How much money fear of Brexit has wiped off the pound in one chart

Some analysts have said that the pound could fall to parity with the euro, where £1 equals €1, the day after the referendum

The pound could fall 20 per cent if the UK votes to leave the EU on June 23.

That’s the view of HSBC, which said in February that the pound would tank and that the housing market and the banking sector would follow if Brexit goes ahead.

While a tumble of that size has yet to materialise, analysts have been quick to attribute slides in May and June to the threat of Brexit.

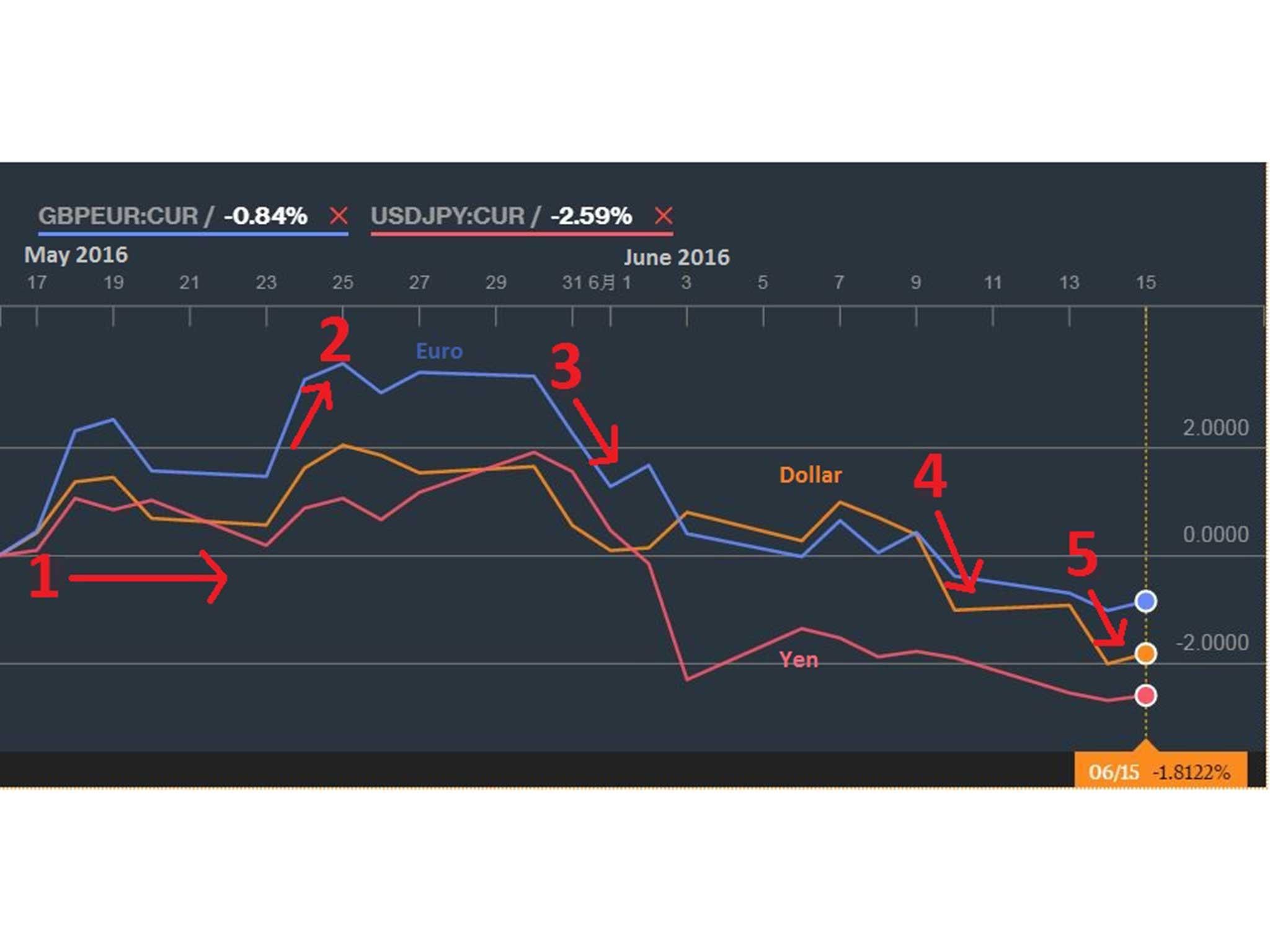

The pound is down against the dollar (orange), euro (blue) and yen (red) since Brexit polls swung to Leave at the end of May

1. May 17-20: Remain comfortably ahead

Multiple polls put Remain ahead in mid-May. An Ipsos Mori poll put Remain ahead by 18 percentage points, YouGov showed 44 per cent of respondents wanted the UK to stay in the EU. The OBR reported May numbers showing the UK was 55 per cent Remain and just 40 per cent Leave.

If you had exchanged £100 at the beginning of the year, you would have got $147 dollars or €135, but by May 17 that had dropped to $144 or €127.

That's a loss of €80 or £63 if you had changed £1000.

The pound even hit a three month high against 10 rival currencies during this time but slipped slightly on May 20 after a Bank of England policy maker, Gertjan Vlieghe, gave a warning about the UK economy’s health.

2. May 25: Pound climbs to three and half month high against the euro

A Survation poll showing the Remain was ahead was credited when the pound hit a three and half month high against the euro. Neil Jones, head of FX currency at Mizuho, said at the time: “The FX market is ill-prepared for an in vote.”

3. May 31: Leave campaign edges ahead

The Leave campaign edged ahead in two opinion polls for the Guardian. In both polls, one conducted by phone and the other online, the leave campaign was just ahead in the 52 per cent – 48 per cent split.

Within minutes, the pound had fallen 1 cent against the dollar to trade at $1.4550, its lowest level since May 3.

4. June 10: Pound makes biggest one-day loss since February

An OBR survey commissioned by the Independent showed that 55 per cent of votes were planning to vote Leave. This sent the pound tumbling to $1.426 against the dollar. The 1.4 per cent loss was the worst performance since February 22.

5. June 14: The Sun comes out as pro-Leave, pound falls again

A last minute pledge of support from The Sun newspaper for the Leave camp send the pound sliding to a two-month low against the dollar.

By June 14, £100 was worth $141 or €126. If you had exchanged £1000 into euros then, you would have got £71 (€90) less than if you had done so at the beginning of the year.

What comes next?

Predictions for what could come next have been all over the place, but most agree that the day after the referendum will be one of extremes. Some analysts have said that the pound could fall to parity with the euro, where £1 equals €1.

“If Britain votes to stay in the EU, I would expect the pound to spike to its highest level this year. If Britain were to vote out, all signs suggest a massive and immediate drop in the pound – in all likelihood sinking to its lowest point of the 21st century,” Paresh Davdra, analyst at RationalFX, said.

But not everyone thinks that would last. Some analysts believe that after the initial sell-off that would follow a vote for the UK to Leave the EU, the pound would bounce back.

“I think we could see the pound down at 1.20 against the euro, but within a matter of course, days at most, I think we could be back up nudging 1.40,” Nick Parsons, head of European research at National Australia Bank, told PoundSterlingLive.

Brexit isn’t the only risk that is weighing on the pound, according to some analysts.

Many investors are looking not only at Brexit but at a cocktail of other global economic events, including central bank updates from the US Federal Reserve and the Bank of England.

David Buik, a market commentator at Panmure Gordon, said that the threat of higher interest rates in the US has wiped 9 per cent of the pound since November.

“It should not be forgotten that the UK’s economy has been coming off the boil for some months with growth falling from 2.4 per cent in 2016 to 2 per cent and may even drop to 1.8 per cent by the end of the year. So the contribution so far from the threat of Brexit I would venture to suggest is modest,” he said.

The EU referendum debate has so far been characterised by bias, distortion and exaggeration. So until 23 June we we’re running a series of question and answer features that explain the most important issues in a detailed, dispassionate way to help inform your decision.

What is Brexit and why are we having an EU referendum?

Will we gain or lose rights by leaving the European Union?

What will happen to immigration if there's Brexit?

Will Brexit make the UK more or less safe?

Will the UK benefit from being released from EU laws?

Will leaving the EU save taxpayers money and mean more money for the NHS?

What will Brexit do to UK trade?

How Brexit will affect British tourism

What will Brexit mean for British tourists booking holidays in the EU?

Will Brexit help or damage the environment?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments