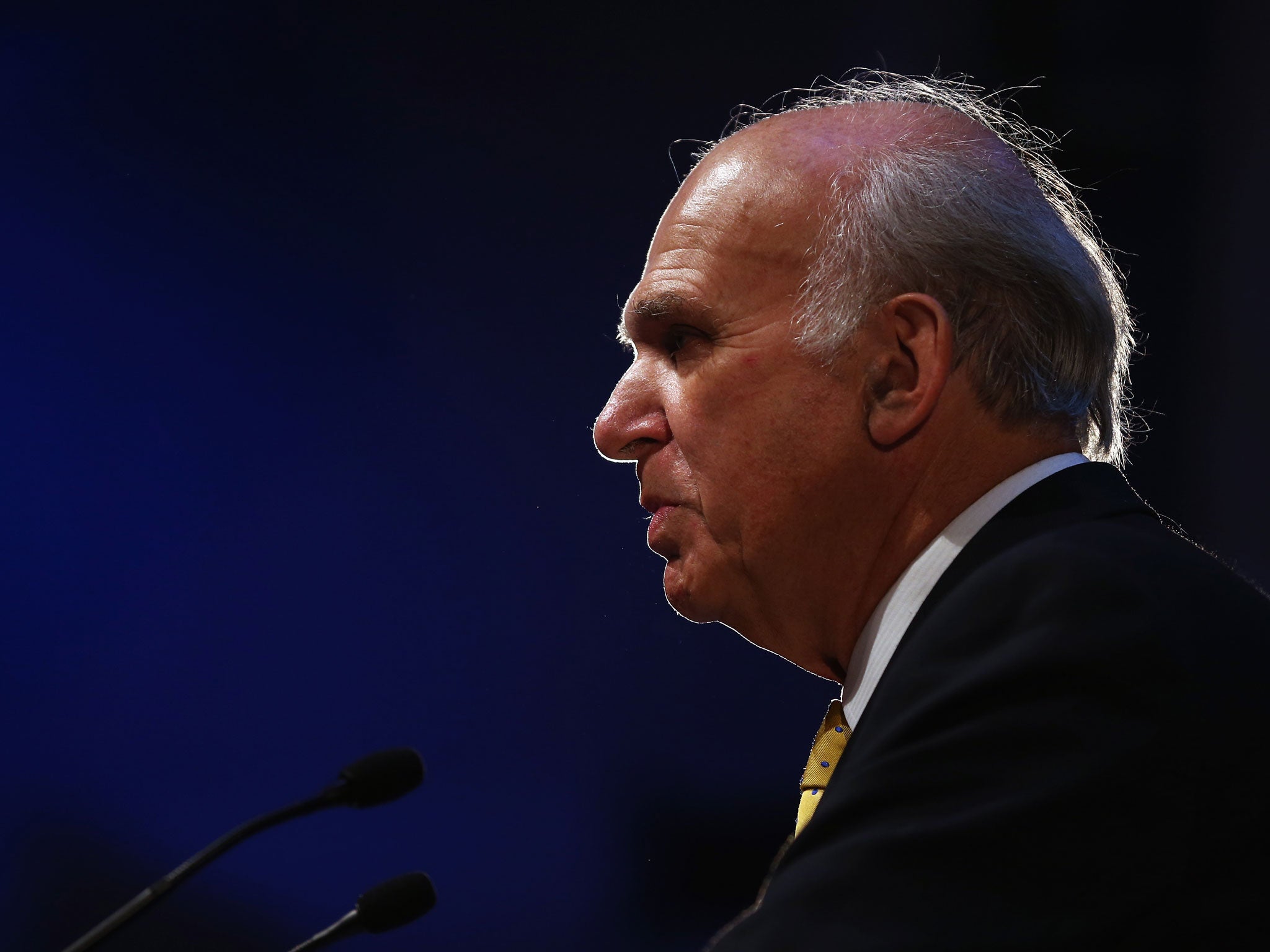

Vince Cable warns against housing bubble-linked recovery

Vince Cable has warned a housing boom could mean the economic recovery is merely a “short term bounce” in a warning shot aimed at the Liberal Democrats' Coalition partners.

In a keynote speech at the Bank of England, the Business Secretary said Britain's continued growth requires a rebalancing of the economy to prevent a return to "boom and bust".

The Lib Dem's warning was the latest in a series of many he has made on the state of the property market and the dangers of creating a housing bubble in the south east.

In a scathing attack on his party's Tory coalition partners, Mr Cable said plans for deeper spending cuts after the election would be "slashing for its own sake".

He also said a potential EU referendum promised by the Conservatives could undermine confidence in the business community.

Mr Cable said the Tories had already been proved wrong over calls to make it easier for firms to 'hire and fire' workers.

In the address to the Royal Economic Society, Mr Cable argued that a "real recovery is taking place".

"The big question now is whether and how recent growth and optimism can be translated into long term sustainable, balanced, recovery without repeating the mistakes of the past," he said.

"We cannot risk another property-linked boom-bust cycle which has done so much damage before, notably in the financial crash in 2008...

"If the recovery is to be sustained it will need to be balanced, geographically and sectorally, to correct the bias against traded activities and against investment - and to ensure we do not return to boom-bust cycles around property markets.

"Indeed, unless our government put long term rebalancing at the heart of economic decision-making I believe the recovery could prove to be short-lived."

Mr Cable stressed he was "confident" that the government was taking action to ensure the UK has a "sustainable, balanced, long term recovery" rather than a "short term bounce".

He highlighted the joint decision by ministers and the Bank of England to stop backing mortgage lending through the Funding for Lending scheme. The Help to Buy initiative for house purchases championed by David Cameron and Chancellor George Osborne was also receiving "attention", he added.

In a series of broadsides at the Tories, Mr Cable accused them of having a "small state agenda".

"Undoubtedly some on the Conservative side of the Coalition see fiscal consolidation as a cover for an ideologically driven, 'small state' agenda," he said. "It is one thing to respond to a record deficit after a long period of rising public spending, as we have since 2010.

"It is quite another to continue cutting hard from a position where the debt burden is falling and when spending has been under pressure for half a decade.

"Some of the proposals to extend deep spending cuts on departments and welfare far into the next parliament have more than a whiff of ideology: slashing for its own sake."

Mr Cable said Britain's debt burden could be reduced after 2015 while at the same time keeping public spending stable.

He added Mr Cameron's promise of an in-out EU referendum by 2017 had been "deeply unsettling for businesses trading in the European Single Market, from the car industry to financial services".

"The actual risks of leaving may be small but one of the most useful contributions to recovery our coalition partners could make, in the national interest, would be to do more to remove this unnecessary risk," he added.

Mr Cable also took a swipe at Labour, saying Ed Miliband's proposal for freezing energy prices was "a recipe for killing investment".

Additional reporting agencies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies