US GDP growth slows in first official report since Donald Trump tax cuts passed

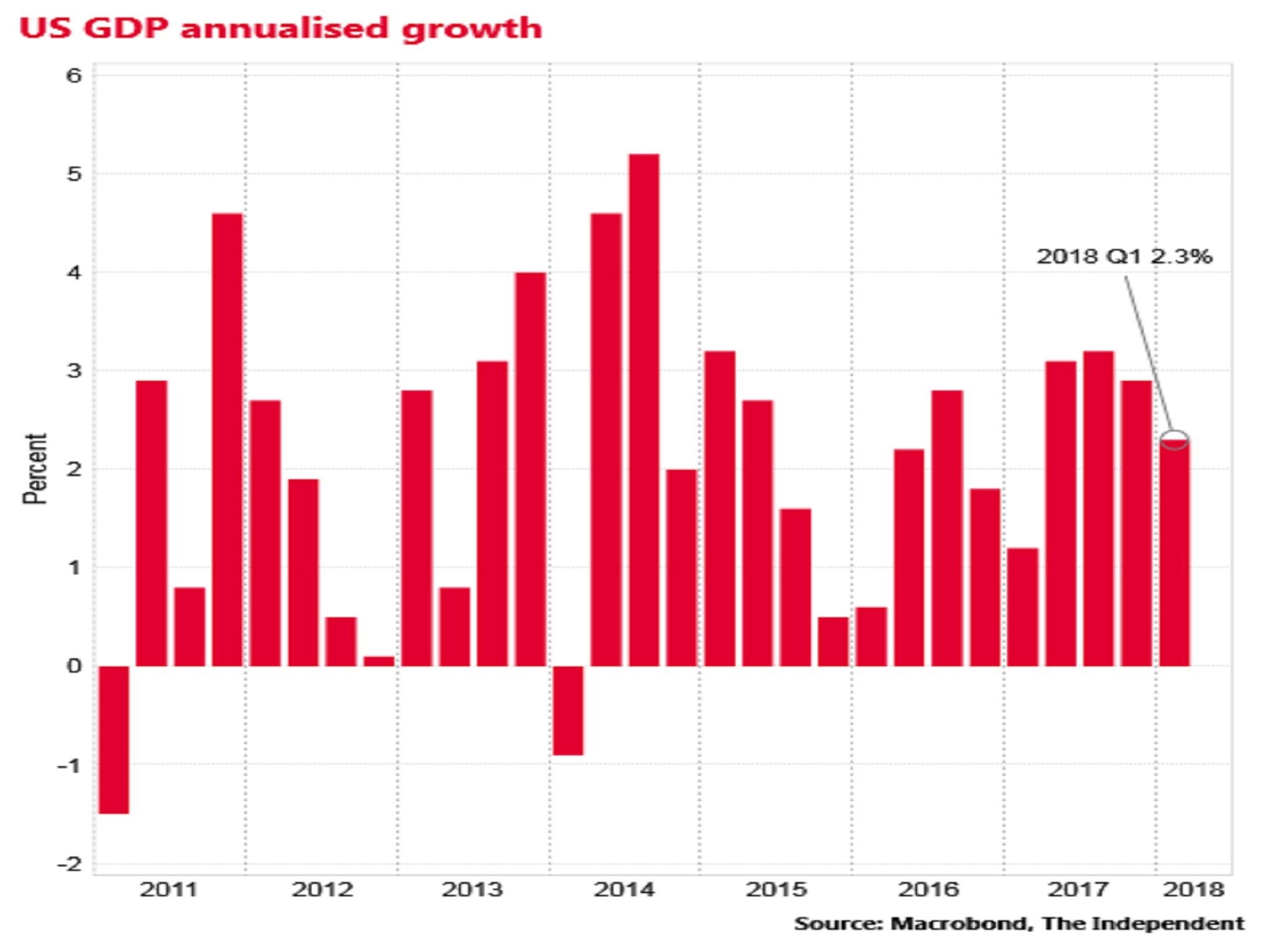

The annualised rate of GDP growth was 2.3 per cent in the three months to March, down from 2.9 per cent in the final quarter of 2017

The US economy slowed down in the first three months of 2018, the first quarter since Donald Trump’s tax cuts were passed.

The Bureau of Economic Analysis (BEA) reported that the annualised rate of GDP growth was 2.3 per cent in the three months to March, down from 2.9 per cent in the final quarter of 2017.

However, it was better than the 2 per cent growth pencilled in by Wall Street analysts.

The BEA said that the slowdown was due to weaker exports, government spending and residential investment.

“The slowdown in GDP growth...was something of a disappointment since the tax cuts should have provided an immediate boost,” said Paul Ashworth of Capital Economics.

In December 2017 the US Congress passed a tax bill, promoted by the President, that slashed income and corporate tax rates, though without implementing any substantive measures to increase revenues, resulting in projections of a sharp increase in US government borrowing over the coming years.

On a non-annualised basis the US’s quarterly GDP growth was 0.6 per cent. Official data in the UK earlier on Friday showed a collapse in the domestic growth rate to just 0.1 per cent.

The US currency and bond markets were calm in the wake of the US data, suggesting that traders do not expect the figures to have much impact on the views of the Federal Reserve about the appropriate rate of interest rate rises.

The Fed raised rates to 1.75 per cent last month and its next meeting is due on 2 May.

“Will this tempt the US Federal Reserve into another interest rate hike next week? That seems unlikely but fears of a fourth rate hike this year have been creeping back into the markets and it can’t be ruled out if the economy goes on a charge,” said Jacob Deppe of the online trading platform Infinox.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments