Spring Statement: UK growth outlook revised up in 2018, but down in 2021 and 2022

The overall economic and fiscal picture was 'broadly the same' according to the OBR, disappointing hopes the outlook would be transformed by relatively buoyant tax revenues and productivity in recent months

The UK economy will grow faster this year than previously forecast and the deficit will be some £5bn lower, the Chancellor, Philip Hammond, said on Tuesday as he delivered his first Spring Statement.

But the overall economic and fiscal picture is “broadly the same” according to the Office for Budget Responsibility, disappointing hopes that the outlook would be transformed by relatively buoyant tax revenues and productivity in recent months.

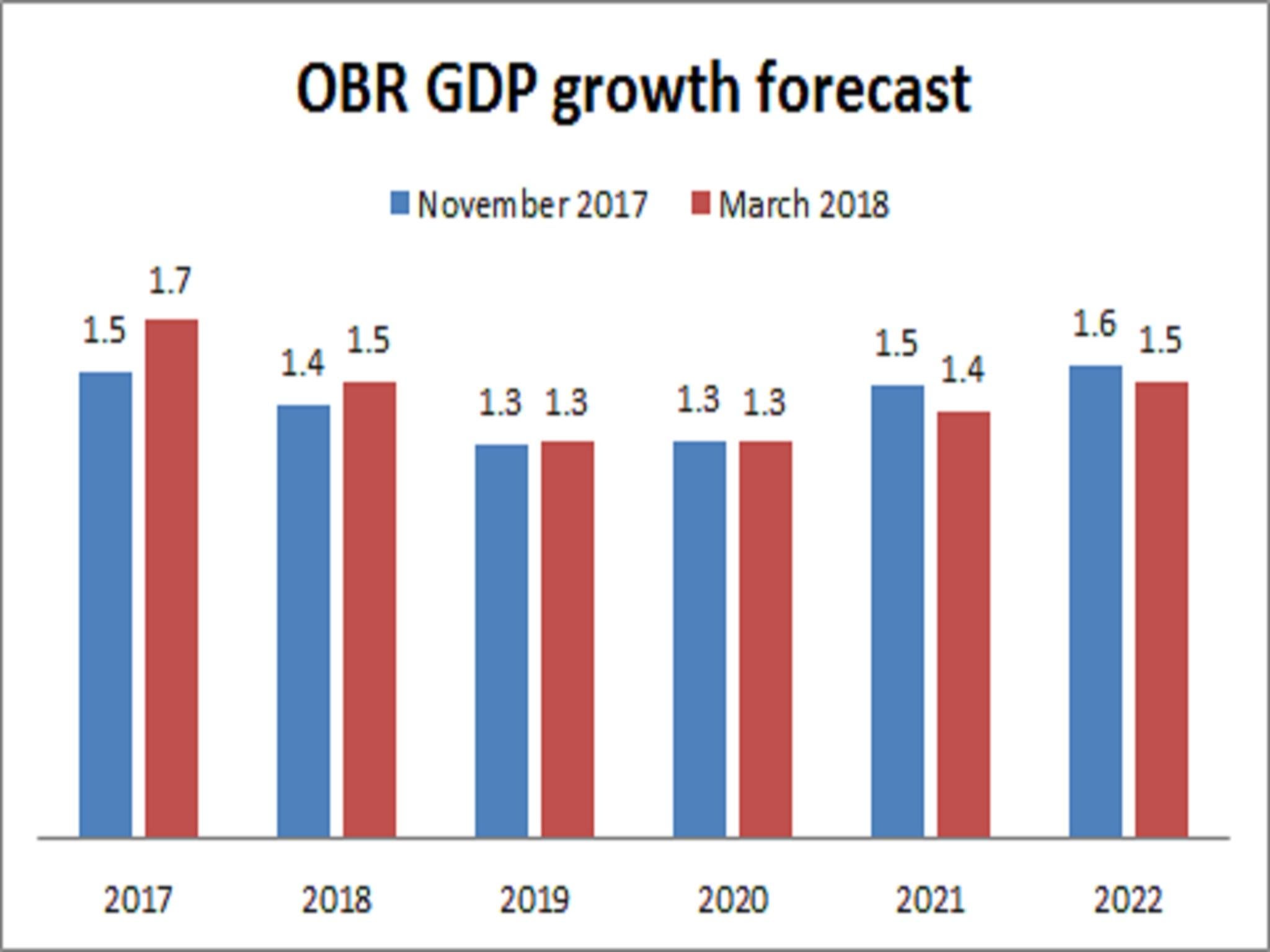

In the Spring Statement, the Chancellor revealed the OBR is forecasting that GDP growth will be 1.5 per cent this year, up from the 1.4 per cent previously expected.

Forecast growth for 2019 and 2020 is unchanged at 1.3 per cent, but growth in 2021 and 2022 is actually revised down slightly by 0.1 per cent to 1.4 per cent and 1.5 per cent respectively.

The OBR pointed out that the average GDP growth of 1.4 per cent over its forecast horizon is unchanged from the average projected in the Autumn Budget.

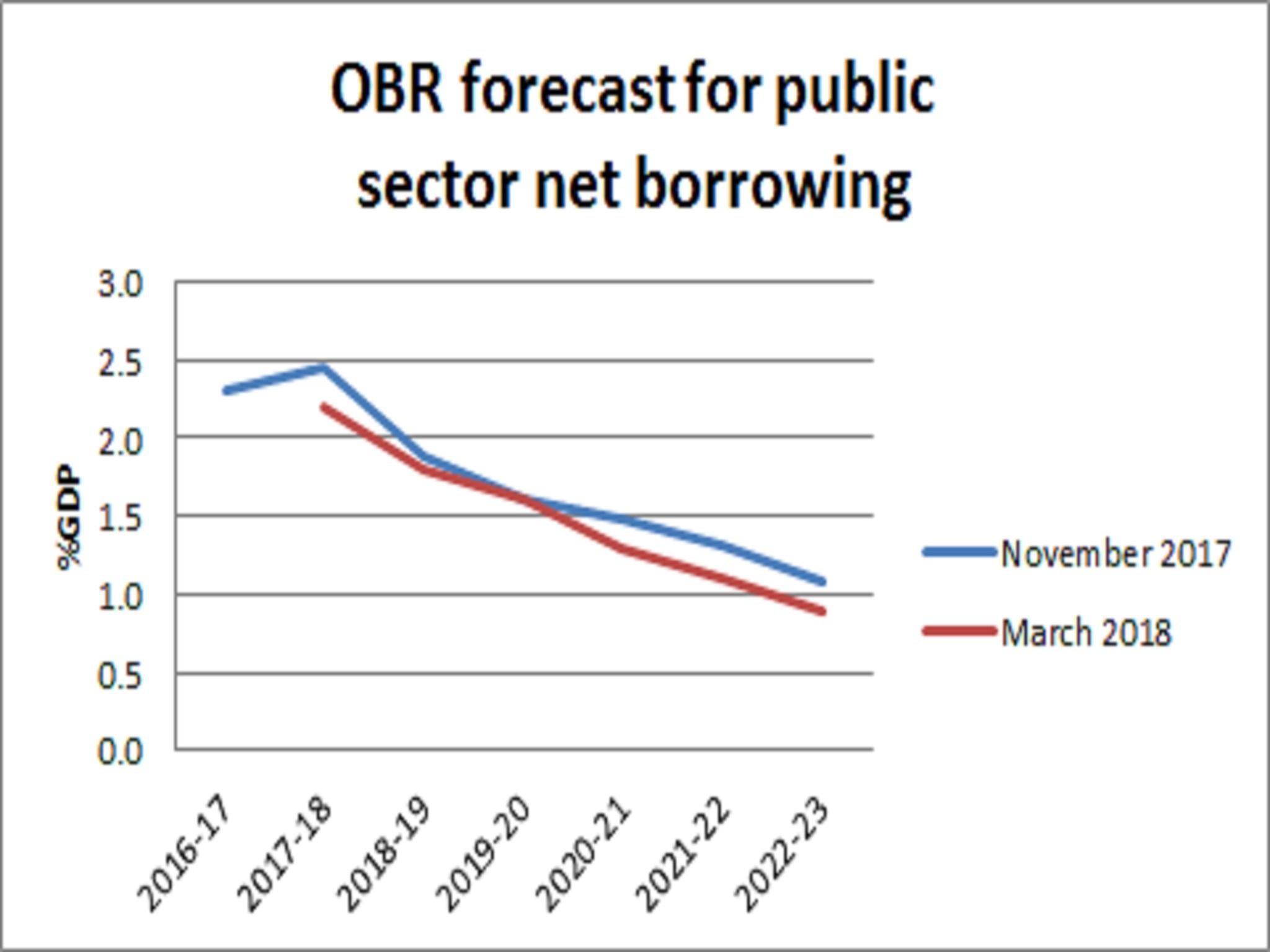

Mr Hammond also revealed that public sector net borrowing in 2017-18 would be £45.2bn, down from the £49.9bn forecast in November.

As a share of GDP that would be be 2.2 per cent, lower than the 2.4 per cent previously expected.

The OBR expects borrowing of 1.8 per cent of GDP in 2018-19, down from the 1.9 per cent forecast previously.

Borrowing in 2020-21 is seen as coming in at 1.3 per cent, rather than 1.5 per cent.

In 2018-19 the Chancellor said the OBR was expecting a “small” current budget surplus. The former Chancellor, George Osborne, back in 2010, had pledged to achieve balance on the cyclically-adjusted current budget by 2014-15.

Mr Hammond’s own central fiscal mandate is to achieve a structural budget deficit of less than 2 per cent of GDP by 2021.

He said that the OBR is projecting headroom for him against this target of £15.4bn in 2021 – around 0.7 per cent of GDP – essentially unchanged from November.

The OBR itself was downbeat about the revisions on Tuesday, saying “there seems little reason to change our view of [the UK’s] medium-term growth potential”.

It said that it did not expect the strong productivity pick-up registered in the second half of 2017 by the Office for National Statistics to last, noting that it was driven by weakness in hours worked rather than a surge in output by workers.

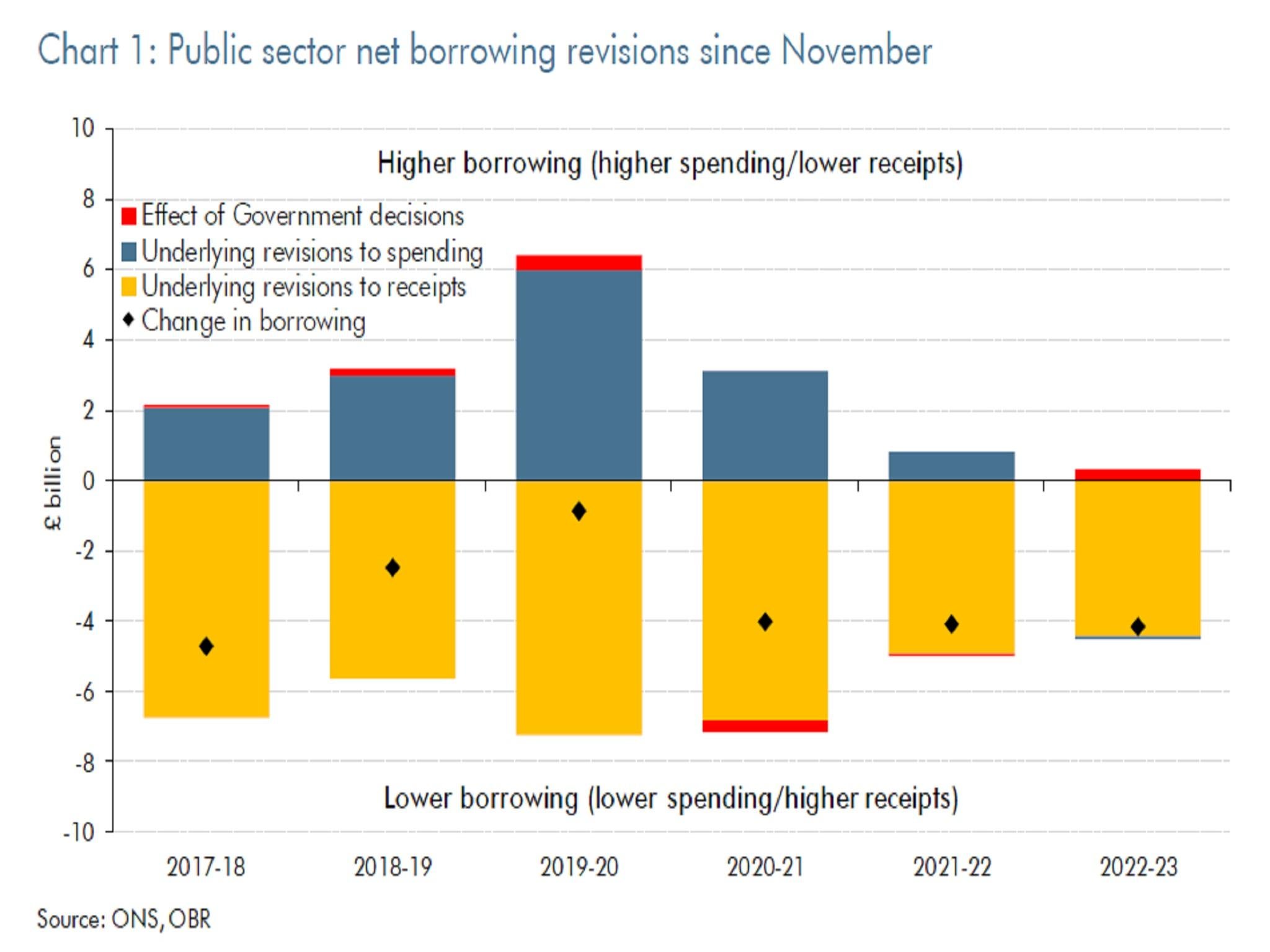

Some analysts had been expecting a bigger boost to the public finances outlook than the OBR delivered.

The OBR said that this had not materialised because it had assumed that much of the the recent pick-up in tax revenues was cyclical, rather than structural, meaning it would not be permanent.

Relative to its November forecast, the fiscal watchdog sees underlying upward revisions to tax receipts over the next five years largely cancelled out by higher underlying upward revisions to government spending, including higher local authority spending.

On Brexit, the OBR said that the Leave vote had slowed the UK economy relative to what would otherwise have happened, but by less than it had expected immediately after the referendum.

However, it cautioned “not to put too much weight on early estimates of economic activity either side of the referendum”, reflecting its long-running scepticism about the reliability of early ONS GDP estimates.

There were no major tax or spending plans in the Spring Statement, as the Chancellor had promised.

But he confirmed that the next full spending review – setting medium-term budgets for Whitehall departments beyond 2020-21 – would take place next year.

Mr Hammond also announced the Government has reached agreement with local authorities to distribute funds from its £4.1bn Housing Infrastructure Fund.

London, he said, would receive an additional £1.7bn to deliver 26,000 affordable homes, including homes for social rent.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments