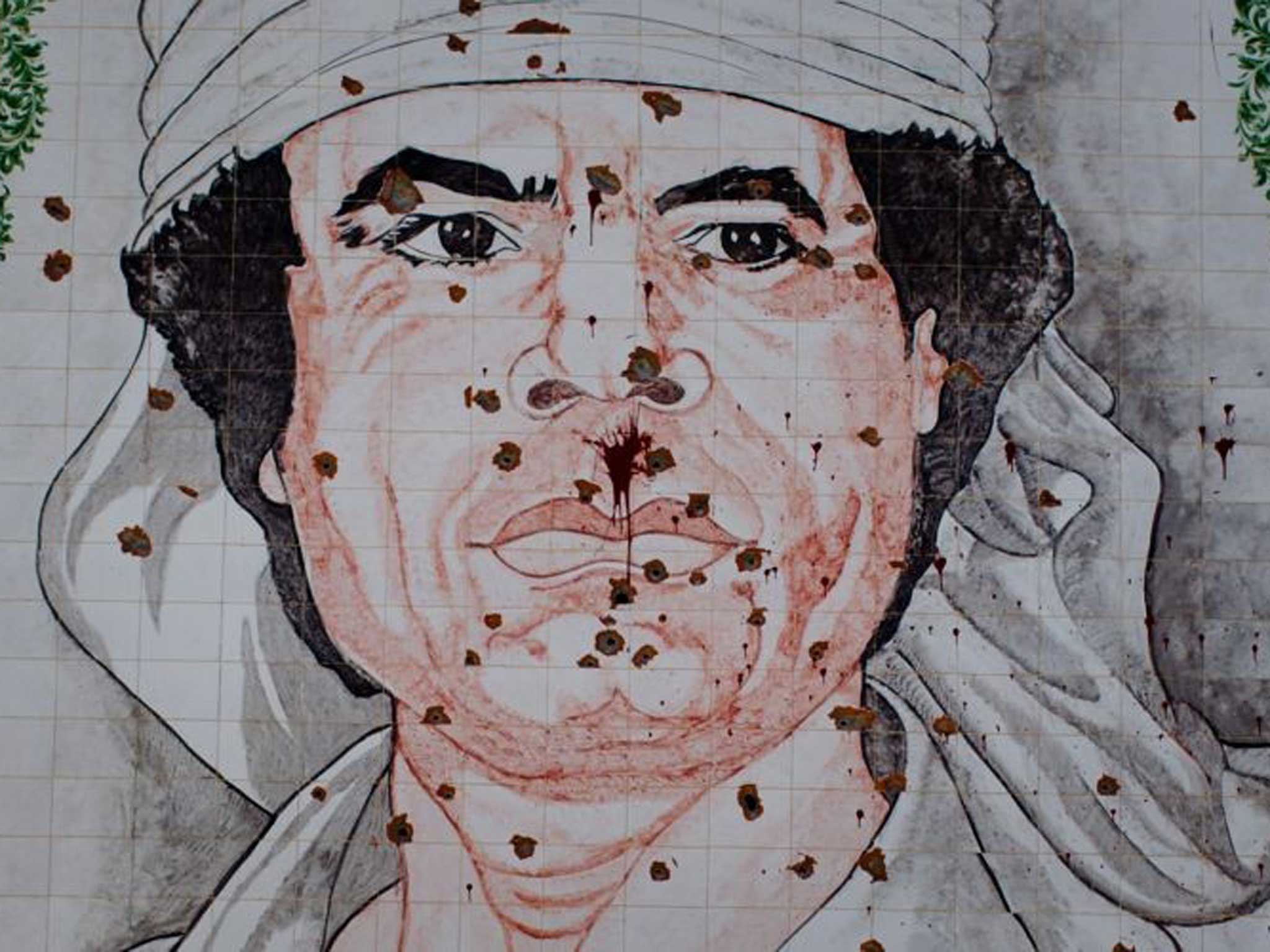

Goldman Sachs 'charmed Gadaffi-era sovereign wealth fund employees with girls and alcohol' in trip to Morocco

Bank 'charmed LIA employees' to make a series of trades worth $1bn that ultimately proved worthless

Support truly

independent journalism

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether $5 or $50, every contribution counts.

Support us to deliver journalism without an agenda.

Louise Thomas

Editor

Goldman Sachs took naive employees of the Gadaffi-era Libyan sovereign wealth fund on an all-expenses paid visit to Morocco where lavish entertainment included “heavy drinking and girls”, an independent lawyer testified in court today.

The Libyan Investment Authority contends the bank did this to persuade its inexperienced staff to invest in highly risky Goldman Sachs investments that ended up losing the fund, and by association, the Libyan people, more than $1bn.

Pop star James Blunt's new society beauty wife Sofia Wellesley has also been dragged into the case, as she worked for the LIA in their London offices in Upper Brook Street at the time of the investment.

She was quoted by the Libyan legal team as saying that when she worked there, she warned that they were “a team of clearly naive and unqualified individuals... doing their best in the face of extremely intelligent, ambitious and experienced individuals.” She added that the top Goldman banker Youssef Kabbaj was “a regular visitor” to the LIA offices.

The risky nature of the derivatives the Libyans had bought from Goldman only came to light when an independent lawyer on secondment from Allen & Overy in London saw them.

It was she, Catherine McDougall, whose witness statement was produced as a key plank in the Libyan Investment Authority's case in the High Court today, arguing that Goldman crossed the line between being arms-length banking advisers and trusted friends of the Libyan staff.

She says the LIA staff did not realise the products Goldman had sold them were high risk derivatives with huge amounts of leverage. “ I asked them where the due dilgence was and they responded: "Due What?"

The LIA staff had not checked the deal as they “completely trusted” Goldman, in particular its top banker Youssef Kabbaj.

“They told me [Kabbaj] was their very close friend. They told me about their lavish trip to Morocco and that there was heavy drinking and girls involved and that the trip was paid for by Youssef Kabbaj on his Goldman corporate credit card. They also told me how Mr Kabbaj would take them out in London for expensive nights out, again paid for on his Goldman Sachs credit card.”

She said the level of relationship was inappropriate.

“In short, I was shocked by what I learned...It was readily apparent to me that Goldman had unfairly taken advantage of the LIA's lack of financial sophistication and the trust and confidence” the LIA staff had given them.

Goldman Sachs counters that the LIA had very experienced bankers on their team and that its complaints now were merely hindsight. It says its staff behaved responsibly at all times and that the investments gave the LIA access to potentially huge returns in return for a minimal amount of capital. The deals only went bad, Goldman says, because of the financial crisis.

Today's court proceeds were the case management conference at which witness statements were filed for the first time.

The case proper is expected to start next year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments