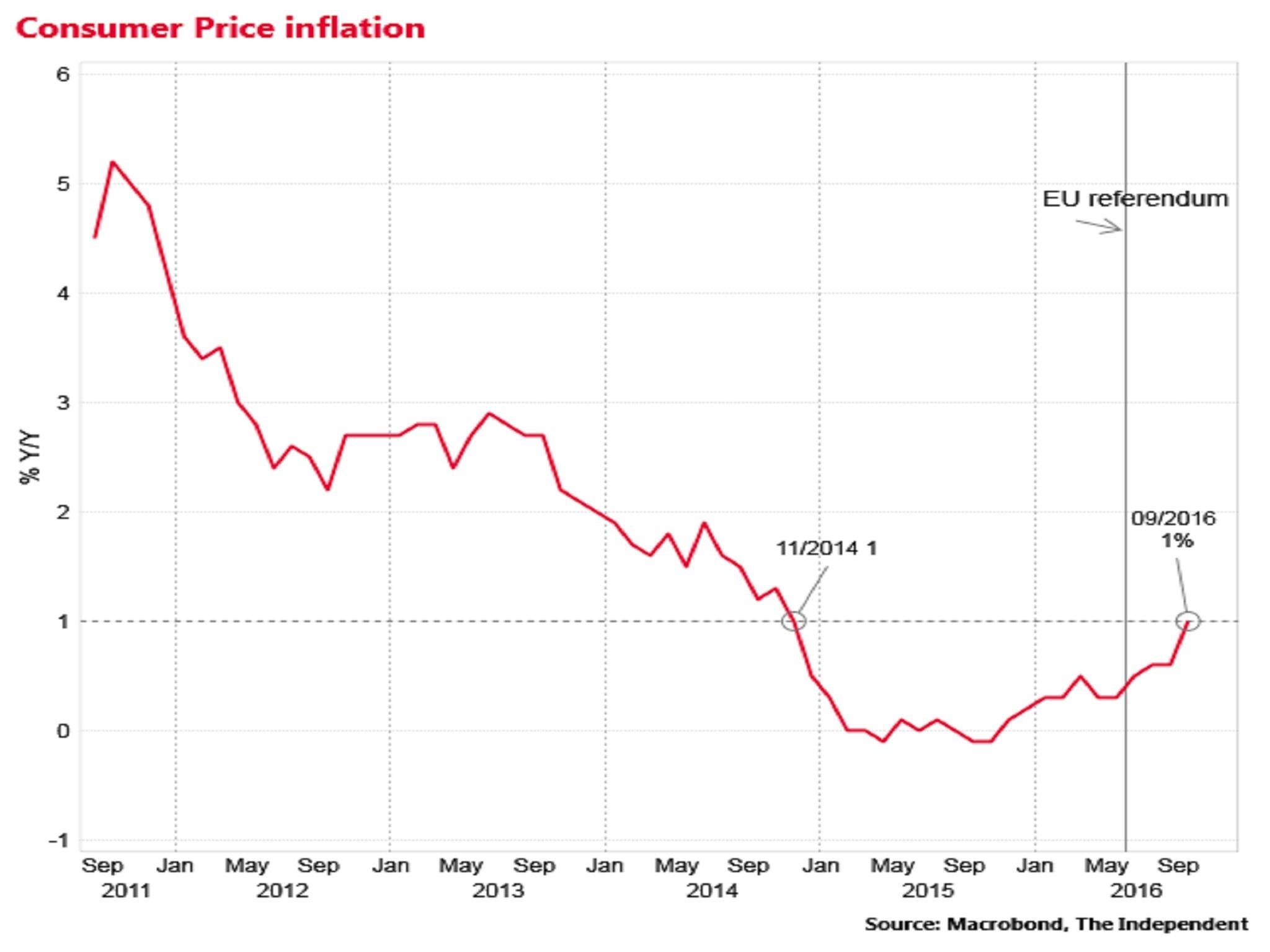

UK inflation rises to 1% in September

The UK consumer price index jumped to 1 per cent - the highest inflation rate since November 2014

Consumer price inflation rose in September, hitting a two-year high, according to official data.

The Office for National Statistic said the annual rate of CPI inflation was 1 per cent, up from 0.6 per cent in August and slightly higher than City of London analysts had been expecting.

This is the biggest monthly rise in the cost of household goods and services since November 2014.

The data could suggest the sharp fall in the value of the pound following the June referendum is already pushing up the imports costs of domestic manufacturers, which is likely to feed through into UK consumers prices in the coming months.

However, the ONS said there was "no explicit evidence" that the the weaker pound was increasing prices of every day goods.

UK inflation was driven up mainly by rising prices for clothing, overnight hotel stays and motor fuels, according to ONS data.

Clothes prices jumped by 6 per cent in September, compared to August. Fuel prices rose to a faster pace compared with the same month a year ago.

The Retail Prices Index (RPI) measure of inflation, which includes housing costs, has also risen to 2 per cent in September from 1.8 per cent in August.

Mike Prestwood, head of inflation at the ONS, said: “CPI inflation has risen to its highest for nearly two years, though it remains low by historic standards."

“The prices paid by manufacturers for raw materials were unchanged over the month and there is no explicit evidence the lower pound is pushing up the prices of everyday consumer goods.”

Richard Lim, chief executive of retail Economics, said the data gives the first real sense of a Brexit impact for many households.

He said: "The cost of living is rising at the fastest pace in two years as the impact of falling energy prices fade and weaker sterling begins to feed through the supply chain."

Lim said he expects inflation to hit 3 per cent in 2017, above the Bank of England's official 2 per cent target.

Tom Stevenson, investment director for personal investing at Fidelity International, said future rises in CPI will spell troubles for savers.

"While the Bank of England Governor Mark Carney may have said that he is willing to tolerate inflation overshooting for the next year or so, savers are less likely to be so accommodating. Anyone with their savings still sitting in cash will struggle to generate real returns in this ultra-low interest rate and rising inflation environment."

On Friday, the Bank of England’s Governor Mark Carney, said life will “get difficult” for the most vulnerable people in Britain as inflation rises in the coming months due to the sharp depreciation of sterling in the wake of the UK’s vote to leave the EU.

Carney said that inflation was likely to overshoot the Bank’s official 2 per cent target over the coming years, but that the Bank would tolerate this in order to protect jobs.

Ben Broadbent, the Bank of England Deputy Governor, on Monday, said the pound's sharp decline in the four months since Britain's referendum on the European Union has acted like a “shock absorber” for the British economy. He added that having a flexible currency was “extremely important” to cope with economic shocks.

Sterling has plunged by nearly 20 per cent since the UK voted in favour of leaving the EU in June and has lost over 6 per cent in the last two weeks after Prime Minister Theresa May provoked markets fears of a “hard Brexit”.

The pound also hit a new six-year low against the euro on Monday

The EY Item Club has warned that the UK economy has shown greater resilience than many had anticipated since the EU referendum, but that this picture is “deceptive”.

The think tank predicted that rising costs will continue to hit consumer spending next year and in 2018

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments