Budget 2015: IDS accused of unfairly targeting Catholics with 'two-child' tax credit policy

Families with more than two children will not receive tax credits or housing benefit for their third or subsequent child under plans unveiled in the Budget

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Iain Duncan Smith has been accused of unfairly targeting Catholics with his decision to cut tax credit and housing benefit to families with more than two children.

Helen Goodman, Labour's shadow work and pensions minister, said the controversial "two-child policy", which means families will not receive the benefits for their third or subsequent child from April 17, contradicts his Catholic faith's belief that "every child matters".

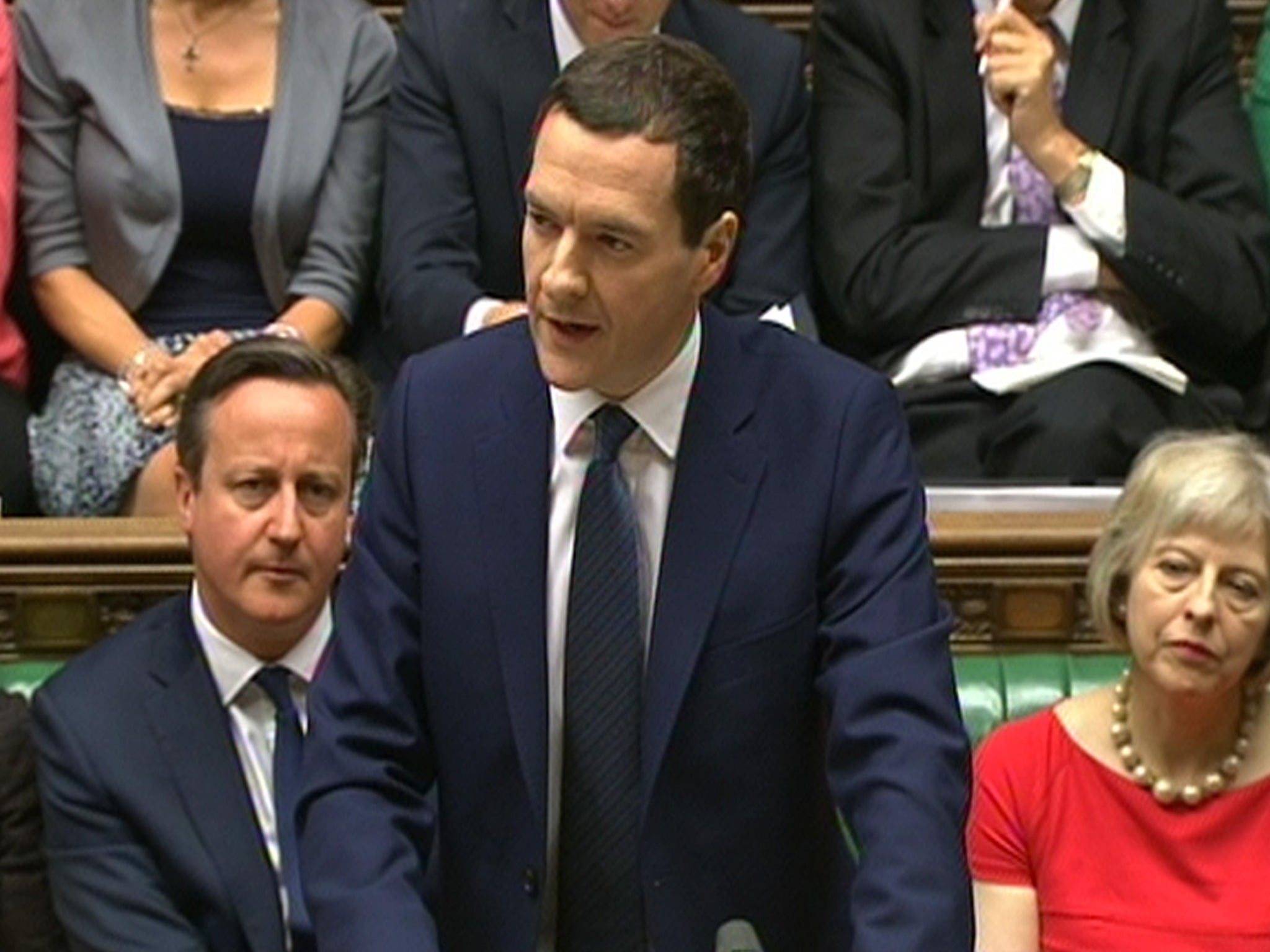

George Osborne announced the new limits to tax credits in Wednesday's Budget - the first all-Conservative one for nearly two decades.

The restrictions will only apply to new claimants and will save the Treasury around £1.35bn by 2020/21 as part of the Chancellor's part of his bid to slash the welfare budget by £12bn.

Speaking during a debate on the new measures in the House of Commons this afternoon, Ms Goodman told Work and Pensions Secretary Mr Duncan Smith: "You always tell the House your politics is based on your faith.

"I wonder if you could you explain to the House why cutting tax credits for large families is a fair thing to do when it will be concentrated - I know you don't want to look at statistics - but it will be concentrated on families where children are living in poverty, on Roman Catholic families, on Catholics from other minorities.

"Don't you understand that every child matters?"

However Mr Duncan Smith insisted that limiting benefits to two children was about a fundamental principle of fairness for the taxpayer, as well as heralding in a new culture to encourage more parents into work.

He replied: "I have for some time believed the way tax credits operated distorted the system so there were far too many families not going into work, living in bigger and bigger houses, with larger families subsidised by the state when many others, the vast majority of families in Britain, make decisions about how many children they can have and the houses they can live in.

"Getting that balance back is about getting fairness back into the system. It is not fair to have somebody living eventually in a house they cannot afford to go back to work on so that they do not enter the work zone and their children will grow up with no sense of work as a way out of poverty."

The cuts to tax credits were announced at the same time as Mr Osborne unveiled a headline-grabbing plan to introduce a new national living wage of £7.20 from next April, with the rate rising to £9 an hour by 2020.

The move is designed to counter the effects of cuts in working tax credits and to stop taxpayers having to top-up poorly-paid workers, handing the responsibility to firms to pay their employees more.

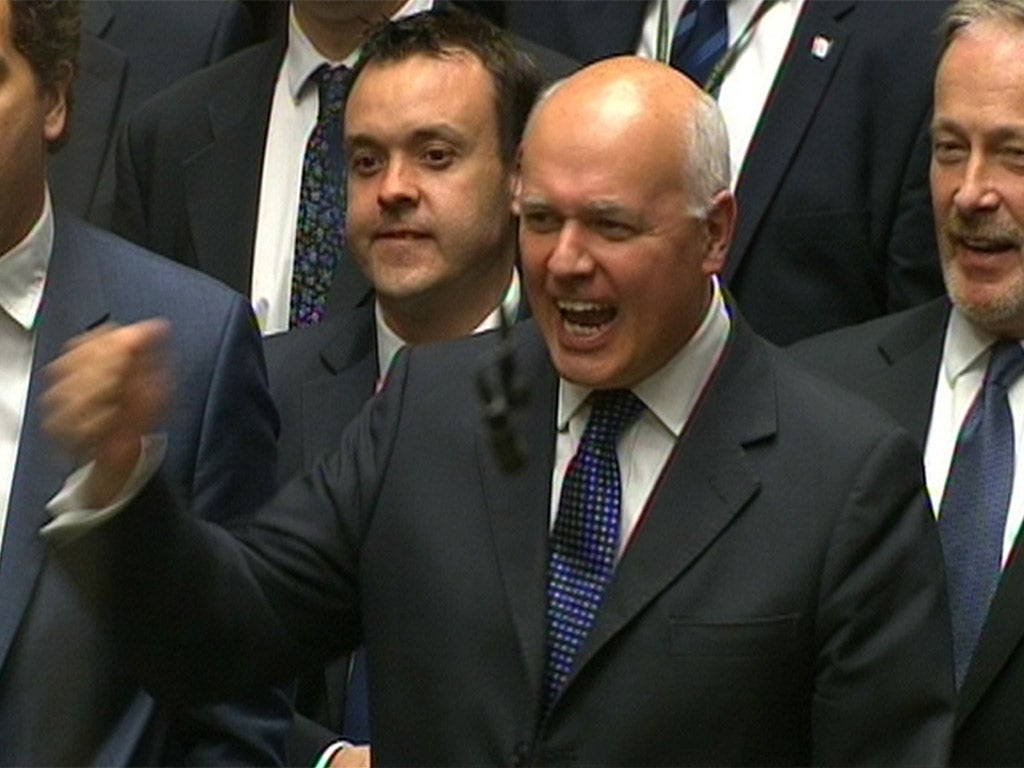

Mr Duncan Smith was seen punching the air with two fists as the Chancellor announced news of the new compulsory minimum wage in Wednesday's Budget.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments