Three charts that show George Osborne's failure on public borrowing

Official borrowing data today confirms how comperhensively the Chancellor has missed his 2010 goals on debt and the deficit

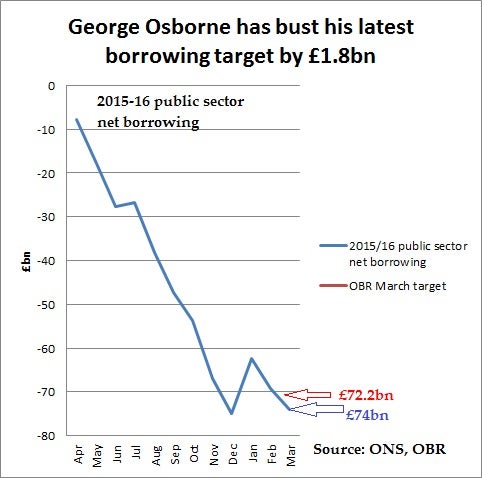

Today's public finances report from the Office for National Statistics shows that George Osborne has overshot his public borrowing target for 2015-16 by £1.8bn, despite those targets only being set by the Office for Budget Responsibility in last month's Budget:

That's embarassing for the Chancellor, especially in the context of his central goal of running an absolute budget surplus in 2019-20. That ambitious target, which many economists think is misguided, already looked precarious.

But the latest ONS figures also enable us to look at the bigger picture and evaluate George Osborne's performance against the targets he chose for himself when he became Chancellor back in 2010.

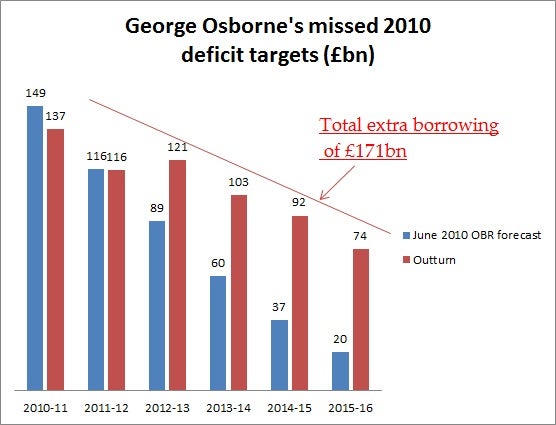

If one compares Osborne's original borrowing targets we find that public borrowing has been higher in every year since 2012-13. The cumulative borrowing is £171bn more than projected six years ago:

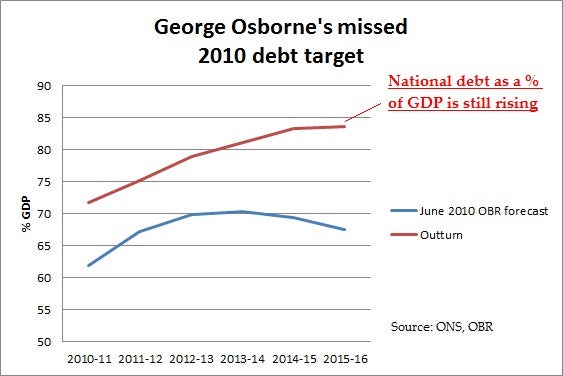

And this extra annual borrowing means, of course, that the Chancellor's original national debt target has been comprehensively missed too:

In those original plans public debt as a share of GDP was supposed to peak at 70 per cent in 2013-14 and decline to 67 per cent by the end of 2015-16. Instead, it has now hit 84 per cent of GDP.

The levels here are misleading because of various redefinitions of what constitutes public debt since 2010. But the point is that the trajectory has been very different to what the Chancellor was aiming for.

This is embarassing for the Chancellor not because it was the wrong thing to allow borrowing to rise when the economy stagnated in 2011 and 2012. Cutting more to keep on target would have done even more damage to the economy. It is embarassing because George Osborne's rhetoric for the past six years has been so relentlessly fixated on the overriding need to bring down the deficit and the debt as quickly as possible.

Would an alternative economic approach, less austerity, as proposed by opposition parties, have resulted in smaller deficits and lower debt? No, and it's important that opponents of the Chancellor's approach do not over-reach and make this claim.

Less austerity would, in all likelihood, have meant even more borrowing. But this additional borrowing would have supported total demand in the economy and GDP in a helpful way, especially if the spending had been on public infrastructure projects that boost our long-run national productivity. National income in the short-run would certainly have been higher, as the Office for Budget Responsibility itself points out.

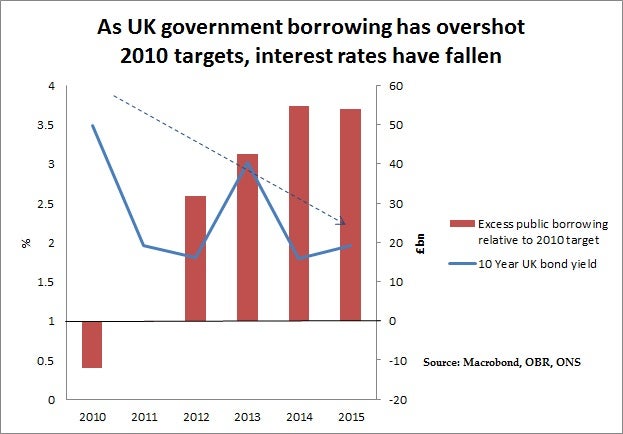

And at a time when interest rates for the UK government are still close to historic lows there was no serious danger - despite what some still argue - of a general run on British debt by international investors if a different fiscal plan had been followed.

Indeed, when the Chancellor borrowed more than his original plans allowed, UK interests rates (as set in global markets) went down demonstrating that buyers of UK government bonds were not preoccupied, contrary to Mr Osborne's rhetoric, with the size of the UK debt and deficit:

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments