Sainsbury's merger with Asda 'must be investigated' by competition watchdog

‘It will be British shoppers that suffer from rising prices and British workers that may be fearing for their jobs’

The competition watchdog is being urged to step in and investigate proposals to merge Sainsbury’s and Asda amid concerns over consumer choice and job losses.

“Advanced discussions” are currently under way into the possible merger of the two supermarket giants in a £10bn deal which could be announced as soon as Monday morning.

Sainsbury’s and Asda are the second and third largest grocery retailers in the UK after Tesco, but this would change if the merger goes ahead.

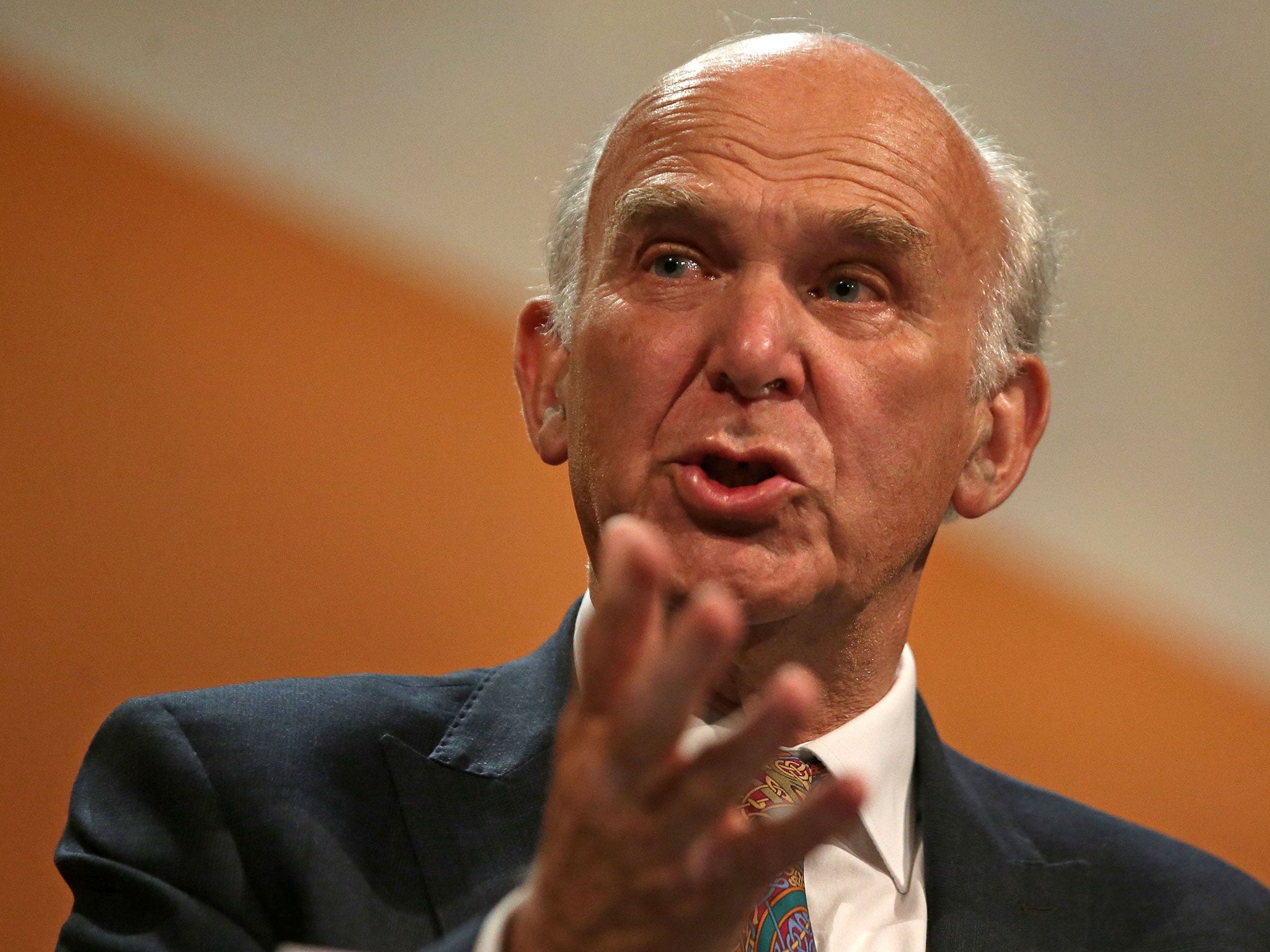

Liberal Democrat leader Sir Vince Cable, the former business secretary, said the Competition and Markets Authority (CMA) “must investigate” any deal after it emerged the companies were in advanced talks.

He warned the CMA should “force” the companies to sell off stores if the proposed merger meant they were dominant in one particular area – and called on the watchdog’s new chief Andrew Tyrie to “get tough with monopolies”.

Shadow business secretary Rebecca Long-Bailey echoed Sir Vince’s calls, warning the merger risked “squeezing what little competition there is in the groceries market even further”.

“It will be British shoppers that suffer from rising prices and British workers that may be fearing for their jobs if this goes ahead without adequate oversight and investigation,” she said.

The latest statistics show that Tesco has a 25 per cent grocery market share, while Sainsbury’s has 13.8 per cent and Asda 12.9 per cent.

Together, they would move ahead of Tesco with 26.7 per cent of the grocery market.

It is understood that any investigation by the CMA would only be announced once an intention to merge was formally unveiled.

The merger would then have to be approved by the CMA since the two entities are the second and third largest grocery retailers in the UK.

But some expect that a deal could be approved given the CMA’s decision to allow Tesco to take over Booker, the UK’s largest grocery wholesaler in a deal worth £3.7bn.

News of the potential deal has also sparked concern among workers’ unions, which have demanded urgent meetings with Sainsbury’s and Asda chiefs.

GMB general secretary Tim Roache said: “Our first priority is to safeguard the job of every single Asda member, both in stores and in distribution.

“GMB will be making sure the voices of supermarket workers are not lost amidst all the talk of mergers and acquisitions.

“We should never forget these companies’ empires are built upon the hard work of their employees.

“Rest assured we will be exploring every available legal avenue to protect our members’ jobs.”

Joanne McGuinness, Usdaw national officer, added: “Our priorities will be to protect our members and ensure any deal between the retailers does not impact on their jobs or incomes.”

Asda is owned by the world’s largest supermarket retailer, Walmart, and it is not yet clear how the deal would be structured.

One option is for Sainsbury’s to absorb Asda stores, while US company Walmart takes a large stake in the combined group.

In a statement, Sainsbury’s said: “J Sainsbury plc notes the speculation concerning a possible combination with Asda Group Limited.

“Sainsbury’s confirms that it and Walmart Inc are in advanced discussions regarding a combination of the Sainsbury’s and Asda businesses.

“A further announcement will be made at 7am on Monday, 30 April.”

It would not be the first time Sainsbury’s has acquired another high street giant.

In April 2016 the supermarket chain announced a £1.4bn takeover of Argos, which led to better than expected results the following Christmas.

The traditional high street has come under increasing pressure in recent years, with the growth in online retailers.

Sainsbury’s and Asda have also been squeezed by the rise of lower-cost supermarkets Aldi and Lidl, which have a 10.5 per cent grocery market share in the UK between them.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments