Another blow for workers in the 'squeezed middle'

Hundreds of thousands of people who come off benefits to take jobs could be worse off as they move up the income scale under the Government's sweeping welfare reforms.

Although ministers have promised that all jobless people will be no worse off in work under their new universal credit, the guarantee will apply only at the "point of transition" and not when their circumstances change.

The new threat to the "squeezed middle" could undermine the Government's attempt to "sell" the Welfare Reform Bill, published yesterday, which it described as the biggest shake-up of the welfare state for 60 years.

Research by the Resolution Foundation, an independent think-tank, found that people on tax credits will keep only 24p of each pound of additional earnings, down from 30p in most cases under the present system.

Full-time workers now receiving tax credits will tend to be better off under universal credit if they are supporting a partner and children, it said. But support will be withdrawn more quickly as their incomes rise than under the current system.

Gavin Kelly, the foundation's chief executive, said: "We support in principle the move to a simpler, universal credit. But the Government needs to show in practice how this improves the position for all low-to-middle income working households. It does not help work incentives if second earners – usually women – have their benefits and tax credits withdrawn more quickly."

Ed Miliband has already made the "squeezed middle" a key Labour campaign theme. An ITV News/ComRes survey last night found that only 23 per cent of people think the Coalition Government understands the concerns of those on low incomes, while 67 per cent believe they do not.

Thirty-one per cent think the Government understands the concerns of those on middle incomes, with 56 per cent saying it does not. However, 71 per cent think the Government understands the concerns of people on high incomes; only 14 per cent do not.

The survey revealed that four in 10 people are either in debt, have gone further into debt or expect to go into debt this year as a result of the economic situation.

Lord Freud, the Welfare Reform minister, said the universal credit would be "designed to make sure that work will always pay" but admitted that some people would be worse off.

"There'll be no immediate cash losers and in practice in the structures that we've got, even when it's fully in and there's no transitional protection, the amounts we're talking about are relatively small," he said.

The small print of the Bill revealed that, while 2.7 million households will qualify for more benefit, 1.7 million will receive less in the long term, of whom 75 per cent will lose less than £25 a week. Some 1.46 million households will see the amount they lose in benefits for every extra £1 they earn go down, but 2.11 million households will see the amount go up.

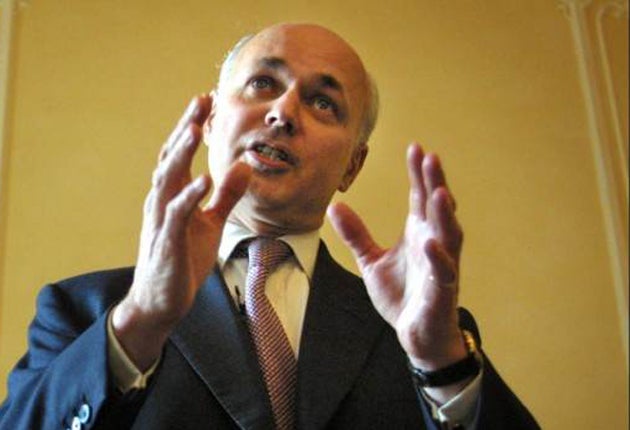

Iain Duncan Smith, the Work and Pensions Secretary, said:"Nobody will be worse off because every single person will be cash-protected. That means that whatever system you are on, we will stay at that level while the new system is set."

He will spend £2bn on phasing in the universal credit, replacing working age benefits and tax credits, between 2013 and 2017. But he expects to save £3.8bn a year by 2014-15 – including £1.4bn by spending less on employment and support allowance for the sick and disabled.

Winners and losers

Winners A couple with two children and one full-time worker earning £11,000. The current tax system would let them keep 10p in every extra pound. The new system would let them keep 24p in the pound.

Losers The same couple, earing £17,000. Current tax system would let them keep 30p in every extra pound. New system would let them keep 24p in the pound.

Source: Donald Hirsch of Loughborough University for the Resolution Foundation

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies