Ukraine: Stock market and oil price reaction after Russia invades

Oil prices reached highest level in eight years following explosions in Ukraine, as investors fled to traditional safe havens

Russia’s attack on Ukraine roiled global markets on Thursday, driving up prices for crude oil and natural gas as investors flood into gold and government debt – traditional safe havens.

Brent crude, the global oil-price benchmark hit $105, topping $100 a barrel for the first time since 2014, before falling back slightly.

Analysts warned on Wednesday that a full-scale attack on Ukraine from Russia could rapidly drive prices well above £1.50 a litre at the pump for British consumers.

Russian stocks listed on Moscow’s Moex index fell by more than 35 per cent, the most on record, while the ruble plummeted to a record low against the dollar.

The wild moves come after Ukrainian authorities said that Russia had launched a “full scale invasion” on the country. Russian president Vladimir Putin said that his country had launched a “special military operation” in Ukraine.

Investors rushed towards safer assets, including gold, driving the precious metal up around 1.7 per cent, its highest level since early 2021, meanwhile silver rose 2.3 per cent based on popularly traded futures contracts.

Sterling fell 1.1 per cent against the dollar and the leading FTSE 100 index plunged more than 200 points, or 2.7 per cent, within moments of opening in reaction to Russia’s invasion of Ukraine. By mid afternoon the index was down 3.3 per cent.

On Wall Street, the Dow Jones Industrial Average plunged more than 800 points or approximately 2.5 per cent.

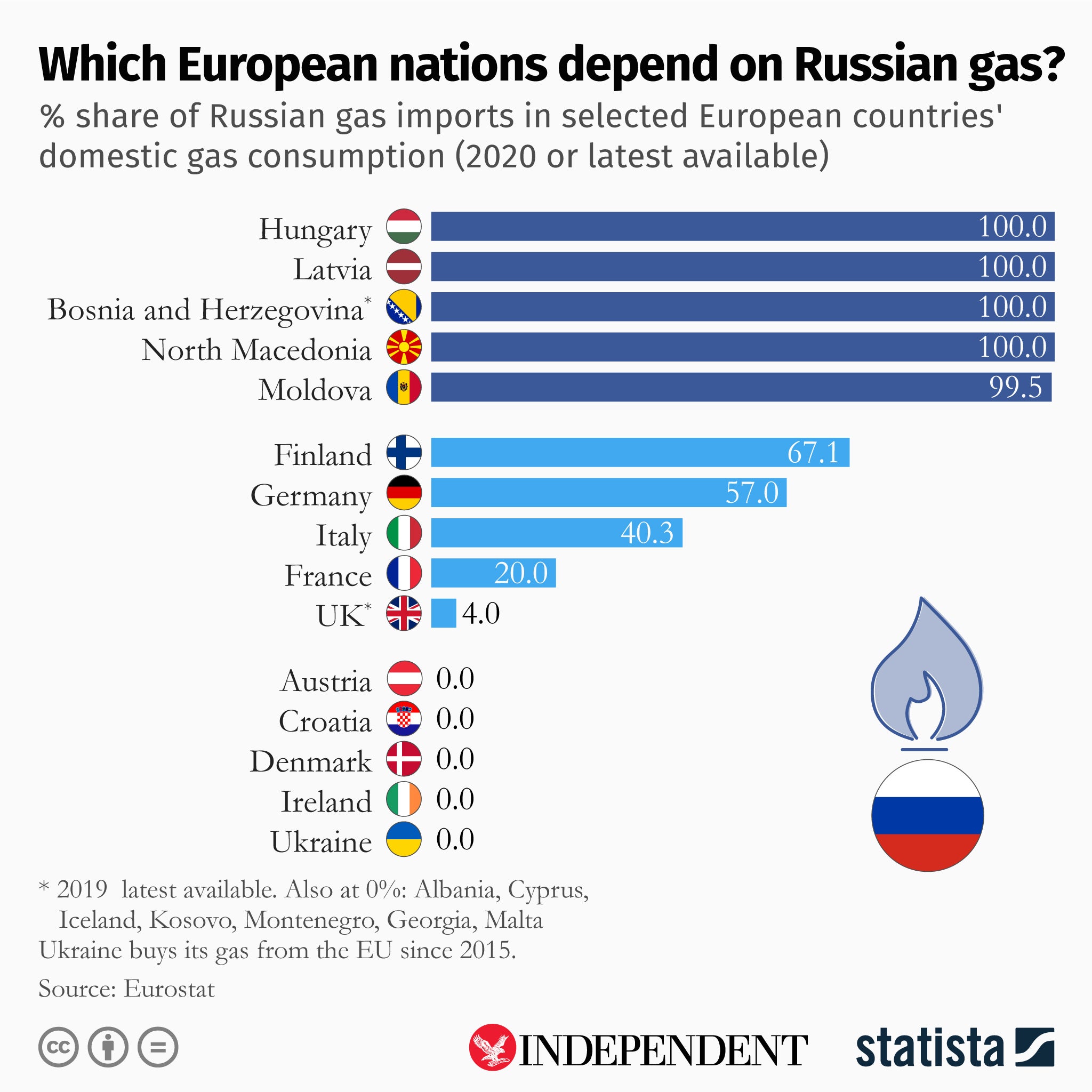

Natural gas prices rocketed around the world as news of the Russian attacks emerged. In some European markets, prices jumped as much as 30 per cent. The region, including the EU’s largest economy, Germany, is highly dependent on Russian energy imports.

Germany’s main share index, the Dax, saw heavy falls on Thursday and was trading 5.3 per cent down by mid-afternoon. In France, the CAC 40 tumbled 4.3 per cent. Stock markets across Asia dropped significantly, with Hong Kong’s Hang Seng Index down 3 per cent.

Market turmoil is expected to further squeeze living standards with UK gas prices shooting up by a third. Rising oil prices are likely to mean the cost of petrol will increase sharply with analysts predicting fuel could surpass £1.60 per litre. Global wheat prices are also soaring because Ukraine is a major supplier.

Europe is likely to take a much bigger economic hit than the US, according to analysts at Pantheon Macroeconomics.

They said in a note: “Consumer sentiment everywhere will weaken further. That has to mean slower economic growth than would otherwise have been expected in Europe, the US, and most emerging markets, at the margin. For eastern Europe, the hit will be bigger, but oil and some metal-producers will do much better.”

Pantheon warned that Russia might cut off gas supplies to Europe, pushing up prices and inflation.

Thomas Pugh, economist at accountancy firm RSM, predicted inflation in the UK would spike higher than 7.5 per cent in April and remain higher for longer.

"The direct effects on inflation will also likely extend to food prices,” he said.

“Between them, Russia and Ukraine export a quarter of the world’s wheat, and Ukraine is a major corn exporter.

“This would put further upward pressure on food prices, which were already rising by 4 per cent year-on-year in December. All of this will exacerbate the cost of living crisis and depress GDP growth.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments