The Government should not cut corporation tax any further because it is already low enough and further reductions would have diminishing returns, businesses have said.

A survey of businesses by financial services and accountacy firm PwC found that bosses believe cutting the profit tax rate further below 17 per cent would “have limited impact” and also “risk alienating the public”.

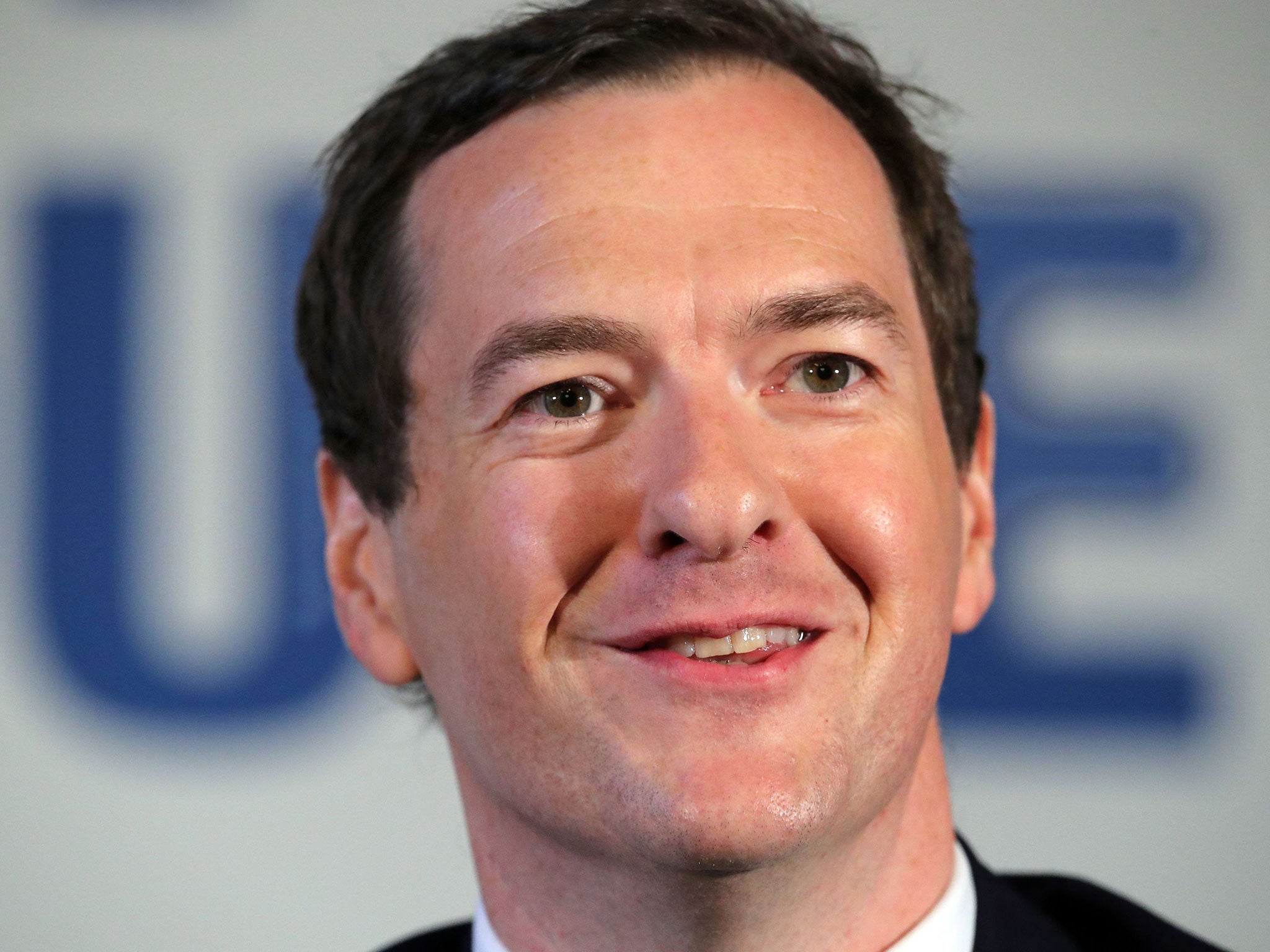

It comes after suggestions in the press that the Treasury is examining whether or not to cut the tax-rate further in a desperate bid to attract foreign investment despite Brexit. Former Chancellor George Osborne said he would cut the rate to 15 per cent.

Ms Osborne had already cut the corporation tax rate to 17 per cent, the lowest in the G20, down from 28 per cent when he took office. The rate is a historic low; it was as high as 52 per cent under Margaret Thatcher.

The UK’s rate is dramatically lower than its other competitor countries. The United States has a rate of 40 per cent, while Germany’s is 29.9 per cent, Japan’s tax rate is 32.3 per cent, and France’s is 33.3 per cent.

The majority of businesses consulted by PwC – 71 per cent – said corporation tax should either stay at 20 per cent or not go below the 17 per cent cut pencilled in for April 2020.

Summarising the findings, Kevin Nicholson, head of tax at PwC, said: “Businesses large and small recognise the benefits of a competitive corporation tax rate, but it’s not the be all and end all.

“There comes a point when rate cuts have diminishing impact and can send unhelpful messages about business’ contribution, even though corporation tax is just one of the taxes business bears. Businesses think there should more focus on the taxes that generate the most revenue such as national insurance contributions and VAT. ”

“Using tax to support specific industries is also relatively unpopular. Six out of 10 respondents feel that tax shouldn’t be used in this way. A third of businesses however, feel there is room to use tax policy to incentivise small and medium size enterprises, while a further third believe there should instead be a level playing field for all.”

The findings come from a 17-strong focus-group or “business jury” set up by PwC. The findings were then tested across a representative sample of 70 businesses – including small, media and larger firmer.

Philip Hammond, the Chancellor, has said that suggestions the rate would be cut further were simply suggestions.

“At 20 per cent, we have a highly competitive Corporation Tax rate,” Mr Hammond said in his speech to Conservative party conference.

“And as it falls to 17 per cent over the next three years, it will be more attractive still."

HM Treasury spokesperson said: “The Government has legislated to cut corporation tax to 17 per cent by 2020 and will continue to consider how we can use the corporate tax regime to best support business investment and growth”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments