Hope fades for Ireland's fight to keep financial independence

Senior officials in Ireland and the European Union yesterday moved closer than ever to conceding that the indebted country may now have no choice but to seek a bail-out.

José Manuel Barroso, the President of the European Commission, said the European Union stood ready to help Ireland if it needed financial assistance. "What is important to know is that we have all the essential instruments in place in the European Union andeurozone to act if necessary," MrBarroso said. "We are monitoring the situation closely."

Brian Lenihan, Ireland's Finance Minister, described the country's borrowing problems as "very serious", as the yields on its bonds hit yet another all-time high. The yield on 10-year bonds peaked at 9.26 per cent yesterday, almost four times the yield that is demanded by investors in equivalent German bonds.

"The bond spreads are very serious and there is international concern about that," Mr Lenihan said. He was also forced to clarify remarks made on Wednesday by Patrick Honohan, the Governor of the Bank of Ireland, who said that, were the International Monetary Fund to intervene, the package of economic measures it would demand would not be hugely different to what Ireland's Government was in any case proposing. Mr Honohan's remarks should not be interpreted as preparing the way for an IMF bail-out, Mr Lenihan insisted.

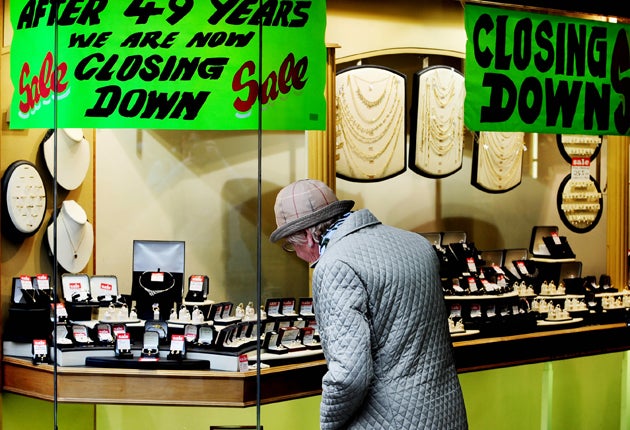

Ireland continues to argue it does not need outside assistance with debt refinancing and is pinning its hopes on a four-year programme of austerity cuts, due to be unveiled later this month. The Government hopes the package will be credible enough to soothe the fears of investors in its sovereign debt.

The first refinancing of that debt is due early in the new year, but will not be viable unless yields fall markedly. Ireland has sufficient funds to get through until April, the Government has previously said.

However, with wild speculation sweeping the markets, analysts believe Ireland will now struggle to get through the crisis without external help. In a poll of 30 economists and analysts by Reuters, two-thirds said they did not expect the country to get to the end of 2011 without requesting a bail-out.

Gary Jenkins, head of fixed income research at Evolution Securities, said: "The most likely outcome now is that Ireland will need to receive assistance from the EU/IMF." That would most likely see Ireland make the first call on a new facility, primarily financed by members of the eurozone, set up earlier this year following the Greek sovereign debt crisis.

The European Union's €750bn bail-out fund is available to countries should they not be able to raise money on the open market. Ireland is likely to need more than €40bn from the fund over the next two years, Mr Jenkins warned.

The level of anxiety across Europe about Ireland's plight was underlined yesterday by a sell-off in many of the continent's stock markets. The yields on the bonds of several "peripheral" eurozone members, including Spain, Portugal and Greece, also rose sharply.

The Irish crisis also knocked shares in Royal Bank of Scotland, which is seen as the British bank with the greatest exposure to the country. The state-backed bank fell as much as 5.6 per cent in early trading, before closing 2.7 per cent down.

RBS last week singled out losses on Irish loans as one reason for its disappointing third-quarter performance. MF Global Securities analysts believe RBS's total loan exposure to Ireland could be as high as €42bn.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies